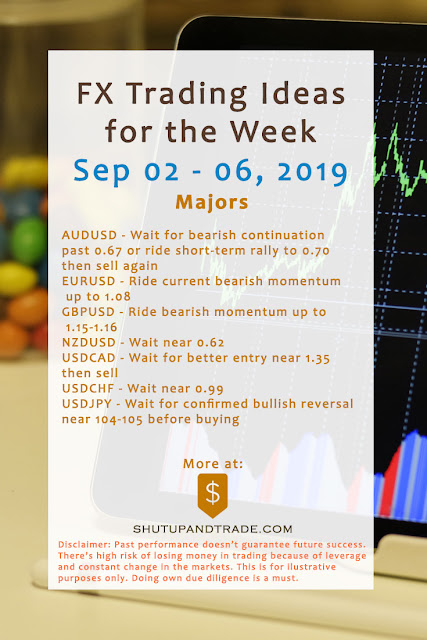

FX Trading Ideas for the Week | Sep 02 - Sep 06, 2019

A wild kick from last weekend's tariffs, then the dust has finally settled.

After the strong momentum last Monday as the market reacted to the US-China tariff spat, expecting most pairs now to settle a bit as most traders go wait-and-see mode for the next few days.

Before you proceed, make sure to read and understand this Disclaimer here and TRADE AT YOUR OWN RISK.

I. FX Trading Ideas for the Week

AUD - Wait

Based on its September seasonality and fundamentals, AUD will continue to be bearish.However, it might rally a bit in the short-run especially most of AUD pairs are already oversold, so wait for better entry first and also wait for the next econ news to be released soon (GDP tomorrow).

AUDCAD - Wait for confirmed bearish continuation past 0.889

AUDCHF - Wait for better entry near 0.65 before buying

AUDJPY - Wait for rally near 73 or higher then sell again

AUDNZD - Wait for reversal near 1.07 then sell

AUDUSD - Wait for bearish continuation past 0.67 or ride short-term rally to 0.70 then sell again

EURAUD - Ride possible short-term reversal near 0.65 and continue counter-trend selling

GBPAUD - Wait for bullish reversal around 1.75-1.78 before buying

| AUDUSD Long |

CAD - Sell (short-term)

The recent US-China tariff imposition had also taken a toll on oil, so at least in the short-run, best to ride the drop in CAD for the meantime but be careful for any signs of reversal soon especially in oil.CADCHF - Ride short-term rally past 0.74 and sell, else wait for better entry near 0.73 before counter-trend buying

CADJPY - Wait for better entry near 77-78 then counter-trend buy up to 81.5

EURCAD - Wait for confirmed bullish reversal near 1.45 then buy

GBPCAD - Wait for confirmed bullish reversal near 1.55 then buy

NZDCAD - Wait for confirmed bullish reversal near 83.2 or lower then buy

USDCAD - Wait for better entry near 1.35 then sell

AUDCAD - Wait for confirmed bearish continuation past 0.889

CHF - Wait

Still same as last week with S&P 500 also going range-bound recently. Just grab any short-term trading opportunities for CHF pairs based on technicals and other currencies' momentum, and get in and out quickly.CHFJPY - Wait for confirmed bullish reversal near 106.5 then counter-trend buy

EURCHF - Wait near 1.083

GBPCHF - Wait for rally near 1.21 or continue selling

NZDCHF - Wait for confirmed bullish reversal near 0.62 then counter-trend buy

USDCHF - Wait near 0.99

AUDCHF - Wait for better entry near 0.65 before buying

CADCHF - Ride short-term rally past 0.74 and sell, else wait for better entry near 0.73 before counter-trend buying

EUR - Sell (short-term)

Ride current counter-trend momentum (same as last week) since most EUR pairs are overbought (except for EURJPY and EURCAD). However, make sure to be able to close any short positions quickly the moment both DXY and S&P 500 start reversing their current upward momentum. If JPY, CHF, metals and BTC all start gaining bullish momentum again after their recent consolidation, then it's time to go long in EUR again.EURGBP - Wait for confirmed bearish reversal near 0.92 before counter-trend selling

EURJPY - Wait for confirmed bullish reversal near 115 before counter-trend buying

EURNZD - Wait for confirmed bearish reversal near 1.75 or sell stop around 1.73 before counter-trend selling

EURUSD - Ride current bearish momentum up to 1.08

EURAUD - Ride possible short-term reversal near 0.65 and continue counter-trend selling

EURCAD - Wait for confirmed bullish reversal near 1.45 then buy

EURCHF - Wait near 1.083

| EURNZD Double-Top |

GBP - Sell

Either counter-trend buy any short-term rally (only if risk-reward ratio is favorable), else continue selling GBP pairs instead because as mentioned here, it's quite a scene now in UK after Boris Johnson requested for a parliament suspension until October 14-- just 2 weeks before the official no-deal Brexit day.GBPJPY - Wait for bullish reversal near 125 then counter-trend buy

GBPNZD - Wait near 1.90

GBPUSD - Ride bearish momentum up to 1.15-1.16

EURGBP - Wait for confirmed bearish reversal near 0.92 before counter-trend selling

GBPAUD - Wait for bullish reversal around 1.75-1.78 before buying

GBPCAD - Wait for confirmed bullish reversal near 1.55 then buy

GBPCHF - Wait for rally near 1.21 or continue selling

| GBPJPY Possible Reversal |

NZD - Buy (short-term)

Like AUD, seasonality bias for the Kiwi in the latter part of this year is all bearish. The recent official imposition of tariffs between US and China is also dragging the Kiwi down. However, technically-speaking, most NZD pairs now are oversold. So there's an opportunity to take a counter-trend long position especially as mentioned in the previous week's idea, NZD's economy is underrated.NZDJPY - Wait for confirmed bullish reversal near 66.7 then counter-trend buy

NZDUSD - Wait near 0.62

AUDNZD - Wait for reversal near 1.07 then sell

EURNZD - Wait for confirmed bearish reversal near 1.75 or sell stop around 1.73 before counter-trend selling

GBPNZD - Wait near 1.90

NZDCAD - Wait for confirmed bullish reversal near 83.2 or lower then buy

NZDCHF - Wait for confirmed bullish reversal near 0.62 then counter-trend buy

JPY - Sell (short-term)

JPY continues to appreciate lately especially there's no sign yet from Kuroda regarding any BOJ easing strategy. However, most JPY pairs are oversold now. So there might be a good opportunity to grab some short-term counter-trend position between now and next week, but wait for some confirmation first.USDJPY - Wait for confirmed bullish reversal near 104-105 before buying

AUDJPY - Wait for rally near 73 or higher then sell again

CADJPY - Wait for better entry near 77-78 then counter-trend buy up to 81.5

CHFJPY - Wait for confirmed bullish reversal near 106.5 then counter-trend buy

EURJPY - Wait for confirmed bullish reversal near 115 before counter-trend buying

GBPJPY - Wait for bullish reversal near 125 then counter-trend buy

NZDJPY - Wait for confirmed bullish reversal near 66.7 then counter-trend buy

USD - Wait

The recent tariffs had given a boost to the USD, however more high risk economic news are coming up soon this week (NFP, PMI, Unemployment) so it's advisable to wait until next week instead. If you're scalping, there might be good opportunity to short USD but close the position quickly.AUDUSD - Wait for bearish continuation past 0.67 or ride short-term rally to 0.70 then sell again

EURUSD - Ride current bearish momentum up to 1.08

GBPUSD - Ride bearish momentum up to 1.15-1.16

NZDUSD - Wait near 0.62

USDCAD - Wait for better entry near 1.35 then sell

USDCHF - Wait near 0.99

USDJPY - Wait for confirmed bullish reversal near 104-105 before buying

XAUUSD - Ride possible reversal and short-term correction near 1560 and counter-trend sell up to 1470

XAGUSD - Ride possible reversal and short-term correction near 18.5 and counter-trend sell up to 17

XTIUSD - Wait for better entry near 51.5 before buying

USDZAR - Wait for bearish reversal near 15.5 then sell up to 14.30

USDMXN - Wait for bearish reversal near 20 then sell up to 19

| USDMXN High-risk Bounceplay |

Feature post image by N. Radojcic of Unsplash.

0 comments:

Post a Comment