Oil and Metals Analysis and Forecast for May 2020

Back when oil went sub-zero, wish we have our own gasoline station business.

Replacing swimming pool water with oil is also an enticing option lol.

From this:

To this:

|

| by JF Hobb of Panoramio |

TABLE OF CONTENTSI. Outcome of Oil and Metals Monthly Forecast for April 2020II. Oil and Metals Analysis and Forecast for May 2020 |

I. Outcome of Oil and Metals Monthly Forecast for April 2020

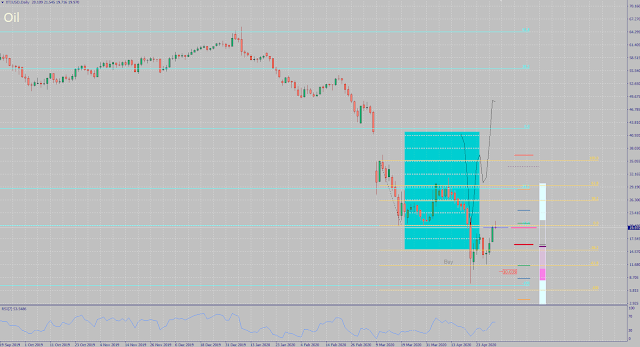

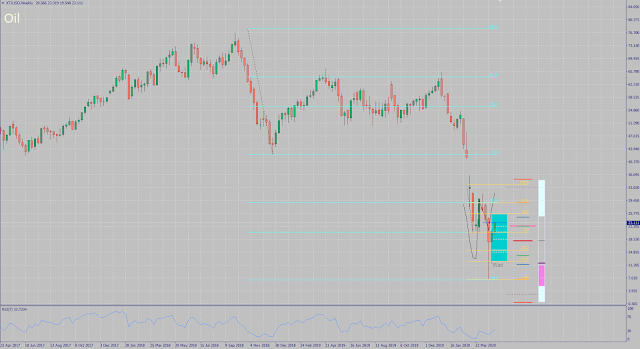

XTIUSD

Contrary to last month's expectation that oil would close that gap soon especially OPEC had been enforcing production cuts to address the oil glut and storage problem, along with consolidating DXY, oil slid further instead beyond 10, and briefly touched the 100 fibonacci level in the weekly chart

XAUUSD

Instead of bouncing down near 1500 as expected the moment gold touched the 100 fibonacci level, it went a couple of pips past it (I might have to double-check and revise the weekly fibonacci levels) and formed a double-top.

XAGUSD

Silver, on the other hand, have indeed bounced back from its previous low similar to gold, but remained in a lower range than gold.II. Oil and Metals Analysis and Forecast for May 2020

Overall, at least for the mid-term, still bearish in oil and cautiously bullish in metals assuming the same conditions now gets prolonged, and if we're indeed actually in the beginning of a 1920's-like Great Depression. Though we have better technology now and infrastructures compared to my grandmother's era and don't wanna be some debbie-downer in general, it's still highly probable that the global economy won't recover as fast as most of us want. Similar to how it was both in the 1920's and early 2000's, it's gonna be a slow crawl up to recovery.

However, there are interesting setups this month which might not necessarily align with that broad picture outlook and fundamentals (hence, riskier), and might interest counter-trend traders and day traders.

XTIUSD Monthly Forecast

May 2020 Outlook: Ride rally up to 30, then possible drop back to 11.5

However for this month, since confirmed cases haven't peaked yet (may realistically do so by July), and there have been actual cases of a second wave in China for instance (one of the huge buyers of oil), as well as an expected stronger dollar this month as mentioned in the FX May 2020 outlook, it's more probable for oil to move sideways after instead (similar to recent movement of CHF pairs) after hitting 30-- more like a bowl-type recovery instead of a v-type -- we'll see.

XAUUSD Monthly Forecast

May 2020 Outlook: Wait for better entry near 1600 or lower before buying

Since gold is still considered a safe haven asset, it's more likely to continue going up and reach a new high at 1800. But whether it does so before consolidating near 1600 or after is uncertain (more likely the latter, but we'll see). So it's best to wait for confirmation first, or wait for consolidation and buy XAUUSD at a better entry especially with high likelihood of dollar rallying soon (more so if whales go sell in May and go away in equities).

XAGUSD Monthly Forecast

May 2020 Outlook: Remain range-bound; move in a tighter range between 13.5-16

With low production numbers despite other areas easing their lockdown, expecting silver which is an industrial metal to continue going range-bound at the 0 fibonacci level in the weekly chart (61.8 fibonacci in the monthly chart) and underperform compared to gold.Back to Top

Analysis made here is based on my current opinion and research as of the time of this writing and doesn't serve as a recommendation or financial advice. Be sure to read the Disclaimer here and also do your own due diligence.

0 comments:

Post a Comment