FX Seasonality Forecast for April 2020

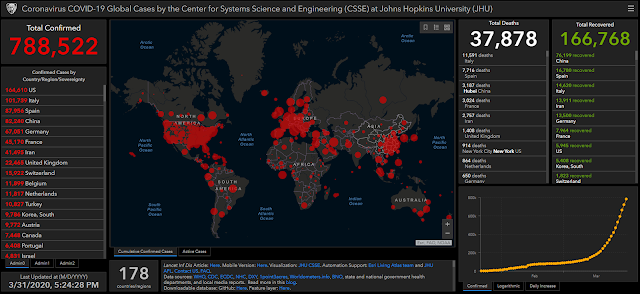

Although I expected the stock market crash to happen soon and sudden volatility in the FX markets would definitely follow suit (hence, no March FX seasonality post because the movements would be unpredictable at best and historical seasonality won't be a good basis), I didn't expect this number to reach 700k+ by end of March:

|

| Source: JHU CSSE |

I didn't even expect for us to experience something like China now.

With most world leaders and whales trying to control the spread of panic and "fake news" back in January, I trusted that they would be proactively taking measures behind-the-scenes to prevent this from spreading and thwart a global pandemic.

Welp.

Considering its current exponential growth rate, it's disturbing how 788k is more likely to grow and become 1M over the weekend.

Anyway, the good side of this is less pollution. The universe really has its own way of keeping things balanced.

Except of course to those in manual service. I hope they continue to receive some form of help or compensation because of this predicament. Also hoping they'll be able to upgrade their skills during this down time to help them get a job that they can work at from home during emergencies.

TABLE OF CONTENTSI. Outcome of FX Seasonality-Based Prediction for February and March 2020II. Forecast for April 2020 Based on Recent 10-Year FX Seasonality |

I. Outcome of FX Seasonality-Based Prediction for February and March 2020

For the month of February, comdolls continued to decline faster than expected despite the sudden drop in DXY too. I attribute this to the reality of the actual situation finally sinking in and making the markets fully risk-averse. That was the time when gold also broke out its 61.8 fib and continued rising past 1600 a bit before correcting this month when whales realized they should hoard some dollar too.Hence the sudden jump of DXY by March:

Given the current global scenario, USD becomes a safe-have asset too like gold (even better than gold because of liquidity and ease of using it to buy day-to-day goods). I'll be adjusting my expectations in DXY to reflect this for the month of April.

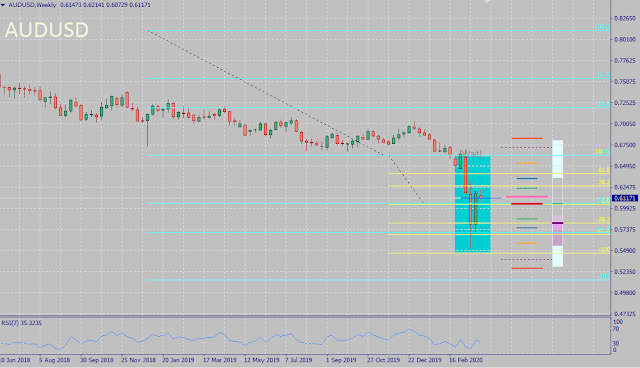

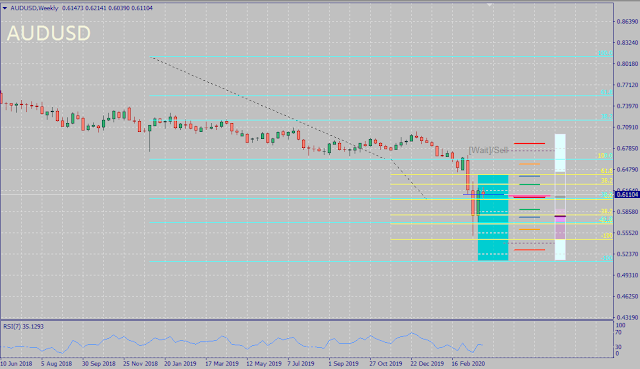

AUDUSD

|

| Feb 2020 actual result |

|

| Mar 2020 volatility |

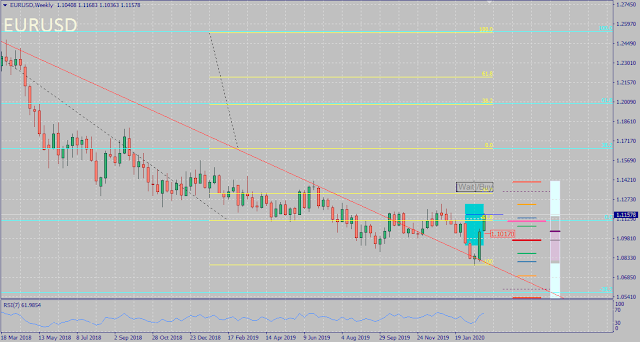

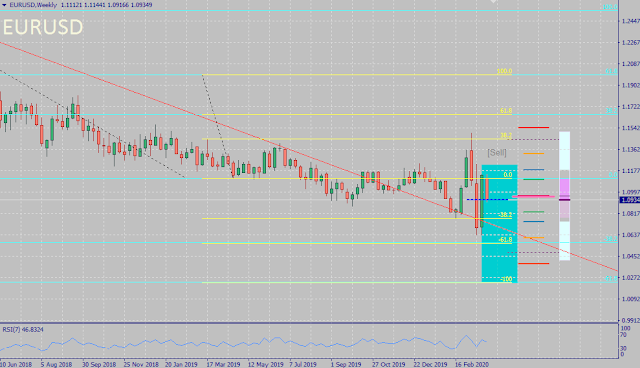

EURUSD

|

| Feb 2020 actual result |

|

| Mar 2020 movement |

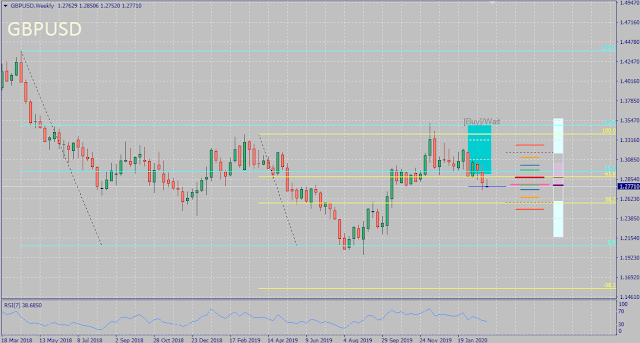

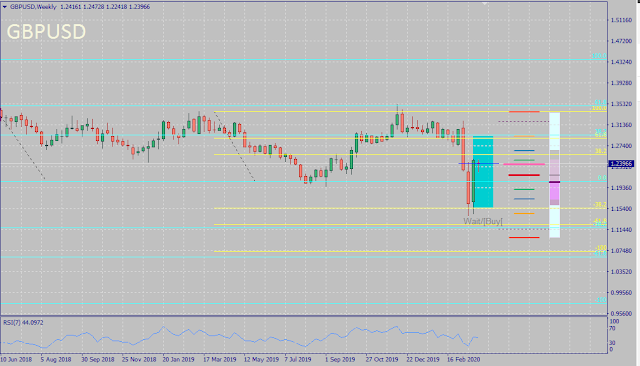

GBPUSD

|

| Feb 2020 actual result |

|

| March 2020 movement |

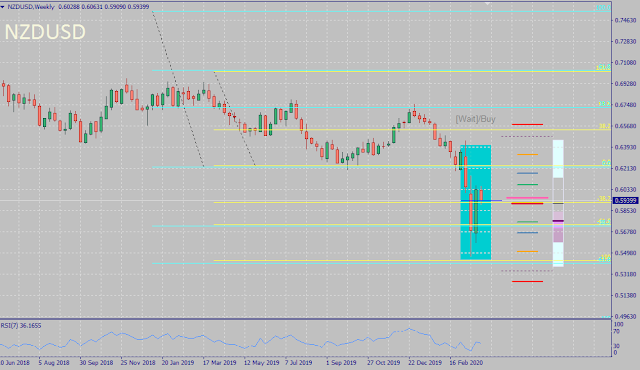

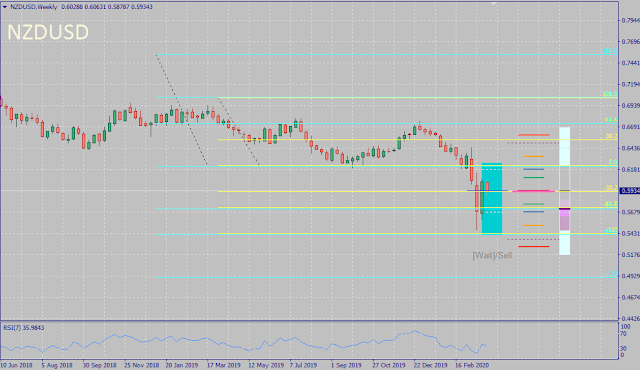

NZDUSD

|

| Feb 2020 actual result |

|

| March 2020 movement |

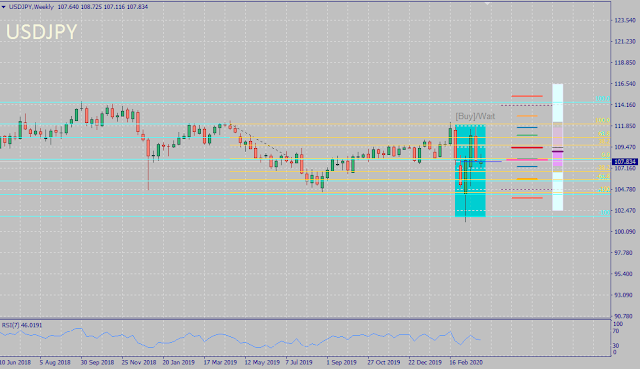

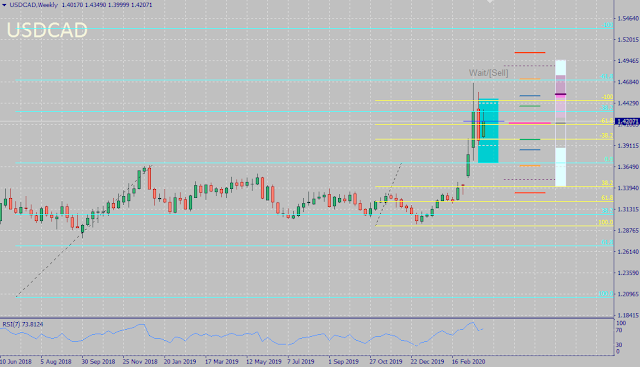

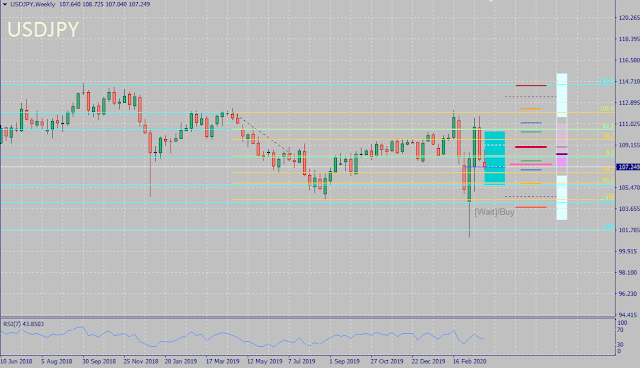

USDJPY

|

| Feb 2020 actual result |

|

| March 2020 movement |

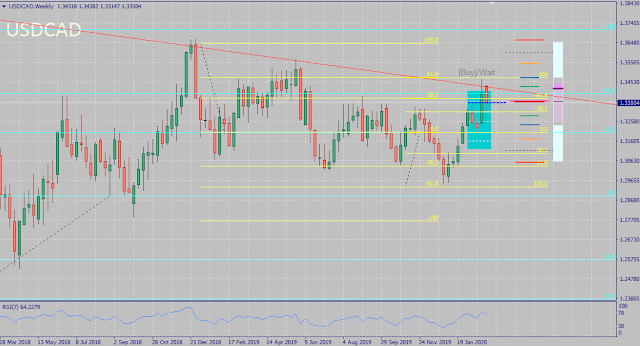

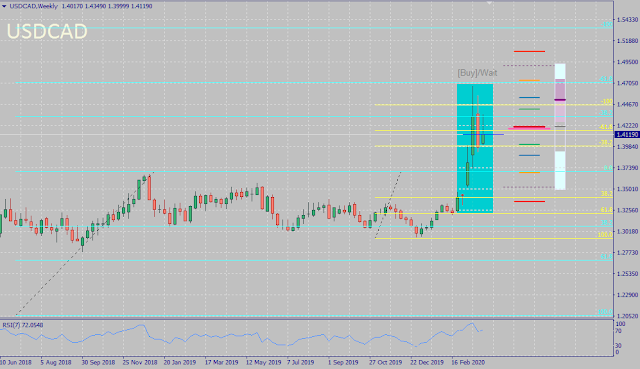

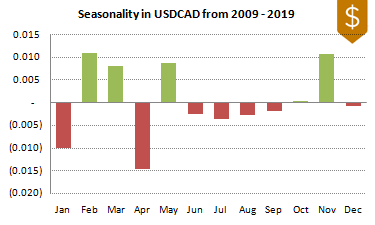

USDCAD

|

| Feb 2020 actual result |

|

| March 2020 movement |

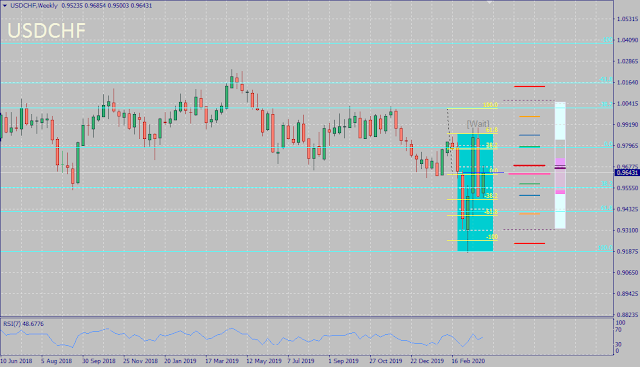

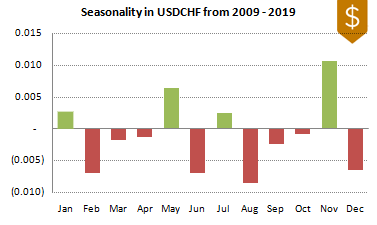

USDCHF

|

| Feb 2020 actual result |

|

| March 2020 movement |

Despite the drop in DXY, the exotics reflected the subsequent bullishness in USD -- partly because of weakening demand in emerging economies now and other risk-on ventures. Whether exotic pairs are a good forward clue regarding where DXY is headed next or not, I have still yet to study the correlation.

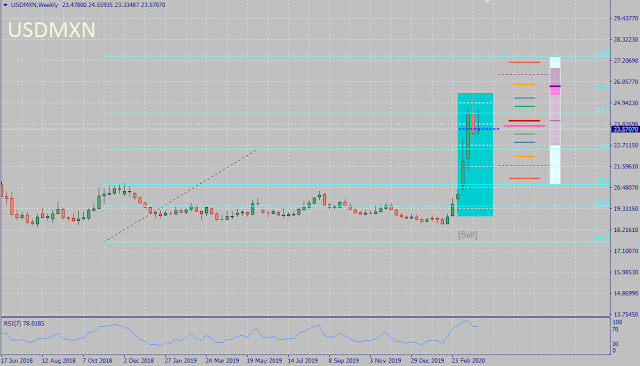

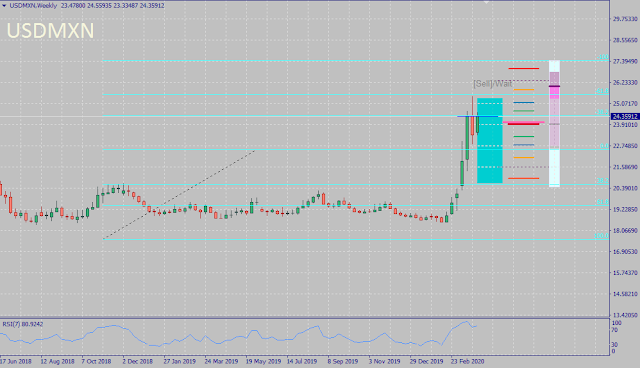

USDMXN

|

| Feb 2020 actual result |

|

| March 2020 movement |

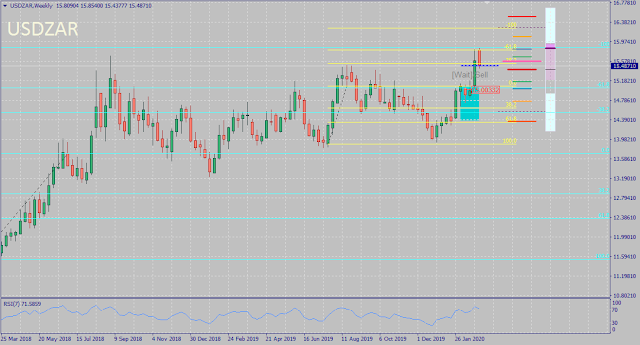

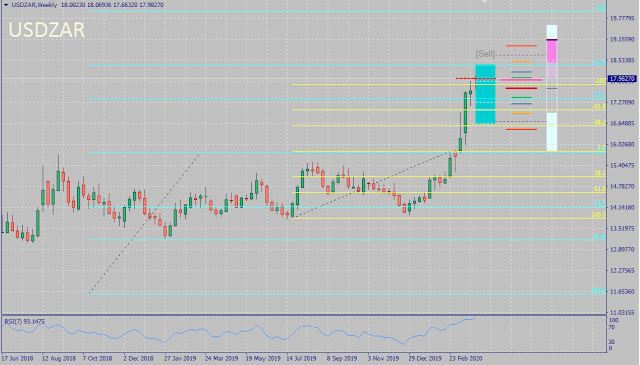

USDZAR

|

| Feb 2020 actual result |

|

| March 2020 movement |

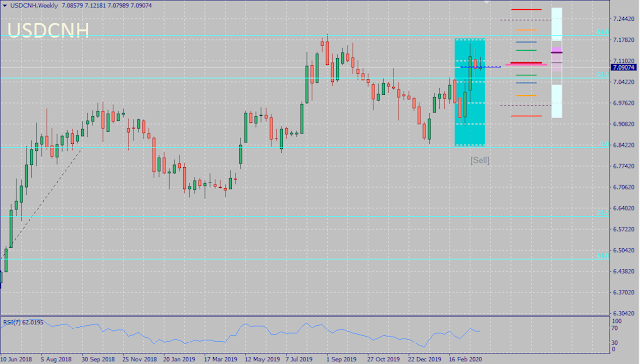

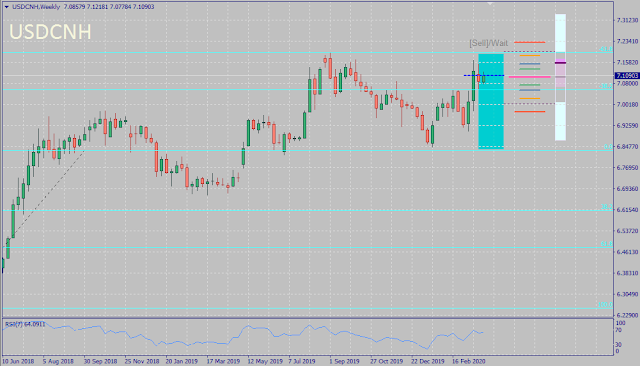

USDCNH

|

| Feb 2020 actual result |

|

| Mar 2020 volatility |

Back to Top

II. Forecast for April 2020 Based on Recent 10-Year FX Seasonality

Despite having the first test runs being done now for the vaccine, realistically-speaking, it will still take more than a year before a safe batch can be produced and sold globally. There's a possibility that global confirmed cases will finally peak before summer then finally be fully controlled-- though not as "quickly" as China for obvious reasons.If this lockdown isn't managed well and create unnecessary blockages for food and other supplies in transit, it might be business-as-usual soon with everyone just hoping for the vaccine to be available soon as the best scenario, while public riot as the worst especially if combined with increasing unemployment rate.

The current downtrend and risk-off sentiment will continue to persist throughout Q2 with possibility of cautious recovery by late Q2 to early Q3 this year.

DXY

Given this special case and unusual scenario above, expecting USD to keep getting stronger, with possibility of rising up to near 104 again, despite its seasonality for April showing otherwise.However, I don't think it will breakout past the previous 2016 high near 104 since the US government is definitely trying its best to keep the dollar from appreciating a lot and prevent further ballooning of US debt-- unless its increasing unemployment rate now becomes the pin that will pop that debt bubble and cause panic to everyone to hoard cash (actually we should keep and hold cash, don't even trust the banks imho).

AUDUSD

Despite the hawkish tone of RBA earlier stating that they won't go the negative interest rate territory, as well as a mildly bullish seasonality this April, expecting the Aussie to recover a bit before resuming its slide down to 0.55 territory and beyond -- especially with a highly bearish seasonality by May, and current lockdown putting a strain to companies and global economy overall.EURUSD

Despite ECB's 750 billion euro Pandemic Emergency Purchase Program (PEPP), the Euro zone will remain in a slump overall for some time because aside from the virus spreading faster there, the financial condition of Southern areas like Italy, Spain and France are much worse now, and definitely will strain relations with Germany for instance which has yet to provide stimulus in its own economy and revive its car industry prior to the pandemic.GBPUSD

Not sure if being geographically separate from main Euro-zone alone provided advantage for the Brits to control the spread of virus better, or their Brexit also paid off--- I guess it does in the long run afterall since they don't have to pitch in and help shoulder Germany and other conservative Northern European countries' burden in providing financial aid to those financially troubled countries in Southern Europe.But despite that and its bullish seasonality for this month, the pound will only mildly recover especially death rate related to the virus there in UK is higher (almost 10%-- even higher than China) than its recovery rate (less than 1%), unlike most countries with higher recovery rate than their death rate-- possibility of UK being in the early stages and actual recovery rate can't be accurately determined yet, but it's definitely taking a toll on their businesses and citizen's confidence and outlook.

NZDUSD

Similar to the Aussie, expecting the Kiwi to recover a bit early this month at least especially after RBNZ cut rates to zero and also announced a $30 billion asset purchase program. However, a resumption of the slide is highly likely because aside from the bearish seasonality for May, if the virus and lockdown are gonna affect consumer confidence and profitability, then they're likely to suffer an economic slump as well like the other developed nations.USDCAD

Despite a bullish outlook overall on USD being a safe haven during these times, expecting this pair to consolidate this month given its bearish seasonality, and also both its current price action and technicals already flashing 'overbought'. Expecting both oil and loonie to recover a bit early this month, before probably resuming the bearish momentum late this month to early May.USDCHF

Given its neutral seasonality for April, expecting this pair to remain range-bound despite bullish sentiment on USD overall, since it's possible that the whales might consider going back to CHF as safe haven if they want to reduce exposure on USD, especially with the US having the highest number of confirmed cases right now, and the risk of high unemployment rate popping the US debt bubble.USDJPY

Though it's highly probable for this pair to bounce back up soon, considering its April-May seasonality as well as Japan's better than expected economic data along with being able to control the spread of the virus and planned stimulus package of BOJ, expecting this pair to play out a 'tug-o-war' between USD and JPY, and stay range-bound.USDMXN

Despite a bullish bias on DXY and USD in general, since oil is already oversold, seasonality for this month is bearish, and both price action and technicals signal overbought levels for this pair, expecting this to consolidate, if not correct, soon. However, still bullish on this pair in the long-run especially with the outflow of investments from emerging markets while overall sentiment remains risk-off.USDZAR

Almost similar to USDMXN above, expecting USDZAR to consolidate a bit soon but resume its upside by mid-to-late April, especially after Moody downgrades South Africa's credit rating from investment grade to junk.USDCNH

With China being able to successfully manage the spread of the virus now and confirmed cases in China seemingly plateauing at 80k-ish, not to mention having deeper pockets to prop up their economy and resume business-as-usual once it's confirmed that the virus is indeed "gone" in China after 14-days or so, and also a bearish seasonality for this month, expecting CNY to strengthen a bit soon, and for this pair to slide down near 6.85 this month.The reverse will happen though if this has not been priced in yet afterall, and if there's a sudden jump from 80k+ to more than 100k-- more so if China suddenly overtakes US numbers. But if it's just a slight bump and less than 100k, then USDCNH will continue to go range-bound instead of suddenly spiking up like the exotic pairs above.

Back to Top

Featured photo by John Mark S. of Pexels

0 comments:

Post a Comment