FX Trading Ideas for the Week | Jul 29 - Aug 02, 2019

To be on the conservative side, seriously it's best to wait until most of the high risk news in several currencies are out especially the US NFP news on Friday before trading FX again -- or just wait for August when summer's finally over and trading volume is back unless you have the balls of steel to temporarily remove SL (like me) as an extreme precaution against whipsaws.

YOLO.

I used to be short on EUR until mid last week when I started going long, not just in EURUSD but also in EURNZD & EURAUD.

The purple line above is where my SL used to be.

If this doesn't go in my favor, then this is a good example of why you should always put a hard SL in your trades.

If this goes in my favor, then this is gonna be a great example of why you should create your own playbook and not just blindly follow generic advice from people -- except if you're newbie. Edit 9/12: Also you can tell that dude above is also yet another newbie because apparently he's the same dude emotionally trading which I mentioned here.

Update 9/12: Only do this and risk not putting SL's if you can actively check your trades regularly (i.e. if you're trading full-time like me, or a highly diligent part-time trader). Hold on only if there's enough good reason to do so, else manually exit.

While not putting an SL indeed saved me from getting whipsawed after the Fed rate cut last 31 July 2019, had to close the trade by August 8 -- and thankfully I did! Right now EURUSD looks like this:

Unless I'm earning interest from carry trade, I'm not willing to hold a losing trade for more than a month lol. Thankfully I made the right call manually closing that early.

AUDCAD - Wait for bearish continuation past 0.905 or bullish bounce at 0.91

AUDCHF - Wait for bullish confirmation past 0.688,or better, bounce near 0.675 before buying

AUDJPY - Wait for bounce and bullish confirmation past 76.2

AUDNZD - Wait for bullish confirmation past 1.0445 then buy up to 1.06-1.10

AUDUSD - Wait for confirmed bounce from 0.67-0.68 before buying

EURAUD - Ride short-term bullishness or wait for direction confirmation near 1.625

GBPAUD - Wait for direction confirmation near 1.77

It's probably better if I close my positions last week, but I'm too stubborn lol.

CADCHF - Wait for better buying opportunity near 0.74 or lower

CADJPY - Wait for direction confirmation near 82.5

EURCAD - Wait for confirmed bounce and better buy entry near 1.45-1.46 before going long

GBPCAD - Continue selling up to 1.585 - 1.60, or wait for confirmed bounce up at those levels

NZDCAD - Wait for possible short-term bounce up from 0.87

USDCAD - Sell near 1.32-1.33

AUDCAD - Wait for bearish continuation past 0.905 or bullish bounce at 0.91

Why am I so excited... sigh. Don't be like me.

CHFJPY - Wait for confirmed direction near 109.5

EURCHF - Wait for bullish confirmation past 1.110 before buying

GBPCHF - Ride the bearish momentum up to 1.19-1.20 or wait for bounce up at those levels

NZDCHF - Buy at better entry point at around 0.66

USDCHF - Wait for confirmed direction near 0.99

AUDCHF - Wait for bullish confirmation past 0.688,or better, bounce near 0.675 before buying

CADCHF - Wait for better buying opportunity near 0.74 or lower

EURGBP - Overbought; ride possible short-term bounce down/consolidation near 0.91, or wait for better bullish entry near 0.90

EURJPY - Wait for confirmed bounce from 119-120

EURNZD - Wait for next direction confirmation near 1.68

EURUSD - Wait for confirmed bounce near 1.11

EURAUD - Ride short-term bullishness or wait for direction confirmation near 1.625

EURCAD - Wait for confirmed bounce and better buy entry near 1.45-1.46 before going long

EURCHF - Wait for bullish confirmation past 1.110 before buying

GBPJPY - Ride the bearish momentum up to at least 132

GBPNZD - Wait for bounce up from 1.83-1.84

GBPUSD - Ride bearish momentum up to 1.20 or better, wait for bounce up near that level

EURGBP - Overbought; ride possible short-term bounce down/consolidation near 0.91, or wait for better bullish entry near 0.90

GBPAUD - Wait for direction confirmation near 1.77

GBPCAD - Continue selling up to 1.585 - 1.60, or wait for confirmed bounce up at those levels

GBPCHF - Ride the bearish momentum up to 1.19-1.20 or wait for bounce up at those levels

NZDJPY - Wait for next direction confirmation near 72

NZDUSD - Wait for confirmed bounce up near 0.66

AUDNZD - Wait for bullish confirmation past 1.0445 then buy up to 1.06-1.10

EURNZD - Wait for next direction confirmation near 1.68

GBPNZD - Wait for bounce up from 1.83-1.84

NZDCAD - Wait for possible short-term bounce up from 0.87

NZDCHF - Buy at better entry point at around 0.66

USDJPY - Wait for confirmed direction near 108

AUDJPY - Wait for bounce and bullish confirmation past 76.2

CADJPY - Wait for direction confirmation near 82.5

CHFJPY - Wait for confirmed direction near 109.5

EURJPY - Wait for confirmed bounce from 119-120

GBPJPY - Ride the bearish momentum up to at least 132

NZDJPY - Wait for next direction confirmation near 72

AUDUSD - Wait for confirmed bounce from 0.67-0.68 before buying

EURUSD - Wait for confirmed bounce near 1.11

GBPUSD - Ride bearish momentum up to 1.20 or better, wait for bounce up near that level

NZDUSD - Wait for confirmed bounce up near 0.66

USDCAD - Sell near 1.32-1.33

USDCHF - Wait for confirmed direction near 0.99

USDJPY - Wait for confirmed direction near 108

XAUUSD - Continue riding bullish momentum in gold (esp its August seasonality has bullish bias too) up to near 1600

XAGUSD - Continue riding bullish momentum like gold up to 17

XTIUSD - Wait for bullish confirmation past 57.5

USDZAR - Wait for bullish continuation past 14.35

USDMXN - Wait for confirmed direction near 19

Update 9/12: Only do this and risk not putting SL's if you can actively check your trades regularly (i.e. if you're trading full-time like me, or a highly diligent part-time trader). Hold on only if there's enough good reason to do so, else manually exit.

While not putting an SL indeed saved me from getting whipsawed after the Fed rate cut last 31 July 2019, had to close the trade by August 8 -- and thankfully I did! Right now EURUSD looks like this:

Unless I'm earning interest from carry trade, I'm not willing to hold a losing trade for more than a month lol. Thankfully I made the right call manually closing that early.

Not sure if there are still a lot of USD fanboys out there but I wish there are, because the more people expect what I expect here above (bearish DXY soon), the less likely it will happen--or at least, less drop than I expect. Similar to pre-summer's S&P 500 last time.

For the record, I trade very small lot size in EURUSD now and I never remove SL on low volume and highly manipulated pairs (i.e. CHF, GBP, and exotic currencies like ZAR, MXN and RUB). I've never experienced being wiped out or even margin called so far despite doing this, removing SL occasionally in other currencies lol.

But I still don't advice people to do the same because I can't tell either, with 100% certainty, if I'm gonna be profitable in EURUSD here despite having strong conviction that it will go in my favor because of several factors in my trading checklist (which I'm gonna share in another post some time). Unlike before where Trump was my wildcard, this time it's Draghi, especially his term is about to end on October this year.

Edit: Nah.Like typical old traditional men, Boris seems predictable afterall. Also, yeah I made the right call not to put SL in EURUSD and profited from it.😎

Before you proceed, make sure to read and understand this Disclaimer here and TRADE AT YOUR OWN RISK.

I. FX Trading Ideas for the Week

AUD - Wait

The Aussie continued plunging down and didn't recover last week as I expected despite being mostly oversold at this point. It's best to wait until all the high risk news and events for AUD are out before taking any position, and only take short-term trading opportunities in between. This week, the Aussie's figures for building approvals, CPI and Retail Sales are gonna be released, but I'm keeping a closer eye on Chinese PMI news on Wednesday, and if it's better than previous and forecasted amounts, might go long at the first sign of bullish candle in lower timeframes-- we'll see.AUDCAD - Wait for bearish continuation past 0.905 or bullish bounce at 0.91

AUDCHF - Wait for bullish confirmation past 0.688,or better, bounce near 0.675 before buying

AUDJPY - Wait for bounce and bullish confirmation past 76.2

AUDNZD - Wait for bullish confirmation past 1.0445 then buy up to 1.06-1.10

AUDUSD - Wait for confirmed bounce from 0.67-0.68 before buying

EURAUD - Ride short-term bullishness or wait for direction confirmation near 1.625

GBPAUD - Wait for direction confirmation near 1.77

It's probably better if I close my positions last week, but I'm too stubborn lol.

CAD - Wait

Canada's GDP and Trade Balance news are gonna be out later this week so it's best to wait it out until next week unless we see a sudden strong bullish continuation in oil and more amicable trade talks between US and China.CADJPY - Wait for direction confirmation near 82.5

EURCAD - Wait for confirmed bounce and better buy entry near 1.45-1.46 before going long

GBPCAD - Continue selling up to 1.585 - 1.60, or wait for confirmed bounce up at those levels

NZDCAD - Wait for possible short-term bounce up from 0.87

USDCAD - Sell near 1.32-1.33

AUDCAD - Wait for bearish continuation past 0.905 or bullish bounce at 0.91

Why am I so excited... sigh. Don't be like me.

CHF - Wait

If stocks struggle to find direction now, it's the same thing with CHF too with its momentum currently driven by other currencies. It's also gonna be National Day for Switzerland this coming Thursday, August 1, so expect CHF pairs' trading volume to be light.CHFJPY - Wait for confirmed direction near 109.5

EURCHF - Wait for bullish confirmation past 1.110 before buying

GBPCHF - Ride the bearish momentum up to 1.19-1.20 or wait for bounce up at those levels

NZDCHF - Buy at better entry point at around 0.66

USDCHF - Wait for confirmed direction near 0.99

AUDCHF - Wait for bullish confirmation past 0.688,or better, bounce near 0.675 before buying

CADCHF - Wait for better buying opportunity near 0.74 or lower

EUR - Buy

Most EUR pairs went up recently -- except EURUSD and EURCAD. With both hard Brexit and a dovish ECB on September almost fully priced in by now, I believe EUR had already reached the bottom barrel and has nowhere to go next but up. Between Eurozone and UK, the latter would suffer more on a no-deal Brexit especially with Scotland threatening to separate from UK and be independent (and possibly go back to EU on its own). Perhaps Ireland too will do the same.EURGBP - Overbought; ride possible short-term bounce down/consolidation near 0.91, or wait for better bullish entry near 0.90

EURJPY - Wait for confirmed bounce from 119-120

EURNZD - Wait for next direction confirmation near 1.68

EURUSD - Wait for confirmed bounce near 1.11

EURAUD - Ride short-term bullishness or wait for direction confirmation near 1.625

EURCAD - Wait for confirmed bounce and better buy entry near 1.45-1.46 before going long

EURCHF - Wait for bullish confirmation past 1.110 before buying

GBP - Sell

After Boris wins as UK's new Prime Minister, there's a "rumor" that unlike Theresa May who painstakingly went back and forth EU and UK Parliament, and tried her best to strike a good deal, Boris on the other hand has a no-care, no-deal Brexit approach --which will definitely leave UK on a more difficult situation in the near future as mentioned above.GBPJPY - Ride the bearish momentum up to at least 132

GBPNZD - Wait for bounce up from 1.83-1.84

GBPUSD - Ride bearish momentum up to 1.20 or better, wait for bounce up near that level

EURGBP - Overbought; ride possible short-term bounce down/consolidation near 0.91, or wait for better bullish entry near 0.90

GBPAUD - Wait for direction confirmation near 1.77

GBPCAD - Continue selling up to 1.585 - 1.60, or wait for confirmed bounce up at those levels

GBPCHF - Ride the bearish momentum up to 1.19-1.20 or wait for bounce up at those levels

Contradictory GBPCAD trade just to serve as hedge now because I failed to close my short-term bullish position last week before Boris won. Sigh.

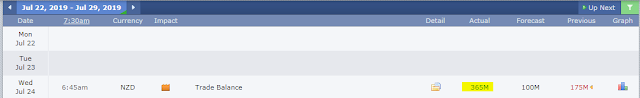

NZD - Wait

The Kiwi continues to be bogged down by Aussie, as its pairs continue to drop further despite having better than expected Trade Balance figures last week. Wait for developments regarding AUD this week before going riding the possible bounce play and being bullish again in NZD.NZDJPY - Wait for next direction confirmation near 72

NZDUSD - Wait for confirmed bounce up near 0.66

AUDNZD - Wait for bullish confirmation past 1.0445 then buy up to 1.06-1.10

EURNZD - Wait for next direction confirmation near 1.68

GBPNZD - Wait for bounce up from 1.83-1.84

NZDCAD - Wait for possible short-term bounce up from 0.87

NZDCHF - Buy at better entry point at around 0.66

JPY - Wait

JPY recently enjoyed a bullish momentum like gold these past few months with the markets being risk-off mainly thanks to US-China trade spats unappealing low-yielding bonds, and a rumored recession coming soon.USDJPY - Wait for confirmed direction near 108

AUDJPY - Wait for bounce and bullish confirmation past 76.2

CADJPY - Wait for direction confirmation near 82.5

CHFJPY - Wait for confirmed direction near 109.5

EURJPY - Wait for confirmed bounce from 119-120

GBPJPY - Ride the bearish momentum up to at least 132

NZDJPY - Wait for next direction confirmation near 72

USD - Wait

I still don't have a strong bias on where DXY will go next, aside from most likely staying flat for awhile before suddenly plunging down because the 97-98 resistance is strong, and currently there's not enough strong stimulus to drive USD to breakout on the upside. Possible it will climb first and touch 100 psychological price point before plunging down, despite current uncertainty in the market regarding the highly probable Fed rate cut soon.AUDUSD - Wait for confirmed bounce from 0.67-0.68 before buying

EURUSD - Wait for confirmed bounce near 1.11

GBPUSD - Ride bearish momentum up to 1.20 or better, wait for bounce up near that level

NZDUSD - Wait for confirmed bounce up near 0.66

USDCAD - Sell near 1.32-1.33

USDCHF - Wait for confirmed direction near 0.99

USDJPY - Wait for confirmed direction near 108

XAUUSD - Continue riding bullish momentum in gold (esp its August seasonality has bullish bias too) up to near 1600

XAGUSD - Continue riding bullish momentum like gold up to 17

XTIUSD - Wait for bullish confirmation past 57.5

USDZAR - Wait for bullish continuation past 14.35

USDMXN - Wait for confirmed direction near 19

Feature image by Marnhe P. of Unsplash

0 comments:

Post a Comment