FX Trading Ideas for the Week | Sep 30 - Oct 04, 2019

Just like my cat here, I'm learning to simply conserve my energy.

And only move and pounce when it's truly needed to do so.

Before you proceed, make sure to read and understand this Disclaimer here and TRADE AT YOUR OWN RISK.

I. FX Trading Ideas for the Week

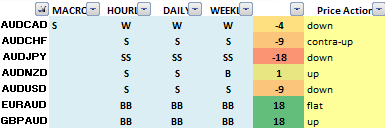

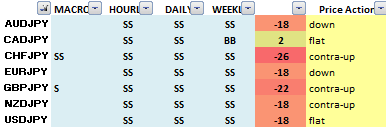

AUD - Buy (short-term)

Though current trend for Aussie pairs is mostly bearish, most of them are now near support levels so it's possible to have some short-term rally we can ride soon in scalp/day trades especially after China reported better than expected PMI figures.

However still needs to be careful when going long in the short-run (better to wait for nice entry to resume selling instead) since the bigger backdrop is still in favor of a bearish Aussie, not only because of the bearish bias in its seasonality for the month, but also because of Trump cooking up more plans against China like delisting their companies in the US exchanges aside from enforcing additional tariffs in Chinese imports by December.

AUDCAD - Wait for confirmed reversal near 0.88 or lower before counter-trend buying

AUDCHF - Wait for bullish confirmation past 0.6757 before buying

AUDJPY - Wait for confirmed reversal near 70 before counter-trend buying

AUDNZD - Wait for bullish continuation near 1.07 before buying

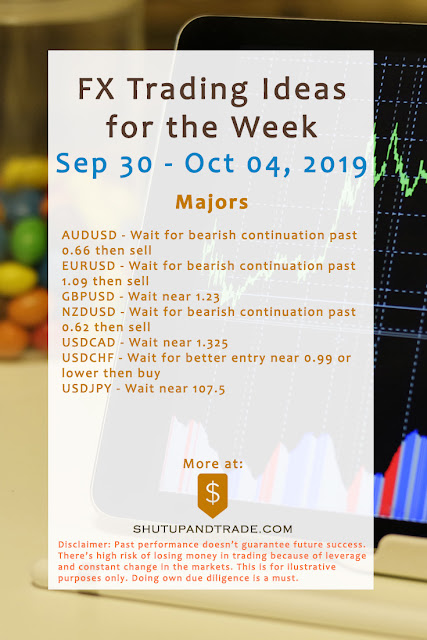

AUDUSD - Wait for bearish continuation past 0.66 then sell

EURAUD - Wait to consolidate back to 1.65 at least before buying

GBPAUD - Wait for better entry near 1.81 then buy

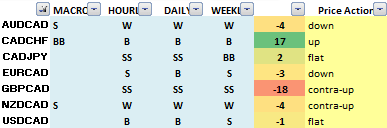

CAD - Sell

Aside from a generally bearish bias on CAD pairs for both October and November, oil has recently closed the gap it created last month and there's general economic slowdown in Canadian economy which are all in favor of shorting CAD. However, need to be careful for any possible whipsaws during the next US-China trade talks this month, and possible rally in oil soon.CADCHF - Wait for confirmed reversal near 0.75545 then counter trend sell

CADJPY - Wait near 81

EURCAD - Wait for better entry near 1.42 before buying

GBPCAD - Wait for bullish continuation past 1.63 then buy

NZDCAD - Wait near 0.83

USDCAD - Wait near 1.325

AUDCAD - Wait for confirmed reversal near 0.88 or lower before counter-trend buying

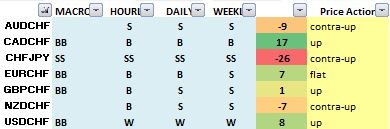

CHF - Wait

CHF pairs are currently a mixed bag overall-- momentum is mostly driven by the other currencies as CHF struggles to either compete with other safe haven assets (because it's being influenced by the Eurozone slump as well + lack of trust on SNB for its manipulation scandals which it's trying to counter last quarter by planning to replace LIBOR with SARON + disappointing CPI figures recently), or simply in "waiting" mode while markets are prepping for the possible impending recession (which is rumored to be already starting in the Eurozone).CHFJPY - Wait for confirmed reversal near 107 then counter-trend buy

EURCHF - Ride short-term recovery up to 1.10 or wait for price to reverse there then sell

GBPCHF - Wait near 1.225

NZDCHF - Wait confirmed reversal near 0.62 then buy

USDCHF - Wait for better entry near 0.99 or lower then buy

AUDCHF - Wait for bullish confirmation past 0.6757 before buying

CADCHF - Wait for confirmed reversal near 0.75545 then counter trend sell

EUR - Sell

"Rumored" recession already starting in Eurozone, production slowdown in Germany, renewed quantitative easing, Brexit delay and Euro's seasonality for Q4 all give an overall bearish backdrop for the Euro despite some short-term opportunities to buy and ride its rallies (and quickly sell them after).EURGBP - Wait for possible rally near 0.90 then sell

EURJPY - Wait near 117.5

EURNZD - Wait near 1.75

EURUSD - Wait for bearish continuation past 1.09 then sell

EURAUD - Wait to consolidate back to 1.65 at least before buying

EURCAD - Wait for better entry near 1.42 before buying

EURCHF - Ride short-term recovery up to 1.10 or wait for price to reverse there then sell

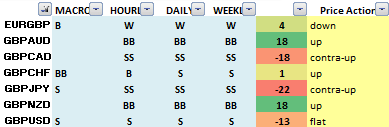

GBP - Buy (short-term)

Still same as last week, continue riding short-term recovery of GBP in general--at least before either the initial Brexit deadline this month, or confirmed delay to 2020.GBPJPY - Wait for better entry near 130.5 then buy again

GBPNZD - Wait near 1.975

GBPUSD - Wait near 1.23

EURGBP - Wait for possible rally near 0.90 then sell

GBPAUD - Wait for better entry near 1.81 then buy

GBPCAD - Wait for bullish continuation past 1.63 then buy

GBPCHF - Wait near 1.225

NZD - Buy (short-term)

Wait for confirmation and ride possible recovery on NZD pairs especially despite being influenced by the Aussie, New Zealand economic growth is underrated, with both IMF and Moody's giving it a "thumbs up", so to speak.NZDJPY - Wait for confirmed bullish reversal near 67 then buy

NZDUSD - Wait for bearish continuation past 0.62 then sell

AUDNZD - Wait for bullish continuation near 1.07 before buying

EURNZD - Wait near 1.75

GBPNZD - Wait near 1.975

NZDCAD - Wait near 0.83

NZDCHF - Wait confirmed reversal near 0.62 then buy

JPY - Sell (short-term)

Despite the recent 10% addition to consumer tax and yen's general safe haven appeal, it's possible for JPY pairs to go against the current trend soon at least in the short-run since the yen in itself is currently overbought too (while JPY pairs on the other hand are too oversold).USDJPY - Wait near 107.5

AUDJPY - Wait for confirmed reversal near 70 before counter-trend buying

CADJPY - Wait near 81

CHFJPY - Wait for confirmed reversal near 107 then counter-trend buy

EURJPY - Wait near 117.5

GBPJPY - Wait for better entry near 130.5 then buy again

NZDJPY - Wait for confirmed bullish reversal near 67 then buy

USD - Wait

It seems like DXY is due to a correction now (as of this writing) instead of continue pushing past its current high at 99 and towards 100 psychological resistance. Wait for confirmation first and better entry lower before riding the current bullish USD, or much better sit it out until the next US-China trade talk a week from now (Oct 10) to avoid getting whipsawed. Patience is a virtue.AUDUSD - Wait for bearish continuation past 0.66 then sell

EURUSD - Wait for bearish continuation past 1.09 then sell

GBPUSD - Wait near 1.23

NZDUSD - Wait for bearish continuation past 0.62 then sell

USDCAD - Wait near 1.325

USDCHF - Wait for better entry near 0.99 or lower then buy

USDJPY - Wait near 107.5

XAUUSD - Wait for better entry near 1420-1450 then buy again

XAGUSD - Wait for better entry near 16-16.5 then buy again

XTIUSD - Wait for confirmed reversal near 53.5 then buy

USDZAR - Wait for confirmed reversal near 15.5 then counter-trend sell

USDMXN - Wait near 19.8

0 comments:

Post a Comment