FX Seasonality Forecast for February 2019 and FX Trading Ideas for the Last 2 Days of the Week | Feb 7 - 8, 2019

I. Outcome of FX Seasonality-Based Prediction for January 2019

Prices moved within the blue-marker forecast for majority of the pairs in January, except for GBPUSD and slightly with USDCAD (again) --which is alright considering how volatile GBP got during the Parliament vote last month, and oil being more sensitive to weaker USD (which might still continue to slide despite the US government shutdown being over now) and dragging USDCAD lower than anticipated.I haven't watched Trump's speech yesterday yet, but here are the key takeaways, and some musings about it. My own takeaway at least based on the summaries I've read and heard is that I'm glad US with Trump isn't going down the socialism route anytime soon (unlike my poor country). I'm all for either capitalism or technocracy.

Back to Top

II. Forecast for February 2019 Based on Recent 10-Year FX Seasonality

AUDUSD

AUDUSD is more likely to continue ranging 0.71 - 0.74 this month, so I'm expecting a bounce soon especially with a hawkish RBA and upward bias on its February seasonality.EURUSD

EURUSD is still more likely to continue ranging like last month and won't break the 1.15506 resistance yet.

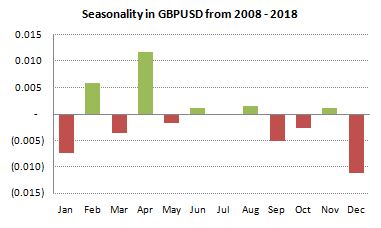

GBPUSD

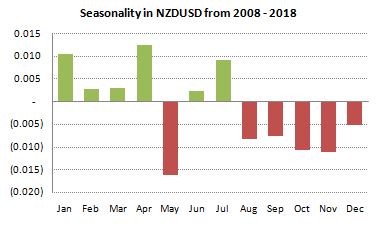

GBPUSD will most likely see-saw at the 1.30 level, though if this doesn't drop to 1.27 soon as predicted, then it might actually recover up to near 1.35 between now and end of March.NZDUSD

Waiting for NZDUSD to bounce up from 0.68 level and rise to 0.70 again, though it might not break that resistance level yet until April, unless USD goes extremely bearish.USDCAD

Most likely this pair will go ranging this month because though its February seasonality is showing a bullish bias, if oil ends its consolidation and recovers again (and breaks the 55 resistance level), then this pair will drop to 1.30 once again.USDCHF

This pair is already touching the resistance zone at 1.00, just waiting for it to bounce down once Euro zone stabilizes some more especially after the initial Brexit deadline, and market continues to be risk-off unless S&P 500 breaks the 2800 level and confirms an end to its bearishness.USDJPY

Almost same logic with USDCHF above regarding risk-off sentiment and bearish USD, but more volatile for this pair.Back to Top

III. Forecast Attempt in S&P500, Oil and Metals for February 2019

S&P 500*

So S&P500 was saved during last month's Blood Moon and actually continued recovering past 2600, and now reaching a new resistance level at 2800. But will it break it and confirm that it has already bottomed, or the inevitable slide is just around the corner? Let's wait and see especially with its February seasonality showing a slight bias on the downside.

Gold*

With weak USD, comes a stronger gold, so I think this metal will continue to rise this month and touch its current resistance near 1365.

Silver*

Kinda similar with gold, silver might bounce up to at least near 16.5, however it's gonna be more sticky to its support level at 15.66.Oil*

Either oil will continue ranging and see-sawing near 55 resistance level (also a psychological level) or suddenly breakout and rise up to near 64. Closely monitoring oil so I can ride that possible jump.*Note: Unlike FX pairs, S&P500, Oil and Metals don't really "follow" their monthly seasonality that's why I didn't include their seasonality charts anymore to avoid confusion. I don't see any consistency on them by simply eyeballing the charts.

Back to Top

IV. FX Trading Ideas for the Week

AUD - Wait

Actually bullish on AUD especially with recent bounce in iron ore prices, and generally hawkish RBA. Since it's already almost Friday, best to wait until I get a confirmed bounce or recovery from AUD's recent consolidation.AUDCAD - Wait near 0.94

AUDCHF - Wait near 0.71271

AUDJPY - Wait near 78.5

AUDNZD - Wait near 1.04

AUDUSD - Wait near 0.71

EURAUD - Wait near 1.60

GBPAUD - Wait near 1.82

CAD - Wait

Still in waiting mode for CAD while oil is still not breaking its current resistance level at 55. Also need to wait for Canada's employment figures tomorrow.CADCHF - Wait near 0.76

CADJPY - Wait near 83

EURCAD - Wait near 1.50

GBPCAD - Wait for bullish confirmation past 0.71 (after BoE news later) then buy with target profit near 1.75

NZDCAD - Wait for confirmed bounce from 0.9015 then buy with target profit near 0.908 - 0.91

USDCAD - Wait near 1.32

AUDCAD - Wait near 0.94

CHF - Buy

Still bullish on CHF in general unless I get a confirmation from S&P500 that it has already bottomed and on its way to recovery if it goes past 2800. With US-China truce still on, market might then start warming up and go risk-on. But until then, I'm still bullish on both CHF and JPY.CHFJPY - Wait for bullish confirmation near 110 then buy with target profit @111

EURCHF - Wait for bullish confirmation past 1.4 then buy with targer profit near 1.14-1.145

GBPCHF - Wait near 1.30

NZDCHF - Wait for bearish confirmation past 0.682 then sell with target profit near 0.674

USDCHF - Scalp and buy stop @1.003 with target profit @1.007, or wait for possible bounce near 1.007

AUDCHF - Wait near 0.71271

CADCHF - Wait near 0.76

EUR - Buy

Still bullish on EUR as last week because of hawkish ECB, but need to be careful for any volatility coming from any new updates regarding Brexit.EURGBP - Wait near 0.88

EURJPY - Wait for bullish confirmation past 125.165 then buy with target profit near 26

EURNZD - Wait near 1.68

EURUSD - Wait for confirmed bounce near 1.136 or wait for bullish confirmation past 1.1384 then buy with target profit @1.145

EURAUD - Wait near 1.60

EURCAD - Wait near 1.50

EURCHF - Wait for bullish confirmation past 1.4 then buy with targer profit near 1.14-1.145

GBP - Wait

Despite the sudden rise in GBP recently, I'm bearish overall (weekly and monthly trend) the more they delay Brexit. Might continue riding any bullish momentum in the short-term though and take advantage of any day trading opportunities.GBPJPY - Wait near 142

GBPNZD - Wait near 1.9122

GBPUSD - Wait near 1.295

EURGBP - Wait near 0.88

GBPAUD - Wait near 1.82

GBPCAD - Wait for bullish confirmation past 0.71 (after BoE news later) then buy with target profit near 1.75

GBPCHF - Wait near 1.30

NZD - Buy

With consistent positive economic data for NZ as well as with Standard and Poor having a stable outlook and reaffirming its AA+ credit rating recently, not to mention the positive outlook in the Aussie as well, I continue to be strongly bullish on the Kiwi.NZDJPY - Wait near 74.5

NZDUSD - Wait for bounce up from 0.675

AUDNZD - Wait near 1.04

EURNZD - Wait near 1.68

GBPNZD - Wait near 1.9122

NZDCAD - Wait for confirmed bounce from 0.9015 then buy with target profit near 0.908 - 0.91

NZDCHF - Wait for bearish confirmation past 0.682 then sell with target profit near 0.674

JPY - Buy

Still bullish overall on JPY until market turns risk-on again as mentioned in the CHF section above.USDJPY - Wait near 110

AUDJPY - Wait near 78.5

CADJPY - Wait near 83

CHFJPY - Wait for bullish confirmation near 110 then buy with target profit @111

EURJPY - Wait for bullish confirmation past 125.165 then buy with target profit near 26

GBPJPY - Wait near 142

NZDJPY - Wait near 74.5

USD - Sell

With recent Fed's dovish tone, US 10-year bonds still dropping and a repeat of US government shutdown after V-day is looming, not to mention DXY's February seasonality being biased on the downside as well, I continue to be bearish overall on USD. However, need to be cautious for any volatility, especially with another Trump-Xi meeting around late February.AUDUSD - Wait near 0.71

EURUSD - Wait for confirmed bounce near 1.136 or wait for bullish confirmation past 1.1384 then buy with target profit @1.145

GBPUSD - Wait near 1.295

NZDUSD - Wait for bounce up from 0.675

USDCAD - Wait near 1.32

USDCHF - Scalp and buy stop @1.003 with target profit @1.007, or wait for possible bounce near 1.007

USDJPY - Wait near 110

XAUUSD - Wait for bullish confirmation near 1310 and buy with target profit @1325

XAGUSD - Wait for bounce from 15.65 or bullish confirmation past 15.72 then buy with target profit near 16

XTIUSD - Wait near 54

USDZAR - Wait for bullish confirmation past 13.64 then buy with target profit near 13.9

USDMXN - Wait near 19.11

0 comments:

Post a Comment