FX Seasonality Forecast for July 2019

This should have been posted about 2 weeks ago, but realized I had to extract the screenshots below from the other laptop and move them here, among other things (*cough* binge watching on Jojo anime and Stranger Things).

Anyway, enough with laziness. Let's get back to work!

I. Outcome of FX Seasonality-Based Prediction for May 2019

DXY finally went down to its current support @96-97 as what I've been expecting since Q1 this year, and stayed there after the Fed decided to keep the rate unchanged last June but market now somehow pricing in the rumored rate cut soon-- a vain attempt to make USD weak and US exports a bit more competitive like China.Well, goodluck on that.

Meanwhile I'll keep a closer eye on oil, metals and crypto because all these trade talks and everything that involves Trump keep DXY flat and directionless for some time.

Regarding majors, glad most of them moved within the forecasted range (blue rectangle), except for GBP, CHF and JPY which broke through their current S/R levels faster than I expected.

Exotic pairs remained on track, so was oil and metals. SP500 on the other hand recovered and bounced back faster than I anticipated. I thought it's gonna start recovering beginning this month, not on June right after the sell-in-May-then-go-away, at least based on its 10-year seasonality pattern.

II. Forecast for July 2019 Based on Recent 10-Year FX Seasonality

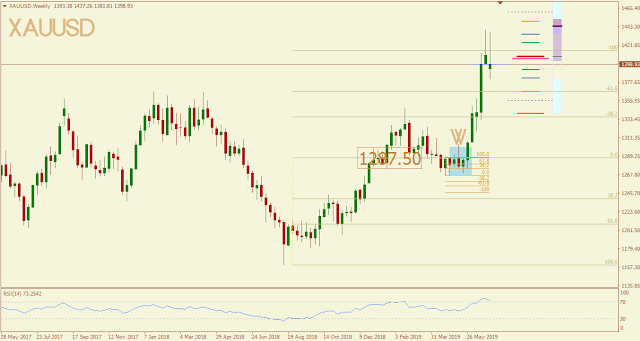

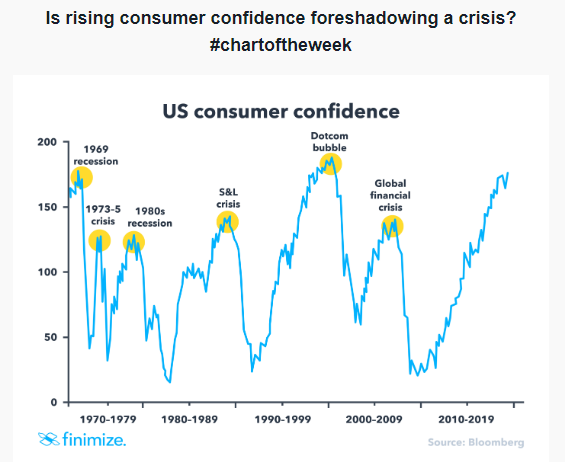

Overall, I'm expecting the majors to bounce up as DXY either stays flat or eventually be pulled down to the next support @93 in the coming months. Oil and metals, on the other hand, might experience a short-term consolidation after recently creating new highs but overall it's more likely that they will continue to rise given that Russia agreed with Saudi Arabia to decrease oil production in the latter part of 2019, while the general risk-off sentiment (due to geopolitical uncertainties from US-China trade "talk" and populism in the Eurozone) makes other assets like metals and even cryptocurrencies more appealing, especially with this negative yielding bonds nowadays.Given that the CFA folks there in finimize is spreading this chart to everyone, Mr. Zerohedge might hold a party soon after finally being right for the first time in a decade.

AUDUSD

Regardless of what Trump has been tweeting lately, China's manufacturing sector is already experiencing a slow down over the years as it reached maturity cycle but I don't think that's enough to conclude that overall Chinese economy is slowing down too.In fact, it's just getting started by copying US technology and military tactics.

Video from Task and Purpose

For the record I'm neither siding with China nor US, but just based on China's recent figures:

Sure, the Chinese could have made these up (again), or Trump could be bluffing (again).

But the way the former copies technological advances and military strategy is still astounding. Having said that, with China being the largest trading partner of Australia, there's more likelihood that the Aussie will recover a bit this month before probably touching it's support @0.675 in the succeeding months and forming a bowl chart at that 100 fibonacci level.

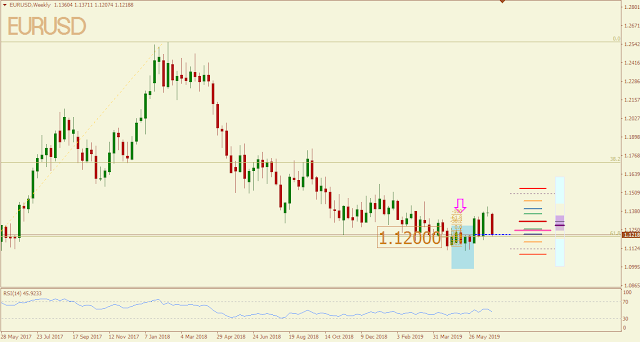

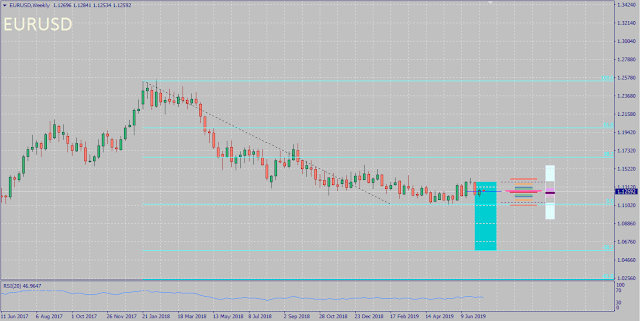

EURUSD

Just based on this pair's seasonality alone, most likely it will stay near 1.11 level and consolidate a bit before going down to 1.05 level if not this month then during the latter part this year. Given the tricky situation ECB is in, I don't think EUR will recover back up to Jan 2018 high within the next year or so until ECB sorts out its geopolitical mess and trade issues worsened by US-China trade "talks".

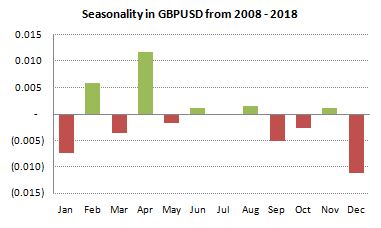

GBPUSD

The seasonality for the month of July doesn't give any clue about its next direction, most likely it all depends now to Carney. But seeing the trend below for the latter part of 2019, I still remain strongly bearish overall (and actually regret not swing trading this since I've been bearish in the pound since last year-- so much for being conservative).NZDUSD

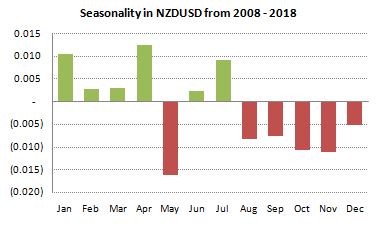

The kiwi will enjoy a recovery this month, especially after its better than prior period CPI.But since it's influenced by AUD, and given its trend below from August onwards, I'll just scalp kiwi pairs.

USDCAD

Given that Russia agreed with Saudi Arabia to decrease oil output for the next few months and also this, I'll wait for this pair to recover near 1.317 before riding the possible slide down next month or so (or better put a short limit order there).USDCHF

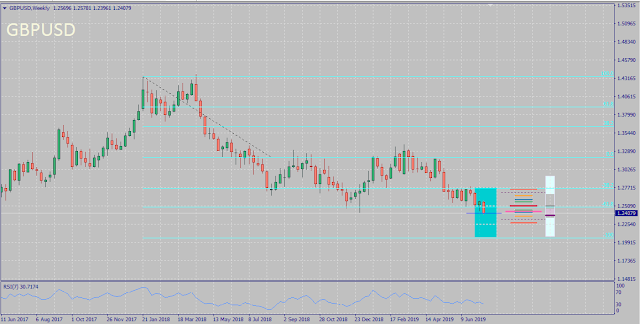

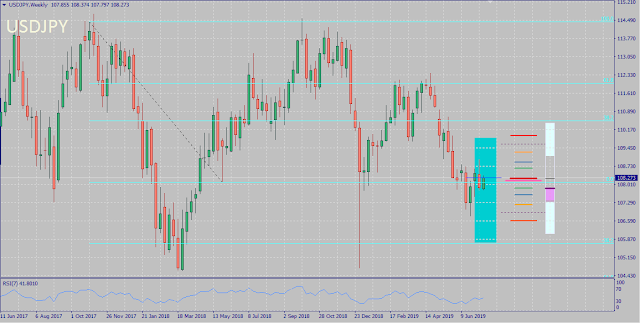

Just based on this month's seasonality and price action, USDCHF is most likely to bounce back soon to 1.00 at least, but need to be cautious with possible more volatility especially if both CHF and JPY, along with gold, become more appealing as asset haven.USDJPY

Almost similar logic as USDCHF above.Back to Top

III. Forecast Attempt in S&P500, Oil and Metals for July 2019

S&P 500*

Expecting the equities to continue rising up to 3065 this month especially with the unappealing bond yields lately.

But with the rumored impending crisis soon, I'm weary about buying any stocks now and would prefer to wait for the SP500 index to drop down to 2500 level before buying -- if you're brave, then try short-selling AAPL since it's dying anyway unless it innovates something not annoying as removing the headphone jack, or at least copies Android's new features.

But with the rumored impending crisis soon, I'm weary about buying any stocks now and would prefer to wait for the SP500 index to drop down to 2500 level before buying -- if you're brave, then try short-selling AAPL since it's dying anyway unless it innovates something not annoying as removing the headphone jack, or at least copies Android's new features.

Gold*

Given its recent highs and those wicky candles lately, aside from its bearish bias in July seasonality, gold will most likely consolidate down near 1375.

Silver*

Almost similar with gold above, and bearish bias in its July seasonality as well. Expecting silver to bounce down to 14.5 soon.Oil*

Seasonality trend for oil this month is directionless like the pound. However, as mentioned in USDCAD above, I still continue to have a general bullish bias on oil unless US producers can counter OPEC's continued reduction in output.*Note: Unlike FX pairs, S&P500, Oil and Metals don't really "follow" their monthly seasonality that's why I didn't include their seasonality charts anymore to avoid confusion. I don't see any consistency on them by simply eyeballing the charts.

Back to Top

Feature image by Mark T. of Unsplash

0 comments:

Post a Comment