FX Trading Ideas for the Week | Aug 05 - Aug 09, 2019

I know you're not supposed to get emotional in trading but I can't brush off the feeling of redemption when the reversals we've been waiting for finally happens.

If you've seen the previous post (seasonality for this month), you probably have an idea what I'm talking about.

Before you proceed, make sure to read and understand this Disclaimer here and TRADE AT YOUR OWN RISK.

I. FX Trading Ideas for the Week

AUD - Wait

I think by now AUD pairs have finally bottomed after RBA cut rate recently in the past 2 months, and also reflected the aftermath of last week's US-China trade talk, not to mention the decline in iron ore and copper as well.But I learned my lesson last month and will wait for some bullish confirmation first before counter-trend trading the Aussie, especially RBA is gonna release its forward guidance this Friday.

AUDCAD - Wait for confirmed bounce up before buying, preferably counter-trend buy near 0.85

AUDCHF - Wait for confirmed bounce up before buying, preferably counter-trend buy near 0.65

AUDJPY - Wait for confirmed bounce up before buying, preferably counter-trend buy near 70.5

AUDNZD - Wait for confirmed direction near 1.035

AUDUSD - Wait for confirmed bounce up first around 0.67, else continue selling up to 0.64

EURAUD - Wait for confirmed bounce down around 1.677 then counter-trend sell

GBPAUD - Wait near 1.80

CAD - Wait

The US-China trade "talk" last week and declining oil didn't help the loonie. If no short positions have been taken for CAD during the past 2-3 weeks, it's best to wait it out now than riding the trend late.CADJPY - Wait for confirmed bullish reversal near 80 before buying

EURCAD - Buy near 1.48 or better entry lower

GBPCAD - Wait near 1.60

NZDCAD - Wait near 0.87

USDCAD - Wait near 1.335

AUDCAD - Wait for confirmed bounce up before buying, preferably counter-trend buy near 0.85

CHF - Wait

CHF pairs still haven't gained significant bullish momentum as another safe haven asset, and simply remain in consolidation for the most part despite the risk-off sentiment exhibited by the market after the US-China trade spat last week, sudden drop in equities last Monday, and increased appeal of gold.CHFJPY - Wait near 1.09

EURCHF - Wait for confirmed bounce up near 1.085

GBPCHF - Wait near 1.18

NZDCHF - Wait near 0.6375

USDCHF - Wait for rally then sell again near 0.99

AUDCHF - Wait for confirmed bounce up before buying, preferably counter-trend buy near 0.65

CADCHF - Wait near 0.735

EUR - counter-trend Sell (short-term)

Despite being overall bullish in EUR pairs for reasons I mentioned last week, technical-wise most of them are about to reach critical resistance levels this week. It's best to ride the pullback for the meantime.EURGBP - Wait for confirmed bounce down from 0.93 before selling

EURJPY - Wait near 119

EURNZD - Wait for confirmed bounce down from 1.73 before selling

EURUSD - Wait for better long entry near 1.11 then buy again

EURAUD - Wait for confirmed bounce down around 1.677 then counter-trend sell

EURCAD - Buy near 1.48 or better entry lower

EURCHF - Wait for confirmed bounce up near 1.085

Lucky to survive Powell last week -- I made the right call to remove my SL, and put it back yesterday just to lock in some gains. Closing my remaining positions in EURUSD now, and not pushing my luck here any further this week.

GBP - counter-trend Buy (short-term)

Almost similar to EUR above but the reverse, enter at least short-term long opportunities, because GBP pairs are now touching multi-year support levels. However in the long-run I still remain bearish.GBPJPY - Wait for confirmed reversal around 130 or lower before buying

GBPNZD - Wait for confirmed bounce up from 1.8367 before buying

GBPUSD - Wait for confirmed reversal around 1.20 or lower before buying

EURGBP - Wait for confirmed bounce down from 0.93 before selling

GBPAUD - Wait near 1.80

GBPCAD - Wait near 1.60

GBPCHF - Wait near 1.18

| GBPJPY Possible Reversal Soon |

Contradictory GBPCAD trade just to serve as hedge now because I failed to close my short-term bullish position last month before Boris won. Sigh.

NZD - Sell (short-term)

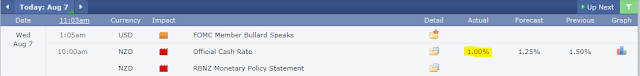

Either continue riding the current strong bearish momentum now after RBNZ cut rates more aggressively than expected to copy RBA, or wait for the kiwi to finally bottom and counter-trend buy like GBP.NZDJPY - Wait for bullish confirmation past 70 before buying

NZDUSD - Wait near 0.65

AUDNZD - Wait for confirmed direction near 1.035

EURNZD - Wait for confirmed bounce down from 1.73 before selling

GBPNZD - Wait for confirmed bounce up from 1.8367 before buying

NZDCAD - Wait near 0.87

NZDCHF - Wait near 0.6375

JPY - Wait

Kuroda still haven't showed any signs of forward guidance, or hinting about possible easing (he still remains averse about negative rates), despite the recent rate cut by the Fed, new 10% tariff by the US on China's imports this coming September, more easing planned by ECB and rate cuts both by RBA and RBNZ.JPY remains strong overall and continues to appreciate, but I'll just take quick short-term counter-trend trading opportunities if they present themselves this week or next.

USDJPY - Wait near 106

AUDJPY - Wait for confirmed bounce up before buying, preferably counter-trend buy near 70.5

CADJPY - Wait for confirmed bullish reversal near 80 before buying

CHFJPY - Wait near 1.09

EURJPY - Wait near 119

GBPJPY - Wait for confirmed reversal around 130 or lower before buying

NZDJPY - Wait for bullish confirmation past 70 before buying

USD - Wait

Overall this week (and even month), I still don't have strong bias which direction DXY will go unless it has finally touched 100 resistance level.How the market perceives the Fed drama and trade "talks" will hint where USD will go next.

As mentioned in the seasonality post for this month, I'm also waiting for the COT futures report for Aug 6 (they still have July 30 in the COT futures website now) to see the overall net position for USD index futures and if there are any significant changes to the previous speculators' positions.

AUDUSD - Wait for confirmed bounce up first around 0.67, else continue selling up to 0.64

EURUSD - Wait for better long entry near 1.11 then buy again

GBPUSD - Wait for confirmed reversal around 1.20 or lower before buying

NZDUSD - Wait near 0.65

USDCAD - Wait near 1.335

USDCHF - Wait for rally then sell again near 0.99

USDJPY - Wait near 106

XAUUSD - Wait for consolidation near 1420 or lower then buy again

XAGUSD - Wait near 16.5

XTIUSD - Wait for drop to 50-51.5

USDZAR - Counter-trend sell between 14-15

USDMXN - Sell near 19.6 or higher with TP at 19

Like EURUSD, I might also close my gold position this week too.

Feature image by Bessi of Pixabay

0 comments:

Post a Comment