FX Trading Ideas for the Week | Jan 20 - Jan 24, 2020

Momentary calm after the official signing of the US-China phase 1 deal-- which involves China buying $200 billion worth of US products (which I dunno if it's even allowed by the WTO) and improving intellectual property rights protection by not requiring American companies anymore to move their tech in Chinese firms when doing business there-- while at the same time both China and US agreeing to at keep the existing tariffs in at least half of their goods.

Knowing the Chinese (and how second nature math is for them unlike their American counterparts who are more blessed on the creative side), in the end when it comes to monetary gains at least, they have the upper-hand here actually since:

1. The $200 billion worth of US imports seem unrealistic indeed in the first place. It most likely will require the US to reduce its export to other countries, and China its imports from other countries, both of which may violate the free trade rule under WTO. No matter what happens, China will always strive to have a trade surplus.

2. The Chinese is notorious for being a copycat, and can always find a loophole especially when it comes to tech since they already monopolize the rare earth elements (REEs) market already by owning at least 70% share, so they pretty much have enough bargaining power especially with this:

|

| Source: AidData |

One side can simply decide to be "voluntary" if the other side exerts enough bargaining power.

“Any transfer or licensing of technology between persons of a party and those of the other party must be based on market terms that are voluntary and reflect mutual agreement..."

3. If nobody can stop China from implementing its social credit system (and even stop its nationwide censoring), there's no way anyone can force them either to reduce its state-owned subsidies-- they can be convinced only if there's an alternative that works better for their own economy and financial system.

With that said, the phase one deal might end up being just a 10-month truce between US and China.

Anyway, expecting this week to be a little quiet because of Martin Luther holiday and upcoming Chinese New Year over the weekend, with interest rate decisions this week being almost a low-risk event with central banks aiming to keep the status quo-- except for BoE hinting at further rate cuts possible starting Q1 after Carney leaves BoE which is being priced in by the markets now.

Despite that, overall market is quite risk-on, at least in the short-term, now that US-China deal is (temporarily) out of the way, and new factors and focus are coming to play. However in the long-run, rumors of a looming recession is still not fully discounted as whales continue to pile more cash (and rent safe deposit boxes), and buy more risk-have assets like gold, CHF and digital assets.

Before you proceed, make sure to read and understand this Disclaimer here and TRADE AT YOUR OWN RISK.

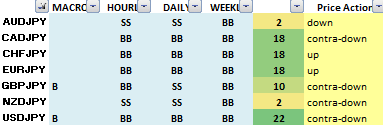

I. FX Trading Ideas for the Week

AUD - Buy (short-term)

AUD might be on its way to at least a short-term respite and rally after US-China phase 1 deal has finally been signed, and also the possibility that RBA won't cut rates on Feb as expected (despite its recent bushfire crisis) since doing so might negatively impact business and consumer confidence and also give them less leeway to exert some power or influence in the future. However in mid to long-term, might be bearish on the Aussie especially certain clause in the US-China phase 1, if implemented without intervention from WTO, can adversely impact Australia.

AUDCAD - Wait for better entry at 0.89 or lower before buying

AUDCHF - Wait for bullish reversal at 0.65-0.66

AUDJPY - Wait to rally at 76.5 and confirm next direction first

AUDNZD - Ride possible rally to 1.05 or just wait

AUDUSD - Wait for better entry near 0.68 or lower before buying

EURAUD - Wait near 1.615

GBPAUD - Sell near 1.90

CAD - Wait

No rate change is expected from the BoC soon. However, CAD might consolidate this week along with oil, especially with USMCA replacing NAFTA, and the phase 1 deal with China not being economically favorable to Canada's exports.CADCHF - Ride short-term rally up to 0.75, & buy at 0.74 or lower or wait

CADJPY - Wait for confirmed bearish reversal at 85 and up

EURCAD - Wait for possible bullish reversal at 0.44-0.45 before buying

GBPCAD - Wait for bearish continuation past 1.69 then sell

NZDCAD - Wait near 0.86

USDCAD - Wait for rally to 1.32 or bearish continuation past 1.29 before selling

AUDCAD - Wait for better entry at 0.89 or lower before buying

CHF - Buy

Possible to consolidate this week a bit but most likely to resume its bullish strength in the mid to long-term (despite the SNB not being happy about that), especially after the US recently added Switzerland in its currency manipulators list.CHFJPY - Either ride late rally to 115 or wait for reversal

EURCHF - Wait for bullish reversal near 1.062-1.07

GBPCHF - Continue selling near 1.26 or add sell limit near 1.275 or higher

NZDCHF - Wait near 0.64

USDCHF - Ride short-term rally up to 0.98 or wait

AUDCHF - Wait for bullish reversal at 0.65-0.66

CADCHF - Ride short-term rally up to 0.75, & buy at 0.74 or lower or wait

EUR - Buy (short-term)

Might rally soon despite EU's slowdown, particularly Germany's sluggish growth in 2019 since they have enough ammunition so to speak to revitalize their economy anytime-- with Germany being awarded as most innovative by Bloomberg now, beating South Korea, consistent trade surplus, and its plan to take advantage of ECB's negative rates by possibly revising its constitution to allow more debt higher than the €5B per year limit)-- Need to watch out for upcoming ZEW survey though for any figures lower than what's expected.EUR also gains from weaker GBP lately as the UK House of Commons finally voted for official Brexit by end of the month. But like Australia, the US-China phase 1 deal has an adverse effect on EU trades as well which can worsen the effect of Brexit in the coming months.

EURGBP - Wait for bullish continuation past 0.86 then buy

EURJPY - Ride short-term consolidation and sell at 122-123, or wait for better entry to buy

EURNZD - Wait near 1.68

EURUSD - Buy near 1.105-1.11

EURAUD - Wait near 1.615

EURCAD - Wait for possible bullish reversal at 0.44-0.45 before buying

EURCHF - Wait for bullish reversal near 1.062-1.07

GBP - Sell

Markets are now pricing in the expected stimulus by BoE and UK government following Brexit, just so they can prevent these kinds of disaster from happening-- similar to what Trump does in the US.GBPJPY - Sell at 143 or higher

GBPNZD - Sell near 1.99 or wait for bearish continuation past 1.93

GBPUSD - Wait near 1.30

EURGBP - Wait for countertrend bullish continuation past 0.86 then buy

GBPAUD - Sell near 1.90

GBPCAD - Wait for bearish continuation past 1.69 then sell

GBPCHF - Continue selling near 1.26 or add sell limit near 1.275 or higher

NZD - Wait

Best to wait for CPI news on Friday for any signs of temporary rally, but most likely NZD will continue to underperform especially with the risks coming from the recent US-China Phase 1 deal.NZDJPY - Wait near 73

NZDUSD - Wait near 1.66

AUDNZD - Ride possible rally to 1.05 or just wait

EURNZD - Wait near 1.68

GBPNZD - Sell near 1.99 or wait for bearish continuation past 1.93

NZDCAD - Wait near 0.86

NZDCHF - Wait near 0.64

JPY - Sell

Continue being bearish on JPY especially with no signs from Kuroda and BoJ of any reversal from their economic stimulus (despite negative rates not having the impact most Japanese people wanted).USDJPY - Wait for confirmed bearish reversal at 110.5

AUDJPY - Wait to rally at 76.5 and confirm next direction first

CADJPY - Wait for confirmed bearish reversal at 85 and up

CHFJPY - Either ride late rally to 115 or wait for reversal

EURJPY - Ride short-term consolidation and sell at 122-123, or wait for better entry to buy

GBPJPY - Sell at 143 or higher

NZDJPY - Wait near 73

USD - Sell

Considering the things mentioned above regarding the Phase 1 deal and DXY's recent price action and weekly chart, it's more likely for USD to weaken further, either down towards 2016 low or just around the 0-fibonacci level at 95.

AUDUSD - Wait for better entry near 0.68 or lower before buying

EURUSD - Buy near 1.105-1.11

GBPUSD - Wait near 1.30

NZDUSD - Wait near 1.66

USDCAD - Wait for rally to 1.32 or bearish continuation past 1.29 before selling

USDCHF - Ride short-term rally up to 0.98 or wait

USDJPY - Wait for confirmed bearish reversal at 110.5

XAUUSD - Ride possible consolidation and sell near 1560

XAGUSD - Ride possible consolidation and sell near 18

XTIUSD - Wait for bullish continuation near 58.5 before buying else wait for short-term consolidation to end

USDZAR - Wait near 14.5

USDMXN - Wait near 19

0 comments:

Post a Comment