How to Use the Commitment of Traders Futures Report (COT Futures) in Trading

Using the COT Futures report alongside other tools when trading FX helps take the guesswork out of contradicting opinions especially during uncertain times.

Back in 2014 when I was just starting out in trading forex, although I read the whole course of BabyPips from pre-school to graduation, I didn't pay that much attention in their COT futures segment until a year later when I was given Anton Kreil's FX Trading course.

|

| Anton Kreil's FX Trading Course -- very in-depth but you won't really need to go through it unless you're working for a major bank or notable hedge fund |

Even if I like his fundamentals approach and appreciate how comprehensive his course is, it requires me to pay for subscription fees to a couple of paywall sites before I can access their data feed.

Considering how risky trading is for small retail traders especially one small mistake means disaster -- not to mention the lack of assurance that I'd consistently get a monthly income the same way a regular employee does (I wasn't into e-commerce yet then and also didn't have Youtube and blogs -- never follow what I did lol!), obviously I wanted to keep recurring costs down.

But I still wanted to get a hint where the whales in FX would hunt their prey next.

As much as possible, I don't want to cross the whales' path and be eaten alive. Instead, I wanted to ride their back like a frog riding this python lol:

So here comes the Commitment of Traders Futures report.

Related Post: How to Get the Commitment of Traders Report for FX Trading

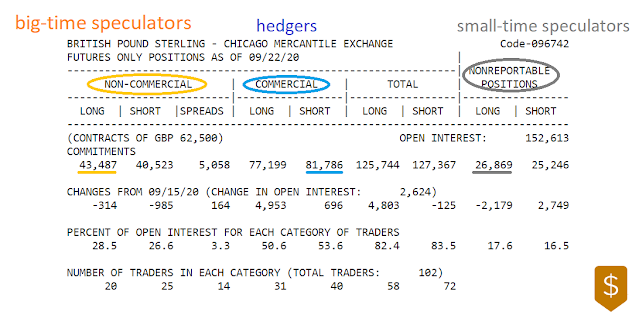

Basically, the COT Futures report shows us the net positions of the big players in the market -- call it a cheat sheet if you may.

Usually the trend of these Non-Commercial traders or big-time speculators (green line) coincide with the general price trend too.

It's not a holy grail though and should be used along with other methods like price action -- it's just pretty much similar to the volume data in stocks.

Since we don't really have that info regarding volume of trades when it comes to trading forex, COT futures report is the best alternative.

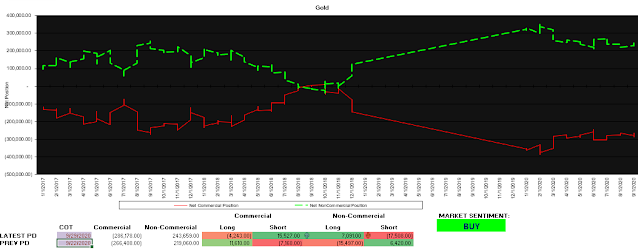

Here in XAUUSD for example, though the green line started crossing the 0 level by late 2018 as gold was initially assumed to be overpriced (and useless) especially by the crypto fanatics holding on and hoping for another hype jump in their chosen crypto after BTC crashed earlier that year, the green line eventually went back above 0 level, and gold continued rising ever since.

So a good hint it is, as long as that green line is moving up from near 0 and above 0 -- it's generally safe to buy (and vice versa and below 0 for selling).

Until we reach the "extreme" level that is -- such as during the beginning of 2020 when we have to start being cautious and trade smaller positions.

Not all "extreme" level signals reversal though, as what Babypips also mentioned in their FX course.

Gold actually still continues going up until the lockdown begins by middle of March when both gold and the green line dropped and started reversing, respectively.

Since the green line continues trending down, I started generally being weary of being bullish on gold in mid to long-term -- especially Russia began selling their gold stash to recoup their losses in oil, while China, another major buyer of gold in the past, now follows the Roman Abaramovich sell-off and not feeling bullish either with the yellow metal.

However by August, the green line starts to flatten instead of continue inching down -- most likely because some big players in the market, who never have an interest in gold back then, started having so (such as Warren Buffet).

If the green line remains flat, OR starts moving up again, then it's highly probable for the XAUUSD to continue climbing up to at least 2200 level or higher (61.8 and 100 fibonacci levels) before correcting down back to either 2055 or 1800.

The report last September 22 indicating a negative change in net long position of the big players (and a slightly positive change in net short position) during that week, mirrors the drop in prices also that week -- and so was the last week of September, the week after that.

|

| You don't say... |

Unfortunately, the COT futures report is a week delayed and only published a week after every Tuesday, so we can't "cheat" our way and know in advance or in real-time how the big players minds work.

Again it's only best for long-term positioning, and knowing when prices may go a month ahead (along with other methods since, again, it's not a holy grail. It's best to understand the actual reasoning behind market trends and reversals similar to what the whales or big players do -- it could be through fundamentals, or Trump's volfefe index).

For short to mid-term, it's best to use it as supplementary to the umbrella trading method and just follow the general trend of the big players aka the green line (or some other color -- depends on how you set the indicator), instead of copying the previous week's position of the big players.

Never EVER assume that just because they're net long last week, the non-commercial traders will be net long again this week (and vice versa). The COT futures report has certain similarities with the volume data in stocks BUT they're not the same, especially stock trading tends to follow a trend, while FX trading is mean reverting.

Else, you'll get burned like I did lol -- that's the main reason why I began incorporating FX seasonality for the past 2 years until this pandemic hits. I then went back and tweaked my previous strategy and thankfully understand now how COT futures should be used. This is one of the things I'll be using from now on though, instead of FX seasonality, for the reasons I explained in my previous post.

Let's use the COT futures report wisely.

Feature photo by Anna K. of Unsplash

0 comments:

Post a Comment