FX Seasonality Forecast for January 2019 and FX Trading Ideas for the Week | Jan 7 - 11, 2019

But before we discuss this week's trading plan, just gonna share how last month's prediction of majors went. It's currently experimental and based on the forex seasonality analysis we did last time. Also I'm still waiting for the first hour or 2 of London open to end before analyzing the charts again for the week to get confirmation from The Big Boys first.

I. Outcome of FX Seasonality-Based Prediction for December 2018

For majority of the time, the prices moved as predicted as shown by the blue marker, and experienced a sudden breakout during the last week of December. I think the main cause was the US government shutdown that happened last December 21, after Trump had tantrums (actually it still continues until now, tsk tsk..) over lack of support from his effin' Mexico border wall idea. Add the rumor that the Fed won't hike rates that often anymore by 2019 (which isn't actually a rumor anymore by now), and USD is sure to continue dropping at least during Q1 2019.GBPUSD also didn't drop as I expected, with 1.25 support still holding until now. I'm not surprised over USDCAD though since aside from oil not recovering right away after the OPEC meeting, the 1.35785 resistance is quite sticky.

I think marking the weekly chart with forecasted boundaries of price movements for the month based on seasonality, together with "umbrella trading" and macroeconomic fundamentals, improves risk management. However, this shouldn't prevent me from being quick enough to get out of the market every time Trump's impulsive nature tries to mess up our profitability :/

|

| I feel your pain... |

|

| Even price action tbh, esp Trump loves tweeting during times that I'm asleep. I've setup my trades well and good the night before, only to get reckt the following day by his tweets. |

|

| I'm waiting for the day his influence over The Whales finally end so we don't need to waste brain matter just creating a bot for this. |

For the record, I'm not a Trump hater and I understand why the American masses love him and appreciate his effort to make America great again. But we don't really care about world politics, I personally don't even care about my own country's politics because doing so is just a waste of time and against the abundance mindset. I'm just here looking back at what went right and wrong. Maybe if I finish reading this book, I'll master how The Big Boys' minds tick, and still be able to predict their next move even when they panic.

Back to Top

II. Forecast for January 2019 Based on Recent 10-Year FX Seasonality

Anyway, back to trading. This monthly prediction thingy is actually fun to do. So I think I'll start doing this regularly -- at least for this year. If I don't get embarrassed enough for any wrong predictions (which is most likely unless I finally master the above), then I'll continue doing so in the succeeding years.AUDUSD

Expecting the Aussie to continue recovering this month, up to at least 0.74 especially if USD continues to be weak with the current US government shutdown.EURUSD

Though I have a slight bullish bias on the Euro, it's possible that EURUSD will continue to go ranging between 1.12 - 1.15 this month, and won't break the 1.15506 resistance yet.

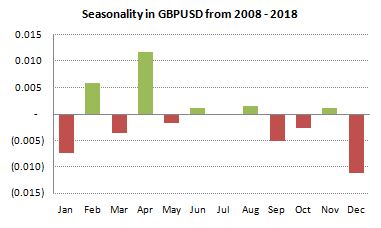

GBPUSD

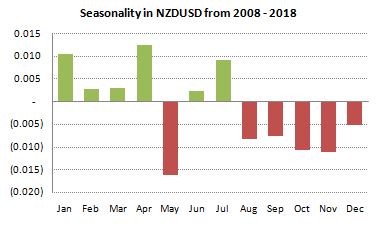

Even if this pair didn't drop to 1.20559 support last month as initially expected, it's probable that it will at least fall back down to 1.25.NZDUSD

Similar to the Aussie, it's highly probable that the Kiwi will continue recovering this month and even break the 2017 low (0.67994).USDCAD

Highly likely for this pair to continue its reversal from the 1.35785 resistance, especially with oil starting to recover soon and that recent ominous bearish engulfing candle as well in the weekly chart below.USDCHF

Despite being bearish in general in USD, I think this pair will go ranging first this month, before breaking the recent 0.98 low by next month (if ever).USDJPY

Expecting this pair to go ranging between 105 - 110 after the huge slide last month.Back to Top

III. Forecast Attempt in S&P500, Oil and Metals for January 2019

S&P 500*

Possibility for S&P to continue rallying a bit this month. If it doesn't break its current 2600 resistance soon and reverses instead, it's highly probable for this to slide down to 2128.58 - 2200 (2016 high).

Gold*

If USD continues to go down, then gold has more likelihood of recovering further. However for this month, I think it's gonna consolidate a bit, then will continue to rise the following month instead.

Silver*

More likelihood for silver to go ranging, but there's also possibility that it will break its current resistance at 15.8 near the end of this month.Oil*

As mentioned earlier under USDCAD, high probability for oil to recover further near 55.*Unlike FX pairs, S&P500, Oil and Metals don't really "follow" their monthly seasonality that's why I didn't include their seasonality charts anymore to avoid confusion. I don't see any consistency on them by simply eyeballing the charts.

They also only have a dismal 51-58% win-rate when I backtested using seasonality alone, unlike with FX pairs that have an ok 56-78% win-rate -- note: only 1 pair among 7 majors, and 3 pairs among 21 crosses have a sub 60% win-rate: USDJPY (56%), CHFJPY (57%), EURCAD (59%) and NZDCHF (57%).

Considering how manipulated oil and metals are, I'm not surprised anymore. But with S&P 500, the seasonality is better used on a per industry level instead of using it on the S&P 500 index itself (something I consider doing in a future post). I decided to put forecast charts for them too nevertheless just to see how it goes, but they're based on fundamentals and price action instead of seasonality.

Back to Top

IV. FX Trading Ideas for the Week

AUD - Buy

Despite the disappointing Trade Balance figure earlier, I'm bullish in Aussie especially after China and US recently agreed to a temporary ceasefire,AUDCAD - Wait near 0.95, buy stop @0.955

AUDCHF - Buy stop @0.70500 with target profit near 0.715 - 0.72

AUDJPY - Wait near 77.5, buy past 78 maybe

AUDNZD - Wait for bounce from 1.06 - 1.065 then sell

AUDUSD - Buy stop @0.715 with target profit @0.73500

EURAUD - Wait for bearish continuation past 1.60 and sell with target profit near 1.57

GBPAUD - Wait for bounce near 1.795 then sell with target profit @1.755 -1.765

CAD - Buy

Currently bullish on CAD despite lower forecasted Trade Balance than the previous period. If oil continues to recover this month, CAD will most likely rally as well. However I'll stay in the sidelines until I see the actual Trade Balance figure later.CADCHF - Buy with target profit near 0.745

CADJPY - Buy with target profit @83, or better, wait for a breakout or bounce confirmation @83 instead

EURCAD - Wait for bearish continuation past 1.51789 then sell with target profit @1.505 - 1.51

GBPCAD - Wait for bearish continuation past 1.69221 then sell with target profit @1.675 - 1.68

NZDCAD - Wait for possible bounce @0.89 then buy with target profit @0.90347 - 0.905

USDCAD - Wait near 1.325, or wait for bearish continuation past it and sell with target profit @1.31710 - 1.32

AUDCAD - Wait near 0.95, buy stop @0.955

CHF - Buy

Overall, I'm bullish in CHF given the current risk-off market. However, I'm taking advantage of stronger bullish momentum in AUD, NZD and CAD than CHF.CHFJPY - Wait for bullish continuation past 111.433 then buy with target profit near 112.5

EURCHF - Wait for bounce or breakout @1.2274

GBPCHF - Wait near 1.25

NZDCHF - Wait for confirmed bounce near 0.66 then buy with target profit @0.66854 - 0.67

USDCHF - Wait near 0.97860

AUDCHF - Buy stop @0.70500 with target profit near 0.715 - 0.72

CADCHF - Buy with target profit near 0.745

EUR - Wait

Though I'm also bullish in EUR in general after ECB expressed some hawkish plans as well as its seasonality above, it's quite overbought already (at least for this week) so I'll ride the possible consolidation if the risk-reward ratio is right. Else, I'll just wait in the sidelines for now.EURGBP - Wait near 0.896

EURJPY - Wait for reversal and bearish confirmation past 124.186 and sell with target profit @123

EURNZD - Wait for bearish confirmation past 1.69381 then sell with target profit @1.685

EURUSD - Wait for bearish past 1.14 then sell with target profit @1.13

EURAUD - Wait for bearish continuation past 1.60 and sell with target profit near 1.57

EURCAD - Wait for bearish continuation past 1.51789 then sell with target profit @1.505 - 1.51

EURCHF - Wait for bounce or breakout @1.2274

GBP - Wait

Waiting for the outcome of the Parliament's vote on PM May's Brexit plan next week, and see if Brexit is actually happening by March before I continue shorting GBP.GBPJPY - Wait for possible reversal near 140 then sell with target profit @137

GBPNZD - Wait for confirmed bounce @1.896 then sell with target profit @1.88534

GBPUSD - Wait for possible reversal @1.28 then sell up with target profit @1.265

EURGBP - Wait near 0.896

GBPAUD - Wait for bounce near 1.795 then sell with target profit @1.755 -1.765

GBPCAD - Wait for bearish continuation past 1.69221 then sell with target profit @1.675 - 1.68

GBPCHF - Wait near 1.25

NZD - Buy

Similar to AUD, NZD is starting to recover as well after the US-China truce. NZD's economy is also strong (so I'm actually even more bullish in it than in AUD).NZDJPY - Wait for bullish continuation past 73.6 then buy with target profit @74.5

NZDUSD - Wait for bullish continuation past 0.675 then buy with target profit @0.68

AUDNZD - Wait for bounce from 1.06 - 1.065 then sell

EURNZD - Wait for bearish confirmation past 1.69381 then sell with target profit @1.685

GBPNZD - Wait for confirmed bounce @1.896 then sell with target profit @1.88534

NZDCAD - Wait for possible bounce @0.89 then buy with target profit @0.90347 - 0.905

NZDCHF - Wait for confirmed bounce near 0.66 then buy with target profit @0.66854 - 0.67

JPY - Buy

Bullish overall on JPY because of current risk-off sentiment in the market. However like CHF, I'm taking advantage of stronger bullish momentum on AUD, CAD and NZD.USDJPY - Wait near 109.207

AUDJPY - Wait near 77.5, buy past 78 maybe

CADJPY - Buy with target profit @83, or better, wait for a breakout or bounce confirmation @83 instead

CHFJPY - Wait for bullish continuation past 111.433 then buy with target profit near 112.5

EURJPY - Wait for reversal and bearish confirmation past 124.186 and sell with target profit @123

GBPJPY - Wait for possible reversal near 140 then sell with target profit @137

NZDJPY - Wait for bullish continuation past 73.6 then buy with target profit @74.5

USD - Sell

Despite the US-China truce, still bearish as usual in USD because of recent events mentioned in the seasonality section above: US government shutdown and reduced hawkishness of the Fed.AUDUSD - Buy stop @0.715 with target profit @0.73500

EURUSD - Wait for bearish past 1.14 then sell with target profit @1.13

GBPUSD - Wait for possible reversal @1.28 then sell up with target profit @1.265

NZDUSD - Wait for bullish continuation past 0.675 then buy with target profit @0.68

USDCAD - Wait near 1.325, or wait for bearish continuation past it and sell with target profit @1.31710 - 1.32

USDCHF - Wait near 0.97860

USDJPY - Wait near 109.207

XAUUSD - Wait near 1290

XAGUSD - Wait for bullish continuation past 15.8 then buy with initial target profit @16.20

XTIUSD - Wait for bullish continuation past 50, then buy with target profit @54-54.6

USDZAR - Continue selling with target profit near 13.5

USDMXN - Continue selling with target profit near 19

Feature image by Tim M. of Unsplash

0 comments:

Post a Comment