FX Trading Ideas for the Week | Sep 09 - Sep 13, 2019

Recovering from last week's euphoric high and not letting anything pop my bubbles lol.

Back after a week of hiatus from trading-- took a break since last Wednesday (and no, I'm not being lazy!) 😸

On the contrary...

If there's "accidentally" leaving your Sims unattended overnight, there's also "accidentally" typing a larger lot size than usual and leaving those trades unattended.

Thankfully those trades went in my favor and despite them giving me the largest gain for the week (so far) this year, I shouldn't do that again to keep things in equilibrium and protect my psychological well-being. Anything that may cause extreme emotional high or low must be avoided at all cost.

The fact I've started using exclamation points (!) is a red flag.

Whether I'm 100% mentally ready to trade again now without overconfidence clouding my judgement, only time will tell.

If I do manage to earn this week, and not bring back to the markets my last week's gains (lol), then I'll make a separate post sharing how I manage my emotions and mental health well.

Else, I'll do still share another post on what went wrong if ever (*knocks on wood*), and why you're better off taking a vacation instead of emotionally trading like me and this dude:

Another positive news: for anyone who wants a Trump indicator, finally it's here guys. JP Morgan created a new index called Volfefe Index based on his tweets.

For those not aware and clueless why the hell some traders are looking for a Trump Index, here's some context hinted by Ivan of Global Prime:

|

| Just to be clear: as mentioned in my previous posts (like this), I don't really care about politics (for the record, I'm neutral). I'm just here for the pips.😁 |

Anyway, enough trading psychology and Trump. I think the overall theme this week is the market cautiously going less risk-off than usual (compared to the previous weeks--- definitely NOT risk-on as some analysts claim as this is still not entirely taken out of consideration esp by the Fed itself) after newfound hope on Thursday last week that there will soon be another US-China trade talk this October, while already pricing in next week's Fed rate cut (except if they panic over this which is making me a bit nervous too if true).

Both sides pressured each other by threatening to further increase existing tariffs on October. Not sure of the actual tariff numbers anymore. But to keep it simple, they won't stop one-upping each other, hence the new scheduled "talk".

I doubt anything will be peacefully agreed, per usual. The same goes with Brexit. Contrary to the final Brexit plan, there's a "rumor" of more delaying tactics (this time, Brexit is being moved to January 2020). The MPs are now scrambling to pass a bill within a week to legally prevent Boris Johnson to enforce a no-deal Brexit by October.

Whether EU will agree to yet another delay or not, I dunno. But in my brash yet realistic opinion, as long as they will be paid whatever the right amount of divorce settlement is (or equivalent) in the end, then EU won't contest.

Before you proceed, make sure to read and understand this Disclaimer here and TRADE AT YOUR OWN RISK.

I. FX Trading Ideas for the Week

AUD - Wait

While the renewed optimism regarding US-China trade talk this October might have also helped the Aussie recover last week and early this week, the following factors might drag down AUD pairs again soon: dwindling Chinese trade balance and export numbers due to new tariffs, Australia's less than expected NAB confidence and PMI together with copper reaching 2-year low (and might be heading to 5000 level soon), risky apartments that may overshadow the recent housing market recovery, and general bearish seasonality bias in the latter part of the year.The positive news for the Aussie so far is the booming cannabis sector which may help diversify its export market, and if Australia becomes a major exporter, it might help offset its current China exposure.

AUDCAD - Wait to bounce down from 0.91

AUDCHF - Wait near 0.68

AUDJPY - Wait near 74

AUDNZD - Wait for reversal near 1.07 then sell

AUDUSD - Ride short-term rally to 0.70 then sell again

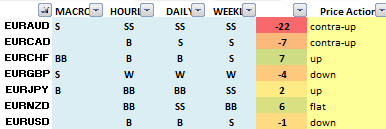

EURAUD - Wait for possible short-term bullish reversal near 1.60 then buy, else continue counter-trend selling

GBPAUD - Wait near 1.80

CAD - Wait

Despite being overall bullish on oil and CAD, since higher demand in upcoming colder months means recovery in oil (amidst new leadership), and renewed US-China talks can benefit both oil and CAD, technical-wise CAD might start consolidating from its recent bullish streak soon. However, to avoid getting whipsawed/huge drawdowns, it's best to wait for confirmation and also for OPEC meeting this week to be over first considering how unpredictable oil and CAD's volatility can be.CADCHF - Wait for confirmed reversal near 0.755 before selling

CADJPY - Wait for confirmed reversal near 82 before selling

EURCAD - Wait for confirmed bullish reversal near 1.45 then buy

GBPCAD - Wait for confirmed bullish continuation past 1.65 then buy again

NZDCAD - Continue buying up to 0.865-0.87

USDCAD - Wait for bearish continuation past 1.30 and sell again, else ride possible short-term bounce up near 1.35

AUDCAD - Wait to bounce down from 0.91

CHF - Sell (short-term)

As equities and other risky currencies (i.e. GBP) continue recovering in the short-run and markets being less risk-off than before, ride any short-term short selling opportunities for the Swissie (except CADCHF).CHFJPY - Wait near 108.5

EURCHF - Wait for bullish continuation past 1.10, else ride possible short-term bounce down this week

GBPCHF - Wait for bullish continuaton past 1.225

NZDCHF - Wait for better entry at 0.63 then continue buying with TP at 0.65 psychological resistance

USDCHF - Wait near 0.99

AUDCHF - Wait near 0.68

CADCHF - Wait for confirmed reversal near 0.755 before selling

EUR - Wait

Despite others' pessimistic outlook on Euro zone especially on its powerhouse, Germany, for possible stagnation and lack of production output, as mentioned in this month's seasonality, EUR overall is bound to recover soon at least in the short-run (just need to wait for confirmation and ECB news on Thursday to come out first) especially after Germany's exports rose by 0.7% in July (from -0.1% in June) while imports dropped by 1.5% (from 0.5%--adjusted to 0.7% in June). Both of these boosted Germany's trade surplus to around €20B+.Need to be cautious on any updates regarding Brexit delay though and the impact of Germany's plan to build new public agencies that will take advantage and earn from ECB's negative interest rate by taking in new debts, which will be accounted for separately from its federal budget (to circumvent the current limit in its law of only borrowing €5B per year).

EURGBP - Wait for bearish continuation past 0.888 then sell again

EURJPY - Wait for bullish confirmation past 120 then counter-trend buy again, else ride current bearish trend or wait near 115 before buying

EURNZD - Wait near 1.70

EURUSD - Wait near 1.105

EURAUD - Wait for possible short-term bullish reversal near 1.60 then buy, else continue counter-trend selling

EURCAD - Wait for confirmed bullish reversal near 1.45 then buy

EURCHF - Wait for bullish continuation past 1.10, else ride possible short-term bounce down this week

GBP - Buy (short-term)

Ride recent bullish momentum in GBP after the mentioned "rumor" above about MPs trying to prevent Boris Johnson from having a no-deal Brexit in October by passing a bill this week how unconstitutional it will be. |

| Though I don't side with anyone (again, I'm just here for the pips), I can't help but feel this way over this Brexit drama spanning 3 years now. |

GBPJPY - Wait for better entry near 130 then buy up to 135

GBPNZD - Wait near 1.92

GBPUSD - Wait for better entry at least around 1.22 then buy up to 1.255

EURGBP - Wait for bearish continuation past 0.888 then sell again

GBPAUD - Wait near 1.80

GBPCAD - Wait for confirmed bullish continuation past 1.65 then buy again

GBPCHF - Wait for bullish continuaton past 1.225

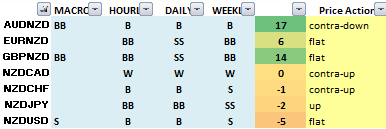

NZD - Wait

Whatever's happening to the Aussie will pass down to the Kiwi, and if Fed cut rates by next week, contrary to the expectation that USD will get weaker, if it's the opposite (especially that 100 psychological resistance in DXY is pretty enticing) based on history, then expect NZD to resume its previous slide soon after enjoying a short-term rally this week.NZDJPY - Wait near 69

NZDUSD - Wait for confirmed direction near 1.645

AUDNZD - Wait for reversal near 1.07 then sell

EURNZD - Wait near 1.70

GBPNZD - Wait near 1.92

NZDCAD - Continue buying up to 0.865-0.87

NZDCHF - Wait for better entry at 0.63 then continue buying with TP at 0.65 psychological resistance

JPY - Wait

Kuroda now hinting of yet another easing despite being in negative territory already. Either ride any short-term trading opportunities that may present now (and get out quickly before Fed rate cut next week), or wait for next BoJ guidance after Fed rate cut.USDJPY - Wait for bullish continuation past 108 then buy again

AUDJPY - Wait near 74

CADJPY - Wait for confirmed reversal near 82 before selling

CHFJPY - Wait near 108.5

EURJPY - Wait for bullish confirmation past 120 then counter-trend buy again, else ride current bearish trend or wait near 115 before buying

GBPJPY - Wait for better entry near 130 then buy up to 135

NZDJPY - Wait near 69

USD - Wait

Either ride any short-term consolidation in USD now, or wait and get ready to ride that possible "jump" after Fed rate cut next week.AUDUSD - Ride short-term rally to 0.70 then sell again

EURUSD - Wait near 1.105

GBPUSD - Wait for better entry at least around 1.22 then buy up to 1.255

NZDUSD - Wait for confirmed direction near 1.645

USDCAD - Wait for bearish continuation past 1.30 and sell again, else ride possible short-term bounce up near 1.35

USDCHF - Wait near 0.99

USDJPY - Wait for bullish continuation past 108 then buy again

XAUUSD - Wait near 1500

XAGUSD - Wait near 18

XTIUSD - Wait near 58

USDZAR - Wait for bearish continuation past 14.5 then sell again

USDMXN - Wait near 19.5

Feature post image by E. Radauscher of Unsplash.

0 comments:

Post a Comment