FX Trading Ideas for the Week | May 06 - May 10, 2019

I don't 100% agree with Investing.com's suggestion though to just buy and hold, although they presented some interesting statistics to back up the sell stocks in May quote. If you know how to get the market's pulse and timing, that's already an edge so it would be stupid (and lazy) not to use that information (well except of course if one is just passively investing in equities, and busy with other business).

With that said, either the stock market plunge will happen late or won't go down as much as I'm expecting it would (2,100-2,500) because a lot of people know and expect the same now. Not sure really if that's how it works with stocks, but that's how it is with FX.

So the aim is never to get your opinion popular or never join a popular opinion unless you're able to get in early before the masses.

Anyway, back to FX now.

I. FX Trading Ideas for the Week

AUD - Wait

The Aussie pairs have mostly been oversold already so I'm expecting a rally especially if US-China trade talks finally conclude. But since that seems like won't be happening anytime soon now, the possible increased tariffs on China would also negatively impact AUD and RBA's dovishness can further bring the Aussie down although not that much since some of that has already been priced in by the markets. Since there's not much room now at the bottom, I'm just waiting for the bounce up especially if the markets overreacts from any positive news related to Australia or China.AUDCAD - Wait for better buy entry near 0.93327 or bullish confirmation past 0.94624 then buy with TP near 0.96

AUDCHF - Buy with TP near 0.72 if risk-reward ratio is still good after RBA meeting

AUDJPY - Buy with TP near 79 if risk-reward ratio is still good after RBA meeting

AUDNZD - Sell with TP near 1.04886 if risk-reward ratio is still good after RBA meeting

AUDUSD - Buy with TP near 0.70731 if risk-reward ratio is still good after RBA meeting

EURAUD - Sell past 1.59745 with TP near 1.58 after RBA meeting

GBPAUD - Sell past 1.8685 with TP near 1.83744 after RBA meeting

CAD - Wait

After consolidating back to 60 last month, I think oil will rise again in the next few months up to 70-75 especially with new sanctions on Iran, which is also bullish for CAD (which I find less risky to trade than oil itself). Need to watch out for this interesting positive carry regarding USDCAD which might keep CAD range-bound instead even if oil rises to 80.CADCHF - Wait near 0.753

CADJPY - Buy near 81.677 - 82.4 with TP near 83.332

EURCAD - Sell past 1.506 with TP near 1.50

GBPCAD - Sell past 1.765 with initial TP @1.75 and 2nd TP @1.734

NZDCAD - Buy near 0.889 - 0.89 with TP near 0.90

USDCAD - Wait near 1.344

AUDCAD - Wait for better buy entry near 0.93327 or bullish confirmation past 0.94624 then buy with TP near 0.96

CHF - Buy

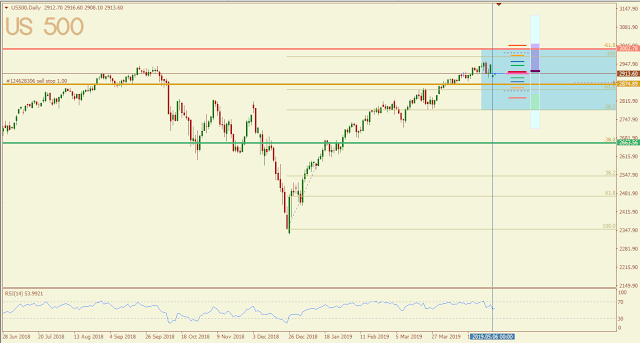

Waiting for confirmation on CHF pairs first though before I go bullish on swiss franc since both technicals and price action favor that. Also waiting for S&P 500 to go below 2880 before I most likely enter more short orders.CHFJPY - Buy with TP near 110.278

EURCHF - Wait near 1.4070

GBPCHF - Sell with TP @1.31307

NZDCHF - Wait for bearish continuation past 0.67 then sell with TP @0.65832

USDCHF - Sell with TP near 1.009

AUDCHF - Buy with TP near 0.72 if risk-reward ratio is still good after RBA meeting

CADCHF - Wait near 0.753

EUR - Wait

EUR doesn't seem to have a clear direction this week and its pairs are mainly carried by the other currencies. Will just ride any short term trading opportunities to get in and out quickly. On the macro level despite EU's shaky geopolitical climate, with USD index possibly bouncing from its resistance and US-China unresolved trade talks, EUR is bound to recover soon with some investors seeing this currency as a new safe haven.EURGBP - Wait near 0.857

EURJPY - Buy near 123.4-124 with TP near 125

EURNZD - Wait near 1.70

EURUSD - Wait near 1.20

EURAUD - Sell past 1.59745 with TP near 1.58 after RBA meeting

EURCAD - Sell past 1.506 with TP near 1.50

EURCHF - Wait near 1.4070

GBP - Sell

After the markets price in the new Brexit deadline (October 13) and reacted to the recent BoE hawkishness, the pound is bound to consolidate this week (probably except for GBPJPY).GBPJPY - Buy near 144.5 with TP @146.33

GBPNZD - Wait for bearish confirmation past 1.98 then sell with TP @1.95

GBPUSD - Wait near 1.31

EURGBP - Wait near 0.857

GBPAUD - Sell past 1.8685 with TP near 1.83744 after RBA meeting

GBPCAD - Sell past 1.765 with initial TP @1.75 and 2nd TP @1.734

GBPCHF - Sell with TP @1.31307

NZD - Wait

I still see Kiwi as an underrated currency, but will just enter short-term trading opportunities or just wait in the sidelines instead of swing trading NZD pairs especially its easily affected by whatever's happening to AUD and China. Also RBNZ meeting coming up soon and 50% probability to have a rate cut which the markets have already priced in a week or 2 ago.NZDJPY - Buy near 72-73 with initial TP @74.7

NZDUSD - Wait for confirmed bounce at 0.66 then buy with TP @0.67195

AUDNZD - Sell with TP near 1.04886 if risk-reward ratio is still good after RBA meeting

EURNZD - Wait near 1.70

GBPNZD - Wait for bearish confirmation past 1.98 then sell with TP @1.95

NZDCAD - Buy near 0.889 - 0.89 with TP near 0.90

NZDCHF - Wait for bearish continuation past 0.67 then sell with TP @0.65832

JPY - Sell (short-term)

Just riding the post-Golden week JPY bearish momentum,but need to be careful though especially once both USD Index and equities drop soon.USDJPY - Wait for bullish confirmation near 111 then buy with initial TP near 112

AUDJPY - Buy with TP near 79 if risk-reward ratio is still good after RBA meeting

CADJPY - Buy near 81.677 - 82.4 with TP near 83.332

CHFJPY - Buy with TP near 110.278

EURJPY - Buy near 123.4-124 with TP near 125

GBPJPY - Buy near 144.5 with TP @146.33

NZDJPY - Buy near 72-73 with initial TP @74.7

USD - Wait

With USD index near its 98 resistance (and my 100 fib line) and being generally overbought, just waiting for bearish confirmation (probably past 97). Still on full alert but be more careful on increased volatility on USD now since a No Deal with China is more likely.AUDUSD - Buy with TP near 0.70731 if risk-reward ratio is still good after RBA meeting

EURUSD - Wait near 1.20

GBPUSD - Wait near 1.31

NZDUSD - Wait for confirmed bounce at 0.66 then buy with TP @0.67195

USDCAD - Wait near 1.344

USDCHF - Sell with TP near 1.009

USDJPY - Wait for bullish confirmation near 111 then buy with initial TP near 112

XAUUSD - Wait near 1280

XAGUSD - Wait near 14.9

XTIUSD - Buy near 60 - 61.5 with TP near 65

USDZAR - Wait near 14.3

USDMXN - Wait near 18.95

0 comments:

Post a Comment