FX Trading Ideas for the Week | Sep 23 - Sep 27, 2019

Wherever you are, it's the place you need to be.

DXY finally budged and moved up right after the hawkish rate cut last week. It's not as high as I expect it to be though (that resistance at 99 is hella strong), but still an expected movement nevertheless before possibly plunging to 94-95 by end of this year or early next year-- we'll see.

Marctomarkets (and also Merk) has insightful view regarding the US Weight Traded Real Broad Dollar Index as well, and gives a big hint of a possible upcoming bearish reversal.

Since it's end of the month again, I don't intend to trade that much. I tend to focus on overseeing and managing some existing small businesses, and learning and building more "passive" income streams during this period. However, I am eyeing some possible reversals soon on NZD pairs, S&P 500 and BTC (aside from USD and DXY) and ready myself to ride that as early as I "safely" can.

Another sidenote: most traders (including me) have been blaming the whale's irrational behavior after every Trump's tweets which I just realized now that it's also pretty evident here:

|

| Source: Reuters |

Before you proceed, make sure to read and understand this Disclaimer here and TRADE AT YOUR OWN RISK.

I. FX Trading Ideas for the Week

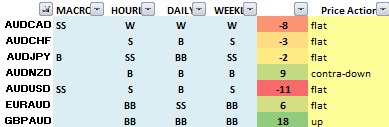

AUD - Wait

After the Fed rate cut, both RBA and RBNZ are expected to do the same especially with Australia's weak economic growth. RBA's planned cut from 1.00 to 0.75, after the recent surge in unemployment, is expected to happen by next week. Unlike USD contrarian moves, this one is directly bearish on AUD. But it's still safer to wait especially with Chinese PMI also coming out soon.

AUDCAD - Wait near 0.90

AUDCHF - Wait near 0.67

AUDJPY - Wait near 73

AUDNZD - Wait for bearish continuation past 1.07 then sell again

AUDUSD - Wait near 0.68

EURAUD - Wait near 1.63

GBPAUD - Wait for better entry between 1.80-1.82 then buy

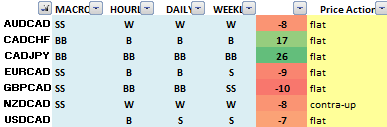

CAD - Wait

Oil recently fell and covered the gap it created last week thanks to US oil reserves, and Aramco now seemingly able to recover faster than expected-- which begs THIS question.Hmmmm...

The US oil producers yeeted Aramco's plans on having a better valuation and attractive IPO, so latter is now forcing the elites in Saudi to support them by hook or by crook.

Having said that, CAD pairs also fell recently. However, in the short-run, they're more likely to bounce and rally soon-- possibly by next week or later part this week. But most likely they'll remain range-bound in higher time frame throughout the remaining quarter of 2019 just like oil.

CADCHF - Wait near 0.7435

CADJPY - Wait near 81

EURCAD - Wait near 1.46

GBPCAD - Wait near 1.65

NZDCAD - Wait for confirmed bullish reversal near 0.832 then buy

USDCAD - Wait near 1.325

AUDCAD - Wait near 0.90

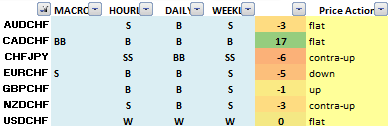

CHF - Wait

Still similar to last week, bullish in CHF in the long-run especially once both S&P 500 and DXY drop few weeks from now, and if the Trump impeachment plans create risky uncertainty even if SNB finally decides to go further in negative territory and lower its current -0.75% rate. The fact they didn't after ECB cut rates means they are considering other measures because going negative further has an impact in their banking system, plus it's hard to go against the natural tendency of risk-off investors in treating CHF as yet another safe haven. But as always when it comes to CHF, it's best to wait for confirmation first and quickly ride the momentum then quickly get out to avoid getting whipsawed.CHFJPY - Wait for bullish continuation past 109.5 then buy

EURCHF - Wait for next direction confirmation near 1.085

GBPCHF - Wait for possible short-term consolidation near 1.20 then buy again

NZDCHF - Buy at 0.62 or lower

USDCHF - Wait near 0.985

AUDCHF - Wait near 0.67

CADCHF - Wait near 0.7435

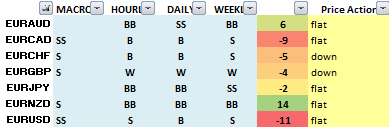

EUR - Wait

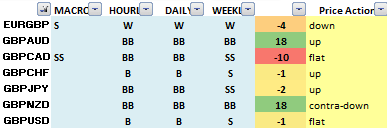

Renewed QE plus disappointing PMI all point to a bearish Euro in the medium term. However in the short run, need to wait for any possible rally first and better entry before shorting.EURGBP - Wait near 0.885

EURJPY - Wait for next direction confirmation near 118

EURNZD - Wait for next direction confirmation near 1.75

EURUSD - Wait near 1.10

EURAUD - Wait near 1.63

EURCAD - Wait near 1.46

EURCHF - Wait for next direction confirmation near 1.085

GBP - Buy (short-term)

Continue riding the GBP's temporary recovery driven by the renewed optimism of a Brexit delay to 2020 since both ECB and UK MP's aren't willing to risk relying on Yellowhammer Operation after violating the Good Friday Agreement and endangering the Northern Ireland border.GBPJPY - Wait for possible short-term consolidation near 130 first before buying

GBPNZD - Wait for bearish continuation past 1.96 then continue selling

GBPUSD - Wait near 1.24

EURGBP - Wait near 0.885

GBPAUD - Wait for better entry between 1.80-1.82 then buy

GBPCAD - Wait near 1.65

GBPCHF - Wait for possible short-term consolidation near 1.20 then buy again

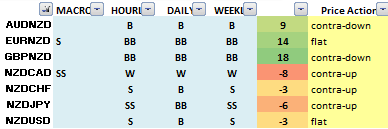

NZD - Buy (short-term)

Ride any possible short-term recovery after being oversold, before RBNZ announces plans to cut rates too after the Fed, ECB and RBA did. Else just wait for a better entry higher, and continue selling.NZDJPY - Wait for confirmed bullish reversal near 67 then buy

NZDUSD - Wait near 0.63

AUDNZD - Wait for bearish continuation past 1.07 then sell again

EURNZD - Wait for next direction confirmation near 1.75

GBPNZD - Wait for bearish continuation past 1.96 then continue selling

NZDCAD - Wait for confirmed bullish reversal near 0.832 then buy

NZDCHF - Buy at 0.62 or lower

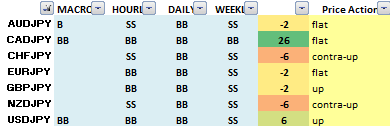

JPY - Sell

Ride the general strong bearish bias on JPY, as markets are now pricing in BOJ's plan to ease further to help hit their 2% inflation target.USDJPY - Continue buying up to 110

AUDJPY - Wait near 73

CADJPY - Wait near 81

CHFJPY - Wait for bullish continuation past 109.5 then buy

EURJPY - Wait for next direction confirmation near 118

GBPJPY - Wait for possible short-term consolidation near 130 first before buying

NZDJPY - Wait for confirmed bullish reversal near 67 then buy

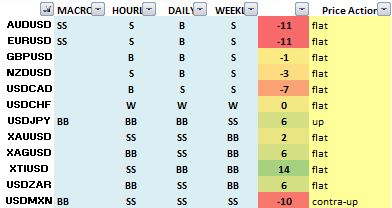

USD - Wait

While USD is recently enjoying a relatively muted bullish momentum, unless there are signs that DXY will finally break that strong 99-level resistance and hint of pushing through 100, it's best to wait on the sidelines first and also wait for GDP and consumer spending figures to come out soon.AUDUSD - Wait near 0.68

EURUSD - Wait near 1.10

GBPUSD - Wait near 1.24

NZDUSD - Wait near 0.63

USDCAD - Wait near 1.325

USDCHF - Wait near 0.985

USDJPY - Continue buying up to 110

XAUUSD - Wait near 1500

XAGUSD - Wait near 18.5

XTIUSD - Wait near 55.5

USDZAR - Wait near 15

USDMXN - Wait near 19.5

Feature image by Thom H. of Unsplash

0 comments:

Post a Comment