FX Trading Ideas for the Week | Nov 11 - Nov 15, 2019

Dealing with boredom in the markets through diversification.

For the meantime, I'm taking heed of this guy's advice to never put your eggs in one basket, and spread the risk instead-- which is also one of the secrets of bigger Youtube channels (i.e. merch, branching out to Twitch) which streamers on the other hand are just starting to learn now by branching out to Youtube.

Though I'm a great believer in the power of specialization, it doesn't hurt to try out other things from time to time especially if you can still capitalize on your strengths and ask help from other people to help you out on some of your weaknesses-- we don't need to do everything!

Lately I've discovered Mixer, and since it seems to be way stricter than its th*t-friendly competitors *ahem* lol, thought it won't be that bad to try out since its branding won't ruin my conservative image (I hope so) like its competitors. Some old friends have been also asking if I stream already since it seems to suit my gaming personality (whatever that means..)-- so I decided to finally give it a try especially I record stuff for my Youtube channels too, and wouldn't hurt to stream my gameplay (and have a backup copy in Mixer available for 14 days). Holiday season pulls in more viewers too (at least I hope so lol 😤). Haven't told them about that though since I don't wanna rely on them for views and wanna attract fellow gamers and other actual gaming enthusiasts in my stream, instead of risk transforming my chat into a weird gossip fest and possibly some frenemies/bitter exes (lol) sneaking in and leaking out private info/doxxing me if word goes around. Just informed my S.O. about it and made him a mod so he can help moderate chat whenever he's not busy :P

Back to trading: I do still keep a close eye on gold, oil and BTCUSD for any sign of bottoming and possible sudden breakout on the upside soon (Q1 next year), while waiting for any signs of weakness in the 3000 area of S&P 500.

Before you proceed, make sure to read and understand this Disclaimer here and TRADE AT YOUR OWN RISK.

I. FX Trading Ideas for the Week

AUD - Buy (short-term)

Continue riding the short-term rally for Aussie especially after recent higher NAB business confidence index than previous period (from 0 to 2), and delay in rate cut now to Feb 2020 which markets have already priced in. Do be careful of upcoming employment figures this week, as well as any updates regarding RBA's planned QE next year.

AUDCAD - Wait near 0.91

AUDCHF - Wait for better price near 0.675 then buy

AUDJPY - Wait for better price near 74 then buy

AUDNZD - Wait for reversal confirmation around 1.08-1.09 then sell

AUDUSD - Wait near 0.685

EURAUD - Wait for reversal confirmation near 1.635 then sell

GBPAUD - Wait for rally near 1.885 (0 fib level) or 1.90 (recent high), then sell again

CAD - Wait

Despite the dovishness of BOC and planned rate cut by March 2020, based on technicals and price action, some CAD pairs have room to rally at least during the remaining weeks of 2019 especially if oil prices continue recovering during winter and US-China trade talk continues to improve.CADCHF - Wait near 0.75

CADJPY - Wait for better entry near 82 then buy

EURCAD - Wait near 1.46

GBPCAD - Wait near 1.70

NZDCAD - Wait for consolidation and confirmed reversal near 0.83 then buy

USDCAD - Wait near 1.32

AUDCAD - Wait near 0.91

CHF - Wait

As US-China trade talks show improvement, markets have recently become risk-on, and continues to increase their risk appetite as also shown in the continued bullishness in equities like S&P 500 lately and gold tanking. However, as mentioned in this month's seasonality, need to be extra cautious still especially both the US tariffs on imports and rumored recession are both not yet totally off the table, and if ever, the whales are simply taking advantage of this period to stock up more on metals and BTC.CHFJPY - Wait for better entry near 1.09 then buy

EURCHF - Wait near 1.095

GBPCHF - Wait near 1.28

NZDCHF - Wait near 0.63

USDCHF - Wait near 0.995

AUDCHF - Wait for better price near 0.675 then buy

CADCHF - Wait near 0.75

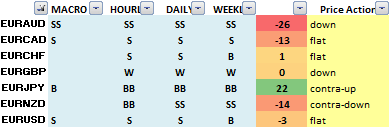

EUR - Sell

Based on its seasonality this month, the expected tariff on European car imports soon this week, geopolitical risks related to delayed Brexit and other parts of EU like Italy, and the economic risks from renewed QE which the new ECB head inherited from Draghi, all give the Euro overall still enough room on the downside.EURGBP - Wait near 0.86

EURJPY - Wait for better entry near 1.20 then buy

EURNZD - Wait for better entry near 1.76 then sell

EURUSD - Wait near 1.10

EURAUD - Wait for reversal confirmation near 1.635 then sell

EURCAD - Wait near 1.46

EURCHF - Wait near 1.095

GBP - Wait

After the agreed upon Brexit extension to January 2020 already priced in and the next election a month from now being the main focus, it's best to wait for now, or grab some short-term counter-trend selling opportunities while the pound pairs are generally overbought and most likely to consolidate/continue consolidating between now and 2nd half of November.GBPJPY - Wait near 140

GBPNZD - Wait for confirmed reversal near 2.05 then sell

GBPUSD - Wait for short-term bearish confirmation past 1.275 then sell

EURGBP - Wait near 0.86

GBPAUD - Wait for rally near 1.885 (0 fib level) or 1.90 (recent high), then sell again

GBPCAD - Wait near 1.70

GBPCHF - Wait near 1.28

NZD - Wait

Despite the bearish bias in its November seasonality, kiwi in generally has already bottomed and most likely to rally soon. But it's best to wait for RBNZ statement later first if they're gonna cut rates now or next month, or delay it like RBA too.NZDJPY - Wait for bullish continuation near 0.69 then buy

NZDUSD - Wait near 0.63

AUDNZD - Wait for reversal confirmation around 1.08-1.09 then sell

EURNZD - Wait for better entry near 1.76 then sell

GBPNZD - Wait for confirmed reversal near 2.05 then sell

NZDCAD - Wait for consolidation and confirmed reversal near 0.83 then buy

NZDCHF - Wait near 0.63

JPY - Sell

Like in CHF, JPY is sliding further the more risk-on the market gets especially with better than expected developments in US-China trade talks recently. BOJ also continues to be dovish and will even continue its QE as well.USDJPY - Wait near 109.5

AUDJPY - Wait for better price near 74 then buy

CADJPY - Wait for better entry near 82 then buy

CHFJPY - Wait for better entry near 1.09 then buy

EURJPY - Wait for better entry near 1.20 then buy

GBPJPY - Wait near 140

NZDJPY - Wait for bullish continuation near 0.69 then buy

USD - Wait

Despite the recent bounce in DXY (possibly on its way back to the 61.8 fib level if not 100), and developments in Phase 1 of US-China trade talk, still best to wait on the sidelines at least until Trump's speech is over to avoid getting whipsawed especially it's possible for the dollar to consolidate a bit this week after its recent recovery last week.AUDUSD - Wait near 0.685

EURUSD - Wait near 1.10

GBPUSD - Wait for short-term bearish confirmation past 1.275 then sell

NZDUSD - Wait near 0.63

USDCAD - Wait near 1.32

USDCHF - Wait near 0.995

USDJPY - Wait near 109.5

XAUUSD - Wait near 1450

XAGUSD - Wait near 16.75

XTIUSD - Wait near 57

USDZAR - Wait near 14.8

USDMXN - Buy near 19

0 comments:

Post a Comment