FX Trading Ideas for the Week | Sep 16 - Sep 20, 2019

Trying my best now not to feel FOMO anymore about yesterday's jump in oil especially it's waiting mode again, and I won't be trading much until the central banks like the Fed are done releasing their rate decisions later this week.

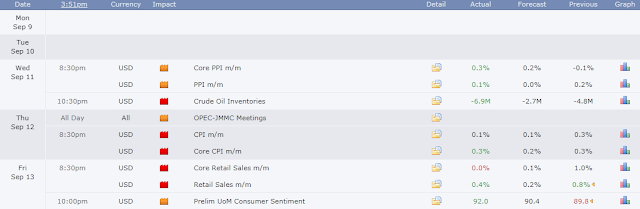

Last week, we've seen higher than expected figures for the US CPI, PPI, Retail Sales and Consumer Sentiment -- all showing a seemingly vibrant and strong US economy.

Macroeconomics 101 would tell us that this usually would give the central bank some leeway to hike rates to control inflation and prevent it from rising fast (and keep USD attractive among investors). Add China's tariff vengeance to the US government's tariff increase earlier this month, and there's enough reason for the Fed to continue being hawkish -- which it still claims to be, and calling the 25 bps rate cut later this week as a mere mid-term correction.

Whether the Fed pushes through with the rumored 3rd rate cut by end of this year remains unclear. Whether the Fed cutting rates is actually a preemptive action against the looming recession, or Powell & Bullard are simply caving in to Trump (and risk being an actual catalyst to recession by being too "proactive" and also ironically encouraging companies & consumers to incur more debt), is also unclear.

Doesn't matter if most whales are risk-off and either stockpile on cash, or hold metals like gold and silver (and also bitcoin now) which contributed to their rise these past few months.

Doesn't matter if companies continue incurring debt faster than they're earning profits-- Tesla is a great example.

Hence, last year's worry about the rise of BBB-corporate bonds. (Most companies are deleveraging now though, paying off their debts to avoid being downgraded to junk bond status while at the same time buying back their stocks to minimize dividends and risk exposure.)

I guess as long as global consumers' optimism is still high and can afford wants, everything is still "fine" even if recession might have already started (consumers react late anyway, by the time the masses realize what's happening, the whales are already chilling on the other side).

Before you proceed, make sure to read and understand this Disclaimer here and TRADE AT YOUR OWN RISK.

I. FX Trading Ideas for the Week

AUD - Wait

Still bearish overall in Aussie as mentioned last week after recent rally and despite slightly better than expected housing price index. Either wait for confirmed resumption of long-term bearish momentum most likely after Fed rate cut soon, or release of employment figures later this week (whichever gives better short entry and confirmation).

AUDCAD - Sell past 0.905 if oil climbs higher post-Monday gap

AUDCHF - Wait for better entry around 0.665 - 0.67 then buy again

AUDJPY - Wait for bullish continuation past 75 then start buying

AUDNZD - Overbought but possible to rally up to 1.10, wait for confirmed bearish reversal either at 1.08 or 1.10 before selling

AUDUSD - Sell past 0.68300

EURAUD - Wait near 1.60

GBPAUD - Wait for better entry near 1.80 then buy

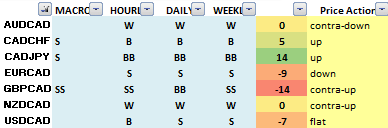

CAD - Wait

Even if oil jumped and created an alarming gap yesterday, it's best to wait first if the bullish momentum will continue or mellow down soon before going long on CAD.CADCHF - Wait near 0.75

CADJPY - Wait near 81.5

EURCAD - Wait near 1.46

GBPCAD - Wait near 1.65

NZDCAD - Wait for confirmed bullish reversal near 0.832 then buy

USDCAD - Wait near 1.325

AUDCAD - Sell past 0.905 if oil climbs higher post-Monday gap

CHF - Wait

With S&P 500 never breaking its 3025 resistance despite recent rally, upcoming Fed rate cut and another bout of recession fear after yesterday's gap in oil, expecting CHF to start gaining bullish momentum as soon as markets get more risk-off again. However it's best to wait for confirmation first and also wait for SNB forward guidance to come out right after its policy rate news later this week before reversing last week's short-term shorts and start going bullish on CHF once more.CHFJPY - Wait for bullish continuation past 109.5 then buy

EURCHF - Wait near 1.09

GBPCHF - Wait near 1.23

NZDCHF - Continue buying up to 0.64-0.65

USDCHF - Wait near 0.99

AUDCHF - Wait for better entry around 0.665 - 0.67 then buy again

CADCHF - Wait near 0.75

EUR - Wait

Wait for Fed rate cut news and any updates regarding the "improved" Brexit talks about the disputed Irish border. News about those, plus increased probability of Brexit delay to 2020, and Germany's plan to circumvent its constitutional limit to incur higher debt to take advantage of negative rates (aka "shadow debt") to help boost its economy keep euro range-bound instead of recovering further despite its trade surplus.Also something I totally missed last time: ECB's back to asset purchases and quantitative easing AGAIN.

Germany is also pressured to provide some stimulus to take advantage of US-China trade tensions and make its exports more competitive by continuing to overhaul its cars and embrace new technology for instance (hopefully, more affordable soon too!), instead of sticking to old combustion engines and cheating its way out of pollution standards.

EURGBP - Wait near 0.885

EURJPY - Wait near 119

EURNZD - Wait near 1.74

EURUSD - Wait near 1.10

EURAUD - Wait near 1.60

EURCAD - Wait near 1.46

EURCHF - Wait near 1.09

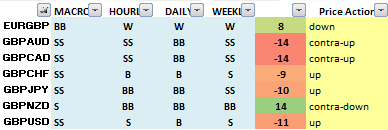

GBP - Buy (short-term)

No matter what Boris Johnson does such as asking the Queen's permission to suspend UK Parliament and even plans to sign a trade deal with Trump, he will get burned if he violates the Belfast or Good Friday Agreement (how Northern Ireland's border should be dealt).Hopefully it doesn't end up with Operation Yellowhammer which the MPs and even the EU don't want to happen. This helped increased the chances of Brexit delay to 2020, reduced the risk of the no-deal Brexit next month, and contributed to the pound's recovery last week.

Whether that recovery will continue or not, it's up to price action and technicals now. But need to be weary of any volatility coming from new Brexit updates which even overshadow BOE news this week, as well as the impact of the upcoming Fed rate cut.

GBPJPY - Wait near 135

GBPNZD - Wait for confirmed bearish reversal near 1.975 then sell

GBPUSD - Wait near 1.25

EURGBP - Wait near 0.885

GBPAUD - Wait for better entry near 1.80 then buy

GBPCAD - Wait near 1.65

GBPCHF - Wait near 1.23

NZD - Wait

Despite being oversold, need to wait for confirmation first and at least get both the Fed rate cut and New Zealand GDP news out of the way first before possibly counter-trend buying the Kiwi.NZDJPY - Wait near 68.5

NZDUSD - Wait near 0.633

AUDNZD - Overbought but possible to rally up to 1.10, wait for confirmed bearish reversal either at 1.08 or 1.10 before selling

EURNZD - Wait near 1.74

GBPNZD - Wait for confirmed bearish reversal near 1.975 then sell

NZDCAD - Wait for confirmed bullish reversal near 0.832 then buy

NZDCHF - Continue buying up to 0.64-0.65

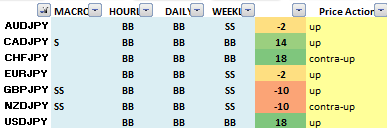

JPY - Wait

Still similar to last week, despite general strong bearish bias on JPY, best to wait for Fed rate cut first and also BoJ guidance after Fed rate cut to avoid whipsaws and other nasty surprises.USDJPY - Continue buying up to 110

AUDJPY - Wait for bullish continuation past 75 then start buying

CADJPY - Wait near 81.5

CHFJPY - Wait for bullish continuation past 109.5 then buy

EURJPY - Wait near 119

GBPJPY - Wait near 135

NZDJPY - Wait near 68.5

USD - Wait

With the 25bps Fed rate cut now priced in, getting ready to go ironically bullish on USD soon with possibility of DXY finally touching that 100 next psychological resistance zone. But if Powell surprises the market with a no change rate later this week, then expect the dollar to drop and making Trump beam with joy and even celebrate a party.AUDUSD - Sell past 0.68300

EURUSD - Wait near 1.10

GBPUSD - Wait near 1.25

NZDUSD - Wait near 0.633

USDCAD - Wait near 1.325

USDCHF - Wait near 0.99

USDJPY - Continue buying up to 110

XAUUSD - Wait near 1495

XAGUSD - Wait near 17.5

XTIUSD - Wait near 62

USDZAR - Wait near 14.75

USDMXN - Wait near 19.45

Feature image by Bruno N.W. of Unsplash

0 comments:

Post a Comment