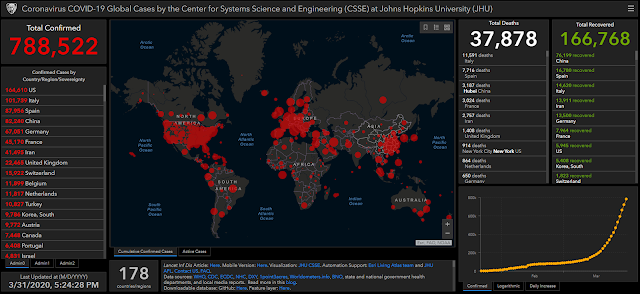

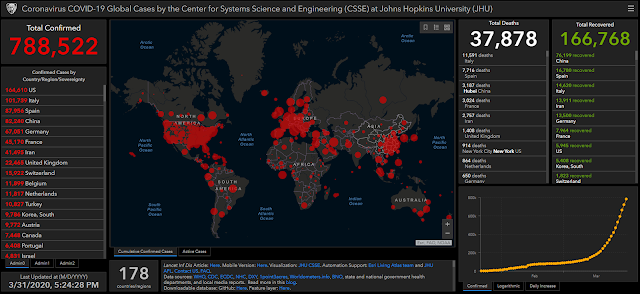

Though the curve is less steep now compared to last March, I don't see any signs of it peaking at the moment, and if we're not being careful, the worse is yet to come until we get a proper vaccine (or cure).

|

| Source: JHU CSSE |

Governments continue to provide support in both consumers and businesses, while central banks also provide stimulus through monetary easing and buybacks, despite only a few of them cutting rates in April like Russia.

US Jobless Insurance claims rose to 3.84 million last week, while annualized Q/Q real GDP decreased at 4.8% (from an increase at 2.1% in prior period), and personal consumption tanked at 7.5% (a greater decrease than what most expected at 4%, and huge difference from prior periods averaging at 0-2% increase).

GDP in Eurozone all showed disappointing figures-- all lower than forecast.

As this current economic contraction is being priced in, some courageous whales take this as an opportunity to buy at a bargain (hence, the recent rally in equities and cryptocurrencies).

Overall sentiment is still bearish and risk-off though, and most central banks are dovish, especially with the risk of a 2nd wave still on the table and the worse may yet to come especially if it happens in colder months (autumn season), until either an official (and safe) vaccine is released realistically by next year, or we're all able to fight it off this summer through lockdown efforts and the effectiveness (and safety) of Remdesivir.

I've been hearing "rumors" around that we're experiencing something like the 20's now-- not only with the stock market, but also this pandemic being reminiscent of the

Spanish flu.

The US Dollar Index (DXY) consolidated last April to 98.5 after briefly breaking past 100 and its 2015 high, and reaching 102 (100 fib level):

This was in line with the slightly bearish bias on DXY for April 2020, despite the USD being high demand and also considered as safe haven.

Forex majors moved within the forecasted range and expected volatility, except for the aussie and fiber which experienced recovery and less bearish than most traders expect, respectively.

AUDUSD

|

| April 2020 actual result |

EURUSD

|

| April 2020 actual result |

GBPUSD

|

| April 2020 actual result |

NZDUSD

|

| April 2020 actual result |

USDJPY

|

| April 2020 actual result |

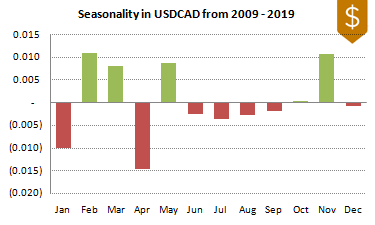

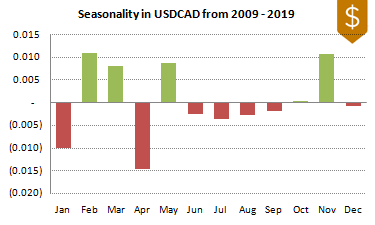

USDCAD

|

| April 2020 actual result |

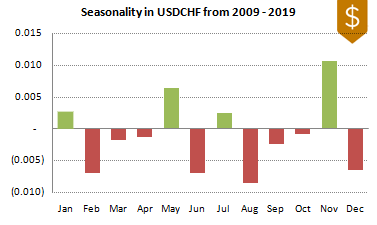

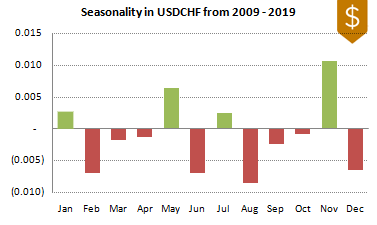

USDCHF

|

| Apr 2020 actual result |

Back to Top

The exotic pairs below have been less bearish than expected recent consolidation in DXY last month. All of them seem to consolidate in a narrowing channel hinting a breakout soon.

USDMXN

|

| Apr 2020 actual result |

USDZAR

|

| Apr 2020 actual result |

USDCNH

|

| Apr 2020 actual result |

Back to Top

Some states in the US and countries in Europe (i.e. Austria, Germany and Denmark) began cautiously easing their lockdown in hopes of reviving this economic slump due to the current pandemic. We have yet to get a hint soon through PMI figures if confidence have returned, as well as through clinical trial results of

Remdesivir until a proper vaccine or cure is safely made available to the general public.

DXY Monthly Forecast

May 2020 Outlook: Conservative rally

|

| DXY Seasonality Win-Rate: 60% |

Considering the forex seasonality this May, it's more likely for USD to strengthen and DXY to move up in the following scenarios:

a.) high bullish volatility up to near 105-106.5 (61.8 fib) if whales become more risk-averse than usual and cling to USD as safe haven asset, especially if a 2nd wave occurs in the US and Euro zone, and combined with equities plunging further than its previous low back in March (next bearish target at 1800) -- low chance of happening soon especially with central banks providing stimulus and risk of inflation, whales are now more likely to consider other safe haven assets (i.e. metals such as gold, and art) and diversify risk, unless a 2nd wave indeed occurs and push the global economy to a deeper recession, which further increases the demand for USD;

b.) rally up to 100-102.5 soon (prior period 100 fib) given the bullish bias for USD in this month's seasonality, and possible signs of slight economic recovery soon from its current slump last month -- more probable to happen since this is the most realistic one , with an "invisible hand" seemingly keeping the dollar below 100 to keep US exports competitive;

c.) drop to 95 if more whales shift to other safe haven assets, and US-China tensions resurface especially with allegations of the virus coming from Wuhan lab (wow, we Resident Evil now? lol), and confirmed cases finally peak -- least likely to happen, at least for this month, especially confirmed cases will realistically peak by around mid-summer/July and not this May (optimistic scenario), given the current rate it's in and assuming current lockdown is still in place or a disciplined and highly monitored social distancing is implemented for areas that eased their lockdown

AUDUSD Monthly Forecast

May 2020 Outlook: Bearish continuation up to at least 0.617

|

| AUDUSD Seasonality Win-Rate: 61% |

Expecting the aussie to continue its bearish trend for this month, though most likely it will only touch up to 0.617 then resume its bullish reversal afterwards especially forecasted Trade Balance figures is higher than previous period (6.40B vs 4.36 B)-- but let's see actual figures by Thursday, and impact of Trump's renewed interest on

retaliatory tariffs against Beijing.

Australia has also been a little more resistant to this global pandemic compared to other countries, so they're

easing their lockdown soon.

China began easing their lockdown as early as April, however

this study about the possibility of a 2nd wave has been released and

certain provinces like Henan have indeed experienced a 2nd wave, requiring a new stricter lockdown.

Depending on USD strength and how Australia manages its cases after easing their lockdown, it's still possible for the aussie and other AUD pairs to resume its bearish momentum. There's a possibility that the aussie might slide back down to 2008 low at 0.605 or even its low last March (0.55) given its strongly bearish forex seasonality this month. But both fundamentals and higher time-frame price action suggest that a bullish counter-trend reversal is still more probable:

EURUSD Monthly Forecast

May 2020 Outlook: High volatility, range-bound movement inside 1.0805-1.13

|

| EURUSD Seasonality Win-Rate: 69% |

Eurozone is debating among themselves whether to ease the lockdown soon or not, with the majority agreeing that it's still

premature and highly dangerous to do so, considering the high death rates in their area too (except Germany).

Though fundamentals point to a bearish bias on EUR pairs in general especially with recent GDP figures last week and other issues in the euro-zone prior to the pandemic, price action in and the pin-bar last March suggests "uncertainty" and impending range-bound movement for the fiber.

If we're gonna follow the monthly trendline, contrary to popular outlook since April, the fiber can actually rally beyond 1.13-- possibly up to 1.15-- depending on the effects of USD strength, with numbers in Commitment of Traders report suggesting more bullish whales in the previous period.

|

| Source: cftc.gov |

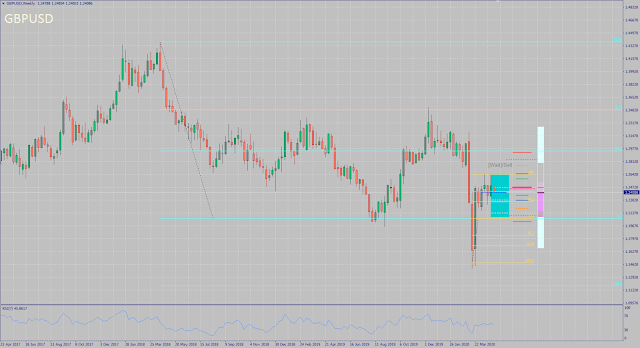

GBPUSD Monthly Forecast

May 2020 Outlook: Tighter range-bound movement between 1.23-1.265

|

| GBPUSD DXY Seasonality Win-Rate: 64% |

After its rally last month, expecting the cable to move in a tighter range this month, with possibility of sliding down near 1.205 (few pips below monthly and weekly 0 fibonacci) later this month especially since the UK is among those places with higher death rates, aside from a bearish forex seasonality bias by June.

NZDUSD Monthly Forecast

May 2020 Outlook: Bearish continuation to 0.55

|

| NZDUSD Seasonality Win-Rate: 65% |

Given the bearish bias on its May seasonality, expecting the kiwi to bounce down to 0.55 from its new ceiling now at 0.62234 (monthly 0 fibonacci level), before possibly going range-bound, depending on USD strength, and impact of Trump's

politicized accusations against Beijing.

USDCAD Monthly Forecast

May 2020 Outlook: Possible breakout to 1.50

|

| USDCAD Seasonality Win-Rate: 70% |

With DXY technically (and fundamentally) bound to rally soon, expecting the loonie to breakout soon to at least 50 especially most institutional whales continue to be bearish on CAD.

|

| Source: cftc.gov |

It's still uncertain whether oil is bound to reverse its current bearish trend soon and resume its recovery, or if the recent upside movement is just temporary and XTIUSD for instance might bounce back to 11.5.

USDCHF Monthly Forecast

May 2020 Outlook: Bounce up to 1.00

|

| USDCHF Seasonality Win-Rate: 70% |

Given its current range-bound movement, bullish bias on this month's seasonality, as well as neutral sentiment of institutional whales to CHF (since USD had been more appealing now as safe haven asset than CHF), expecting the swissie to bounce up to 1.00 soon.

USDJPY Monthly Forecast

May 2020 Outlook: Narrow range-bound movement between 105.5 - 108

|

| USDJPY Seasonality Win-Rate: 81% |

Since JPY is also considered a safe-have asset, both USD and JPY will continue to "clash", and given the neutral bias for this pair this month, it's more probable for its price to simply move in a narrower range soon between 105.5-108, instead of recovering higher soon despite given that bullish engulfing candle last March.

Back to Top

Given an expected stronger US dollar this May based on the analyses above, and the usual "sell in May" mantra not only for stocks, but also to emerging markets and other risk-on endeavors, expecting most of these exotic pairs below to be all bullish.

USDMXN Monthly Forecast

May 2020 Outlook: Breakout to 27

|

| USDMXN Seasonality Win-Rate: 71% |

USDMXN is more likely to consolidate a bit up to 24, before suddenly breaking out to 27 (or higher), near its 100 fibonacci level in the weekly chart.

USDZAR Monthly Forecast

May 2020 Outlook: Bullish continuation to 20.35

|

| USDZAR Seasonality Win-Rate: 69% |

Similar to USDMXN above although to a lesser extent, expecting USDZAR to resume its bullish momentum soon up to 20.35 (61.8 fibonacci level in the weekly chart).

USDCNH Monthly Forecast

May 2020 Outlook: Either bounce down after reaching 7.20, or breakout out to 7.40

|

| USDCNH Seasonality Win-Rate: 58% |

Given the tricky relationship between these 2 countries and sub-60% win-rate for the seasonality of USDCNH, either it will only climb up to 7.20 before reversing down, or suddenly breakout to 7.40 after consolidating

Back to Top

I've selected a few FX minor pairs with interesting levels and seasonality, that are either aligned with current fundamentals and sentiment (i.e. strong JPY, weak AUD), or provide possible hedge to popular outlook (i.e. possible recovery of CAD this month despite weak oil and trade issues related to current pandemic).

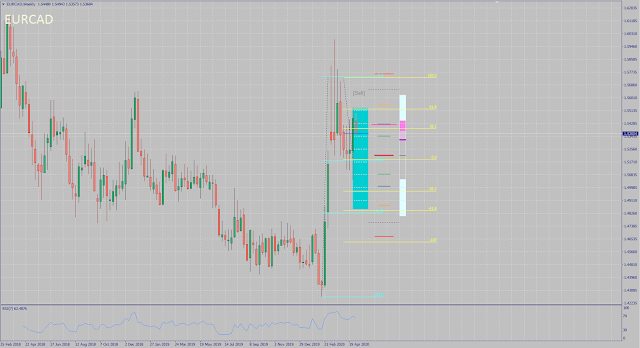

EURCAD Monthly Forecast

May 2020 Outlook: Consolidation to at least 1.52, and possible gradual decline down to 1.50 (or lower)

|

| EURCAD Seasonality Win-Rate: 61% |

EURNZD Monthly Forecast

May 2020 Outlook: Bounce back to at least 1.85 (or higher - depends on how weak NZD gets this month)

|

| EURNZD Seasonality Win-Rate: 68% |

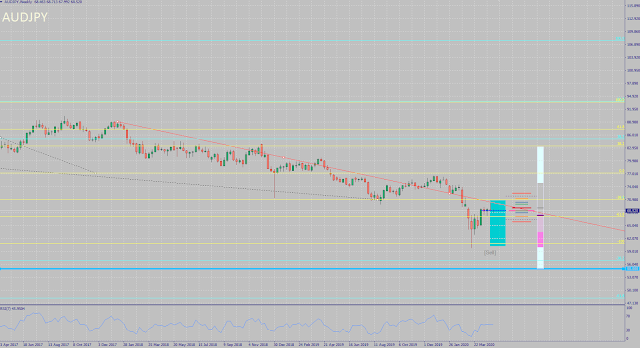

AUDJPY Monthly Forecast

May 2020 Outlook: Resume bearish trend up to 61 (with possibility of extended drop to 55 which is the 2008 low)

|

| AUDJPY Seasonality Win-Rate: 65% |

AUDCAD Monthly Forecast

May 2020 Outlook: Consolidation up to 0.87 (or lower, depending on oil and CAD recovery this month)

|

| AUDCAD Seasonality Win-Rate: 65% |

CADCHF Monthly Forecast

May 2020 Outlook: Bounce up to 70 (or higher at 72 - which is the 0 fibonacci level in the weekly chart)

|

| CADCHF Seasonality Win-Rate: 65% |

Back to Top

Analysis made here simply provides a general overview, and is based on conditions stated at the time of this writing and doesn't serve as financial advice. Read the Disclaimer here , and make sure to do your own due diligence.

Featured photo by Allie of Unsplash

0 comments:

Post a Comment