Oil and Metals Analysis for April 2020

Finally making a separate analysis post for other assets instead of combining them in the monthly FX seasonality post to avoid confusion.

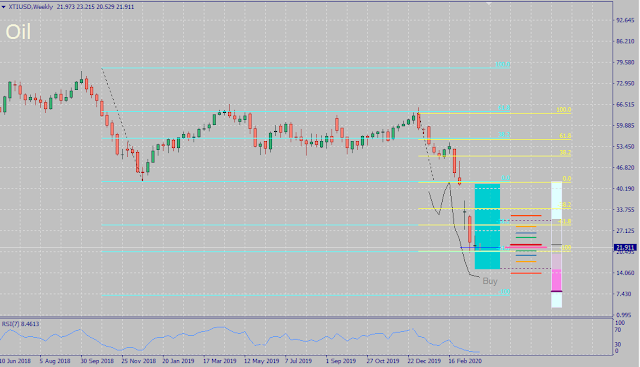

OIL

With less demand in oil and its current supply glut, as well as risk-off market sentiment making oil price worse, expecting XTIUSD to continue its bearish momentum in the long-run, way below 10.However for this month, since price action and RSI are already showing oversold levels, it's possible that it might recover a little soon--- possibly back to 40 but realistically only up to 30, before resuming its bearish slide either by late this month or early May, especially if oil producers run out of space to store their surplus.

METALS

Gold

With one of the major buyers of gold, Russia, recently announcing that they'll cease its gold purchases for now, expecting XAUUSD to drop at 1500 at least this month, if not past 1450 in the next quarter (near its 0-fib level in the weekly chart below) especially once Russia decides to sell some of its gold reserves to help manage their economy and offset the losses from oil.

But since gold is also a safe-haven asset, and there's so much uncertainty now in the markets-- when the vaccine will be available worldwide, when will companies bounce back from this current pandemic (current estimate is after Q2-- but we never know for sure), and how all these impact consumer confidence especially with some them losing their jobs during the lockdown-- it's highly probable for gold to breakout from its current ceiling at 1700 later this year and continue climbing up in the long-run especially if the lockdown is extended and mining companies cease operations (hence limited supply).

Silver

Silver, on the other hand, is more likely to bounce a bit back soon from its sell-off last month, especially with Mexico currently shutting its silver mining operations and also limiting current global supply.

However, once both technicals and price action show some hint of "recovery" from oversold levels, probably after reaching 15-16 (0-fib in the weekly chart), it's possible for silver to drop near 10 again especially with less demand for this metal during lockdown-- unless of course, JP Morgan does some "magic" and try to make it at least lag behind gold.

Analysis made here is based on my current opinion and research as of the time of this writing and doesn't serve as a recommendation whatsoever. Be sure to read the Disclaimer here further, and also do your own due diligence.

Analysis made here is based on my current opinion and research as of the time of this writing and doesn't serve as a recommendation whatsoever. Be sure to read the Disclaimer here further, and also do your own due diligence.

Feature page by Clem O. of Unsplash

0 comments:

Post a Comment