FX Seasonality Forecast for September 2019

And so it finally happened: The US officially imposed additional tariffs on

That propelled DXY higher, finally making its way to 99 (and probably prepping itself to reach the 2015 high or at least 100) instead of dilly-dallying around 98.

How is Trump gonna react to this contrarian USD reaction now especially he's been also pressuring Powell to cut more rates this year to push USD down?

I don't know. Let's wait for his next tweet.

How is my USDMXN swing trade holding up so far?

Well, thankfully that tariff news wasn't enough to hit my SL:

| USDMXN Bounce-Play |

I'm looking forward to a sharp drop in USD as soon as it touches the psychological resistance at 100, or as soon as the rumored recession is felt-- whichever comes first. Both imho are inevitable unless Powell saves the market equilibrium, or whoever will replace Trump soon will do so.

China retaliated by slapping additional 5% and 10% tariffs on soybeans and oil, and on other agricultural goods, respectively. US farmers and oil drillers are clamoring against this senseless trade spats because they bear the brunt of these tantrums.

If Powell can't steer the ship safely away by caving in and cutting more rates (which ironically makes USD go the opposite as what we have seen before with the usual excuse that the Fed didn't adjust rates as much as the market expects them to do), then it's just a matter of consumers feeling the effects of massive debt and inflation which more likely cause a sharp fall in USD and economy later on, especially by December when the US imposes the additional 15% tariff on more tech goods like smartphones and laptops while China will also retaliate again by slapping 25% tariff on US cars.

|

| From Bloomberg. RIP Tesla, esp after this. |

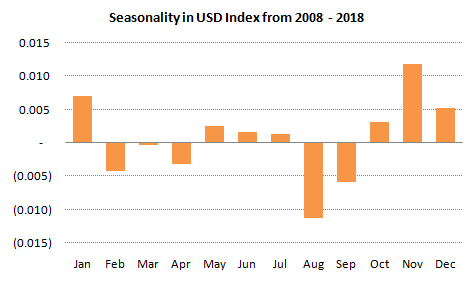

TL;DR: No matter how much the dollar rises now from these trade tariffs and upcoming rate cuts, it will sharply reverse soon not necessarily because of Trump's insistence, but because market fundamentals make it unsustainable.

But who knows? Maybe I'm wrong. I don't have decades of experience regarding global economics. Not even a single decade (I'm still relatively young lol). So, we'll see.

Why does the US dollar move like this unlike other currencies who stick to textbook macroeconomics 101 for the most part (such as mexican peso below)?

This article by Mr. William Cohen of NY Times gives us a hint:

...a period of sustained low interest rates forces investors on a desperate search for higher yields, inflating asset prices and the risks of owning loans and debt of all kinds.

.

That's one of the reasons why negative rates aren't helping much anymore (hence, Kuroda still refuses to do anything about its highly appreciating yen even though it's hurting its export-reliant economy).USD is also losing its safe haven status -- somehow slowly being replaced by EUR which joins JPY, CHF, gold and BTC which are all currently attractive to the risk-off market. If you're a wealthy Chinese, even real estate and fine art are safe haven in these uncertain times.

I. Outcome of FX Seasonality-Based Prediction for August 2019

Currency pairs moved as expected (blue rectangle) in August-- except for the aussie, euro and pound which remained muted most likely as a conservative reaction about the trade tensions, on top of other geopolitical risks such as Brexit and Italian election.Equities, gold and exotic currencies moved within their expected ranges for August as well, while we see a sudden rise in silver (most likely driven by JPMorgan's aggressive buying, and others are following suit like the Russians). Oil, however, was muted and less volatile than expected thanks to ongoing trade tensions direcly affecting oil prices.

II. Forecast for September 2019 Based on Recent 10-Year FX Seasonality

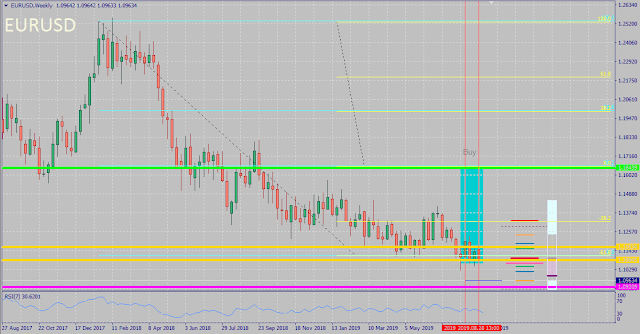

For this month, waiting for most of the pairs to follow mean-reversion and start consolidating especially after the tariffs have been officially imposed and all other news like the next Fed rate cut and additional tariffs on December are already priced in.DXY

Because of recent developments in the US-China trade spats mentioned above with 15% tariff instead of 10%, DXY rose instead of dropping and mirroring its usual August monthly seasonality. Now that trade spats are out of the way and both the rate cuts and another 15% tariff by December are already priced in, DXY is bound to correct (unless Trump suddenly imposes 25% instead of 15% additional tariff on tech imports from China to match China's tariff on US cars) most likely upon reaching the 100 psychological resistance (if it touches this month), else it will go range-bound again between 98-99 this month.

AUDUSD

Expecting the Aussie to rally a bit now that the both US and China are done slapping tariffs on each other, with recent Chinese PMI figures turning out better than expected, and CNY possibly slightly recovering soon from its 11-year low-- however not that much since the PBOC has pegged yuan above 7 per USD last month. So expect CNY to depreciate further and the Aussie to follow suit especially with its generally bearish outlook in its seasonality this month.EURUSD

Expecting EURUSD to do its long overdue bounce up soon, possibly from 1.075 especially if DXY corrects earlier than anticipated, not only because of its bullish seasonality for this month, but also with euro slowly being considered a safe haven asset too.Contrary to what others think that Germany's economy is headed to stagnation because of lack of public spending in its unrelenting discipline to keep its trade balance positive, it actually has the means to boost its economy anytime without relying on having risky national debt like everyone else (especially if the demand on its cars among other things rises if buyers choose BMW and the like, over tariff-laden US cars).

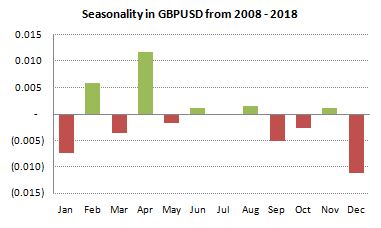

GBPUSD

Continue selling the pound given the possibility of a no-deal Brexit by October and the craziness happening after Boris Johnson requested the Queen to suspend the parliament until October 14, so MPs can only use that time onwards until official Brexit day on October 31 for them to panic and use whatever means they can to deflect his Brexit plans-- a pretty smart move considering the MPs have been debating left-center-right since May days.Wish it was easier for Bremains to simply join Scotland in possibly separating from UK and rejoining EU, and allow the Brexiters to do their own thing alone, so everyone is happy. Unfortunately, UK Brexiters are pretty good at "blackmailing".

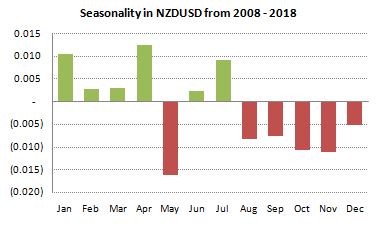

NZDUSD

Same logic as the Aussie above. Also given its seasonality in the succeeding months, expecting the Kiwi to continue sliding down to 0.60 and beyond.USDCAD

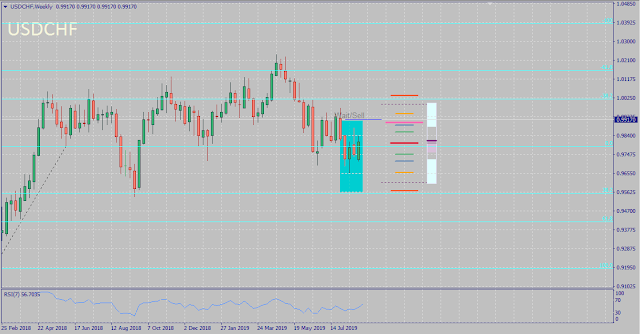

Expecting USDCAD to climb early to 1.35 after the US-China trade spat. It might consolidate a bit afterwards if DXY starts ranging between 98-99 instead of rising to its 2015 high around 100, and if oil starts to recover as well during fall and winter seasons.USDCHF

Most likely USDCHF will continue to go range-bound as USD bulls and risk-off traders and investors continue playing tug-o-war with each other.USDJPY

Either USDJPY will go range-bound like USDCHF above, or it will suddenly jump either based on technicals alone or if there's news that Kuroda encourages further easing to reduce JPY's appreciation (or both).Back to Top

III. Forecast Attempt in S&P500, Oil and Metals for September 2019

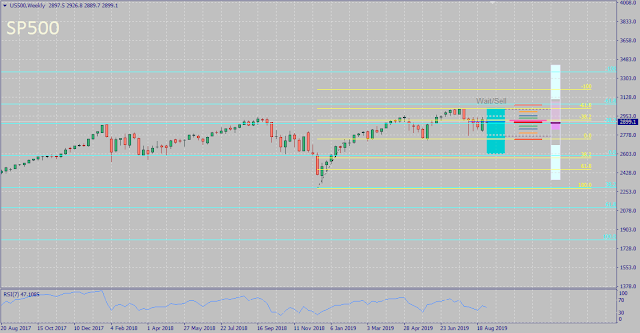

S&P 500*

I'm not very good yet when it comes to elliot wave-- either it has just finished its 5th wave leg and about to start the A-B-C correction, or it's currently just the beginning of 5th wave and it's about to rise to 3300 level soon. But with companies buying back their own stocks to either prop their value back up, or as preparation against impending recession so company executives limit exposure to shareholders who can aggravate the drop (also limit dividends to the "loyal" ones), it feels shady and overall it tells me to stay away from equities for the meantime.

Gold*

Though fundamentally I'm still bullish on metals like gold and silver (and now also cryptocurrencies like BTC), based on technicals and its seasonality this month, gold might be bound to correct soon. So I'll wait near 1400 first before possibly buying again.

Silver*

Same logic and reasoning as gold.Oil*

Based on this month's bullish seasonality and the start of the cold 'ber' season, and with the consequences of trade tensions now priced in, oil is more likely bound to recover soon.*Note: Unlike FX pairs, S&P500, Oil and Metals don't really "follow" their monthly seasonality that's why I didn't include their seasonality charts anymore to avoid confusion. I don't see any consistency on them by simply eyeballing the charts.

Back to Top

Feature image by Capri23auto of Pixabay

0 comments:

Post a Comment