FX Seasonality Forecast for November 2019

Hibernating until the holiday season is over.

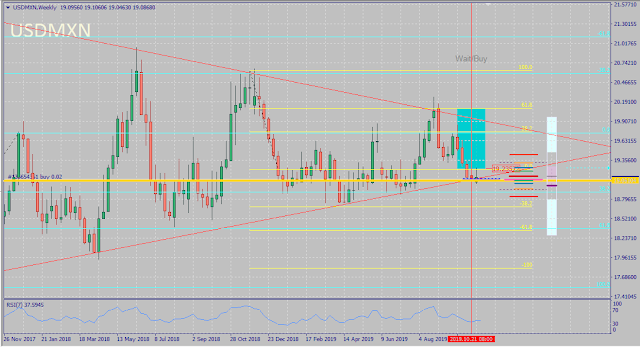

While FX markets continue to stay zzz and less volatile and exciting in general compared to S&P 500 and bitcoin, imho it's now the great time to get in some of the pairs and swing trade them until Q1 next year (i.e. USDMXN). There are also still a few pairs too which is great in trading short-term--- I'm looking at you GBP.

I. Outcome of FX Seasonality-Based Prediction for October 2019

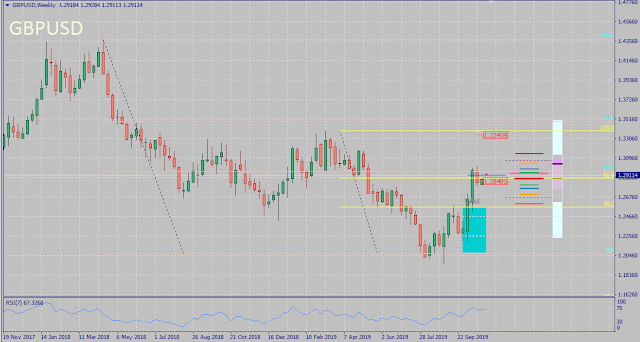

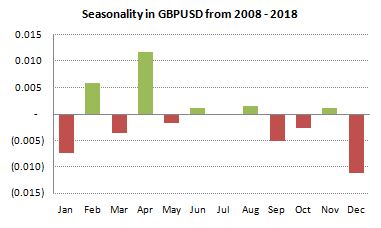

October was a great month for short-term trading since almost all pairs (not only majors but also crosses) were less volatile than usual and moved within the expected range predicted in last month's seasonality-- with the exception of a few GBP pairs like GBPUSD below.Initially thought the pound will stay range-bound in October because of uncertainties surrounding Brexit. Though I knew they're gonna keep delaying it and that's already priced in since last September (as insinuated in my last month's seasonality forecast post or rather, meme lol) with the MPs doing everything at their disposal including creating a new law to prevent a no-deal Brexit and even EU supporting another delay, both its current weekly price action and the new transition phase rumored to be extended from December 2020 to December 2022 pushed the pound higher than the range forecasted in its October seasonality (blue box).

Metals and exotic pairs remained relatively less volatile and quiet, while oil starts to recover and S&P 500 rides the hype of better than expected corporate earnings.

II. Forecast for November 2019 Based on Recent 10-Year FX Seasonality

Markets are currently risk-on mainly due to phase one of US-China trade talks and expected Brexit delay. Imho, it's best to remain cautious and not ride the hype (except possibly BTCUSD-- I'll talk about it in another post), and even counter-trend or enter the next trend early, instead of riding the current trends this late (i.e. buying equities, shorting USD).Overall, expecting the FX markets to move in a tighter range between now and the next holidays, except for a few key pairs.

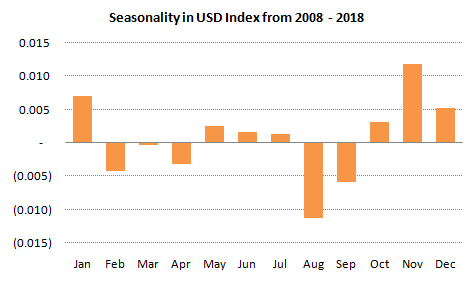

DXY

Aside from the price action and seasonality below, expecting the dollar to resume recovery soon especially after phase one of US-China trade deal, especially with the US losing slightly more from this lose-lose situation in percentage terms. There's possibility that the US will reduce the tariffs on China soon, but the one planned to be imposed by December is still currently on the table.

AUDUSD

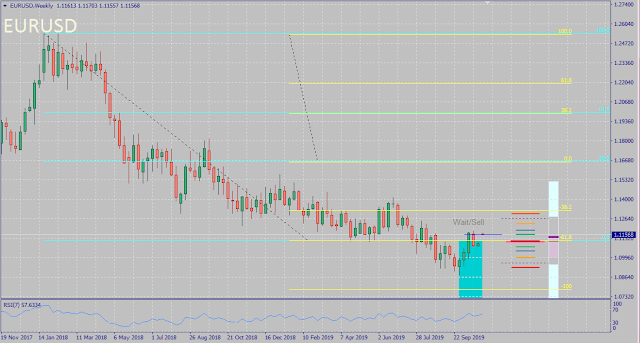

Despite recent developments regarding the US-China trade talks and the Aussie hitting the 0.67 bottom, it's still too early to say that it's on its way to recovery now especially with the bearish bias on its November seasonality. Unless it breaks out past 0.71, it's most likely that the Aussie will go range-bound this month instead especially after RBA kept rate on hold at 0.75 with rumored 25bps rate cut next year already being priced in by the markets now.EURUSD

Based on its trend in higher timeframe and seasonality for this month, on top of dollar's recovery and ECB's renewed quantitative easing, euro is most likely to resume its bearishness up to 1.08 and go ranging from there-- which is the optimistic scenario especially if ever Trump imposes the planned tariff on European car imports by November 13. Looking at its monthly chart, EURUSD has room to slide down up to 1.05 which is a convincing psychological support, unless EU, particularly Germany boosts its economy with increased production and sales of electric cars and also beat China and Japan in hydrogen tech.GBPUSD

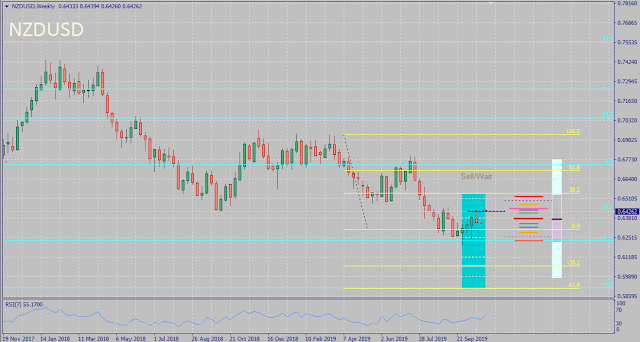

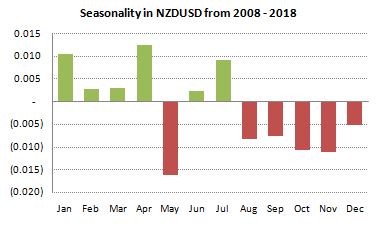

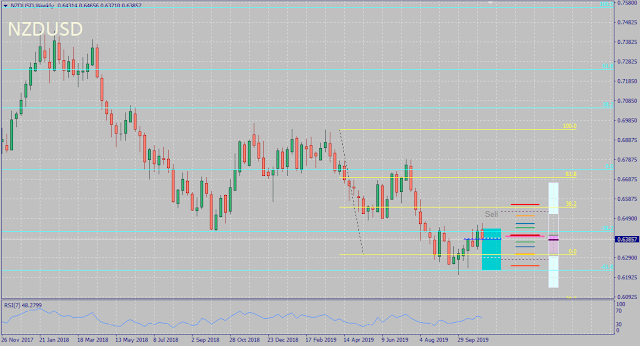

Looking at its recent price action and November seasonality, there's still possibility for the pound to continue climbing up to at least 1.30 before correcting soon (if not by later this month, by December after the general election which is the next key focus of most investors and traders alike right now).NZDUSD

Though the Kiwi enjoyed some brief recovery after bouncing from the 1.62 support, based on its seasonality and also the Aussie's, expecting NZDUSD to move range-bound between 1.62-1.645 this month, with the Kiwi most likely consolidating soon after its disappointing unemployment figures.USDCAD

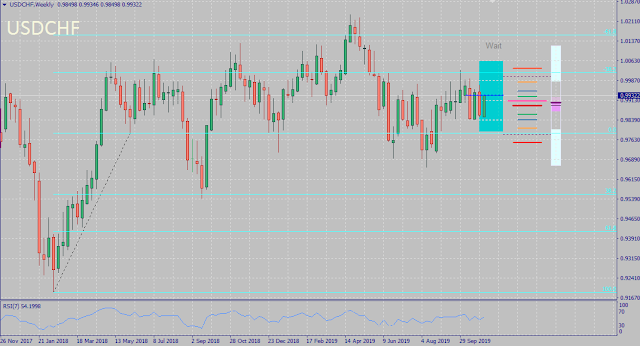

Despite the bullish bias in its seasonality and recent developments in the US-China trade talks, I don't think USDCAD will rise to 1.35 soon especially with oil recovering now as expected during the -ber months and USD itself rallying too. It's more likely that this pair will move in a tighter range instead and still not break its 1.30 support.USDCHF

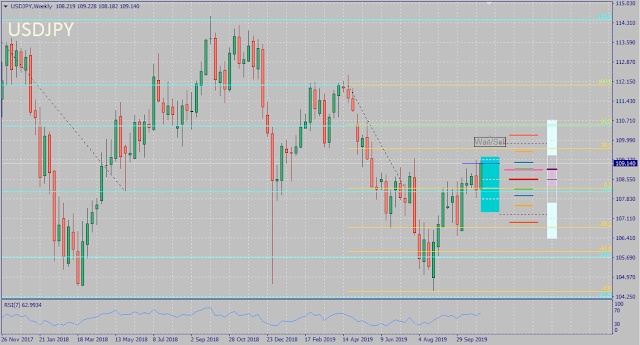

Expecting this pair to continue going range-bound and ho-hum not only this month but also throughout the December holiday season, unless there's either a new round of recession fears, or rumor about SNB cutting rates some more especially after official Brexit by January which will cause this pair to break down from its 0.97 support.USDJPY

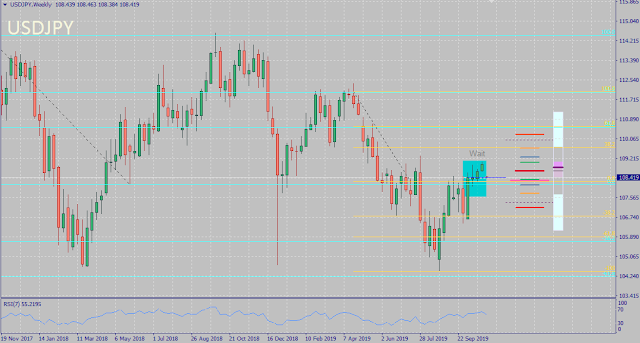

Despite recovering USD and Japan's shrinking services sector, similar to USDCAD and USDCHF above, this pair is more likely to move in a tighter range early this month too and possibly consolidating near 107.5 area first before bouncing up again and breaking out to 110-112 level (if markets continue to be risk-on by December).Back to Top

III. Forecast Attempt in S&P500, Oil and Metals for November 2019

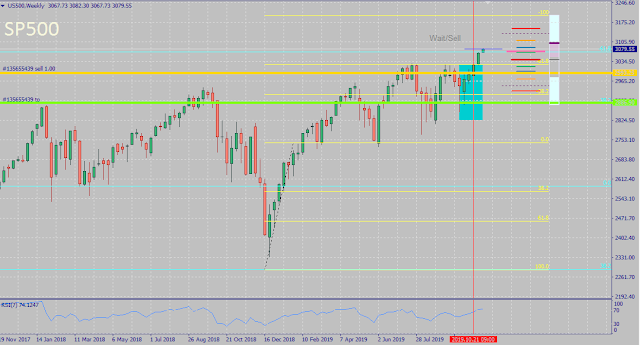

S&P 500*

Made the mistake of shorting too early last month, but still remains to have a bearish bias on SP500 since the recent mini-breakout from its previous resistance was mainly due to better than expected corporate earnings and recent developments in US-China trade talks.

Aside from its price action and even RSI in the higher timeframe (particularly, monthly chart) which both favor a correction, if not a crash soon, I choose to remain cautious like this guy and find stocks too overpriced and also risky. Unless there's assurance that either Trump gets reelected next year or someone who will resume the policies Trump implemented gets elected, then fine. Bullish equities indeed, and maybe Goldmansachs is right and I'll consider putting a hard SL now at 3100.

But if it's more likely that Warren will win the US election next year instead and if recession fears also resume, then I'll stick to being bearish in S&P500 and move my target down further to improve my R/R ratio as well (which doesn't really matter now, unless I put a hard stop instead of just my current mental SL near 3200). Will also definitely add more shorts in this index soon.

Aside from its price action and even RSI in the higher timeframe (particularly, monthly chart) which both favor a correction, if not a crash soon, I choose to remain cautious like this guy and find stocks too overpriced and also risky. Unless there's assurance that either Trump gets reelected next year or someone who will resume the policies Trump implemented gets elected, then fine. Bullish equities indeed, and maybe Goldmansachs is right and I'll consider putting a hard SL now at 3100.

But if it's more likely that Warren will win the US election next year instead and if recession fears also resume, then I'll stick to being bearish in S&P500 and move my target down further to improve my R/R ratio as well (which doesn't really matter now, unless I put a hard stop instead of just my current mental SL near 3200). Will also definitely add more shorts in this index soon.

Gold*

With recent developments in US-China and general increased risk appetite in the markets now (i.e. equities rising), expecting gold to tumble down past its 1470 support soon.

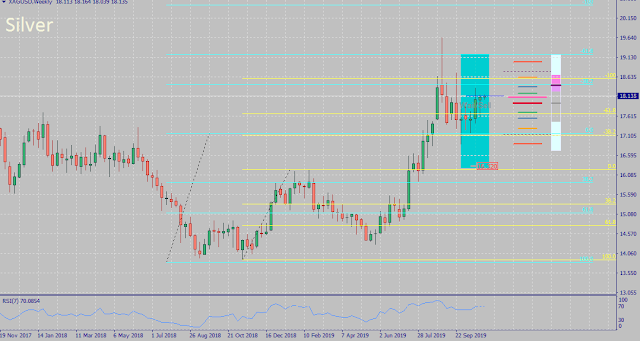

Silver*

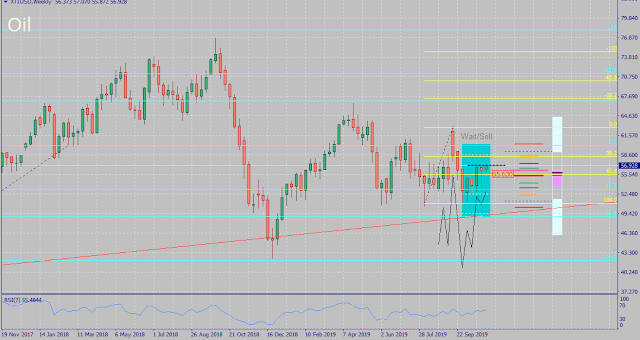

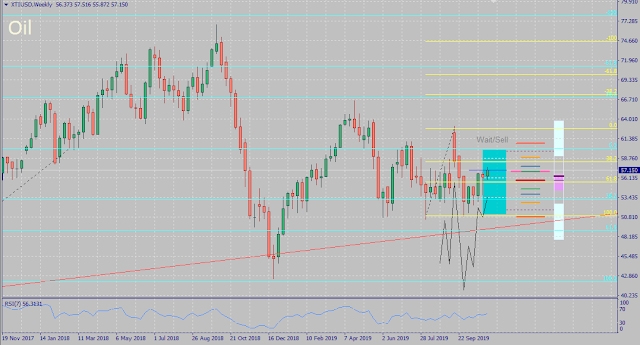

Almost similar to gold, but it's more likely for this metal to continue moving sideways instead of breaking past its current support at 17 (because, JP Morgan)-- we'll see.Oil*

Expecting oil to continue its recovery near 60 at most this month despite recent improvements in US-China trade talks, before correcting again. Though there will be lower demand in oil in the long-run as OPEC predicts, in the short-run it's more likely to increase further, especially peaking at around late Q4 to Q1 next year because of winter season.*Note: Unlike FX pairs, S&P500, Oil and Metals don't really "follow" their monthly seasonality that's why I didn't include their seasonality charts anymore to avoid confusion. I don't see any consistency on them by simply eyeballing the charts.

Back to Top

Feature image by James W. of Pexels

0 comments:

Post a Comment