FX Trading Ideas for the Week | Aug 26 - Aug 30, 2019

Post G7 the forest fire in Amazon continues to burn as Brazil rejects G7's $22m offer and insists that it's their choice what they wanna do with their forest in another vain attempt to boost its sluggish economy, and someday transform its developing country into a developed one.

I'm not surprised that Trump isn't present in G7.

Those wanting to help these real Amazon heroes, you may also donate here.

I know these climate change stuff isn't related to trading whatsoever, but market overall now is moving in a narrower range, and there's a bunch of economic news coming up this week (plus it's end of month).

So there really isn't much anything to do other than ride short-term retracements (or better, avoid trading for the meantime especially USD pairs), and rebalancing our bad consumerist karma with something good like helping out these heroes in any way we can.

Just because celebrities posted old Amazon forest fires photos (possibly to avoid copyright issues like what I also do-- contrary to what those lacking empathy and common sense insist, since those photos are the ones easily available for "free" and we have Creative Commons protection so unscrupulous photographers won't cash on us), doesn't mean it's not happening right now. Also, just because those forest fires happen every year doesn't mean we shouldn't act anymore.

If your house is on fire, wouldn't you still try your best to put out the fire?

Common sense.

Before you proceed, make sure to read and understand this Disclaimer here and TRADE AT YOUR OWN RISK.

I. FX Trading Ideas for the Week

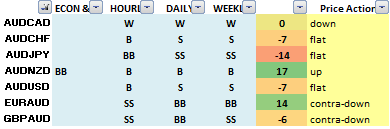

AUD - Wait

The Aussie will most likely continue moving range-bound at least until by end of this week once Building Approvals and China's PMI numbers are out. For the meantime, I prefer to stay out of AUD and trade other pairs instead.AUDCAD - Wait for confirmed direction near 0.90

AUDCHF - Wait for confirmed direction near 0.66

AUDJPY - Wait for confirmed direction near 72

AUDNZD - Wait for confirmed direction near 1.06

AUDUSD - Wait for confirmed direction near 0.675

EURAUD - Wait for better entry near 1.68 then counter-trend sell

GBPAUD - Ride short-term consolidation and sell, or wait for better entry at 1.795 - 1.80 then buy again

How long am I gonna hold this AU position? Until either my SL get hits or if it at least moves past breakeven lol.

| AUDUSD Long |

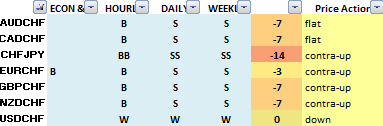

CAD - Buy

Still same as last week's idea, get ready for possible bounce up soon especially by next month (once --ber time begins) and oil breaks its current range and recovers back to 60. Better than expected retail sales figures and latest US-China trade talks favor the CAD.CADCHF - Wait for confirmed direction near 0.74

CADJPY - Wait for better entry near 77-78 then counter-trend buy up to 81.5

EURCAD - Wait near 1.475

GBPCAD - Wait for better entry between 1.63- 1.645 then sell up to 1.60

NZDCAD - Wait near 1.85

USDCAD - Wait for better entry near 1.335 - 1.34 then sell

AUDCAD - Wait for confirmed direction near 0.90

CHF - Wait

Most likely will continue range-bound, but it's possible to ride any short-term bullish momentum as SP500 rallies back to 2920 this week before market decides whether to treat the status quo as the new norm and climb higher, or embrace recession paranoia and slide down.CHFJPY - Wait for bullish continuation past 108.5 then buy again

EURCHF - Wait for confirmed bounce up near 1.085 before buying

GBPCHF - Wait for better entry near 1.18 or bullish confirmation past 1.21 before buying, else continue short-term selling

NZDCHF - Wait for better entry near 1.62 before counter-trend buying

USDCHF - Wait near 0.98

AUDCHF - Wait for confirmed direction near 0.66

CADCHF - Wait for confirmed direction near 0.74

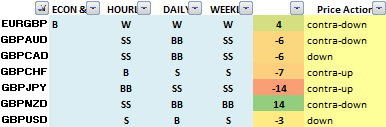

EUR - Wait

Same logic still as last week, EUR pairs mostly overbought (except for EURJPY), so ride possible short-term consolidation soon, or better, wait it out and go long at a bargain price by September.EURGBP - Ride possible short-term rally soon past 0.9117 up 0.92, else wait for counter-trend bearish confirmation past 0.90 before selling again

EURJPY - Wait for bounce up from 115-116, or bullish confirmation past 118.5 before buying

EURNZD - Wait for better entry near 1.74 then short-term sell

EURUSD - Wait near 1.11

EURAUD - Wait for better entry near 1.68 then counter-trend sell

EURCAD - Wait near 1.475

EURCHF - Wait for confirmed bounce up near 1.085 before buying

| EURNZD Double-Top |

GBP - Wait

Still bearish overall in GBP, but like USD, it's best to wait things out for the meantime. Aside from highly probable no-deal Brexit by October, BOE's Carney expressed some dovish tones during the Jackson Hole Symposium, stating that some easing is necessary since the UK is headed for stagnation (actually even worse if Scotland forces its way out of UK itself and attempts to rejoin EU on its own regardless of its budget deficit).GBPJPY - Wait for better entry near 128 or bullish confirmation past 131 before buying

GBPNZD - Wait for better entry near 1.94-1.95 then sell

GBPUSD - Wait for bullish confirmation past 1.23, else ride bearish momentum up to 1.20 and below before counter-trend buying

EURGBP - Ride possible short-term rally soon past 0.9117 up 0.92, else wait for counter-trend bearish confirmation past 0.90 before selling again

GBPAUD - Ride short-term consolidation and sell, or wait for better entry at 1.795 - 1.80 then buy again

GBPCAD - Wait for better entry between 1.63- 1.645 then sell up to 1.60

GBPCHF - Wait for better entry near 1.18 or bullish confirmation past 1.21 before buying, else continue short-term selling

| GBPJPY Possible Reversal |

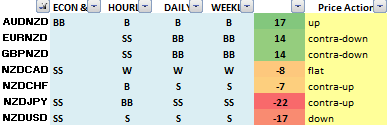

NZD - Wait

Same as last week, I'm still pretty bullish overall on NZD and its economy's strength is overlooked and being dragged down by AUD. However, will wait for confirmation first instead of going long right away, or at least wait for Sept 1 to pass and gauge how the market reacts to new tariffs imposed on China, and also its release of PMI figures by end of this week. Majority of speculators and retail traders continue to have strong bearish bias on Kiwi. The net long position is interesting and gives me a signal to get ready to buy by next month.NZDJPY - Wait for better entry near 67.5 or bullish confirmation past 68.6 before counter-trend buying

NZDUSD - Wait near 0.64

AUDNZD - Wait for confirmed direction near 1.06

EURNZD - Wait for better entry near 1.74 then short-term sell

GBPNZD - Wait for better entry near 1.94-1.95 then sell

NZDCAD - Wait near 1.85

NZDCHF - Wait for better entry near 1.62 before counter-trend buying

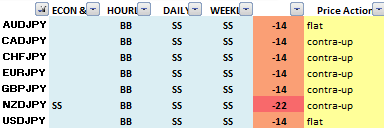

JPY - counter-trend Sell (short-term)

Still same idea as the other week, ride any possible bounce soon especially once the market begins to price in Kuroda's dovish sentiment and possible easing by September.USDJPY - Wait for confirmed bullish reversal near 104-105 before buying

AUDJPY - Wait for confirmed direction near 72

CADJPY - Wait for better entry near 77-78 then counter-trend buy up to 81.5

CHFJPY - Wait for bullish continuation past 108.5 then buy again

EURJPY - Wait for bounce up from 115-116, or bullish confirmation past 118.5 before buying

GBPJPY - Wait for better entry near 128 or bullish confirmation past 131 before buying

NZDJPY - Wait for better entry near 67.5 or bullish confirmation past 68.6 before counter-trend buying

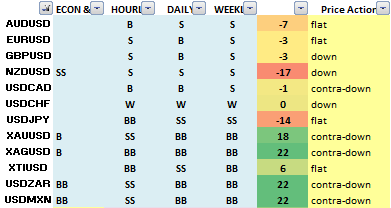

USD - Wait

Technical-wise, I think USD is bound for a consolidation this week. However, it's possible that DXY might resume its climb up to 100 later this week or after September 1. Best to wait for confirmation first, especially recession fears and any risk-off sentiment coming from US-China trade talks give more edge to assets like gold, JPY and now EUR, and even new haven assets like BTC, which can push USD down or at least make DXY go range-bound between 97-98 since future rate cuts by Powell are already priced in.AUDUSD - Wait for confirmed direction near 0.675

EURUSD - Wait near 1.11

GBPUSD - Wait for bullish confirmation past 1.23, else ride bearish momentum up to 1.20 and below before counter-trend buying

NZDUSD - Wait near 0.64

USDCAD - Wait for better entry near 1.335 - 1.34 then sell

USDCHF - Wait near 0.98

USDJPY - Wait for confirmed bullish reversal near 104-105 before buying

XAUUSD - Ride possible short-term consolidation and sell up to 1495

XAGUSD - Wait for better entry near 18 then short-term countertrend sell

XTIUSD - Wait near 53

USDZAR - Wait near 15.5

USDMXN - Wait near 20

| USDMXN High-risk Bounceplay |

Feature post image by R. Miller of Unsplash.

0 comments:

Post a Comment