Care Bears

All this time I thought they're simply having a national election, something like the presidential election in Russia back in March where Putin got re-elected (somehow, being Independent these days has more mass appeal, similar to what Macron did). Little did I know that Italy wants to follow UK's footsteps. Even my parents who are familiar with international politics claimed they never heard about this issue with Italy recently when I asked about their opinion.

Bear #1

A few trolls in some forums mentioned that this is a modern battle between Jews and Germans, with Muslim immigrants being the ball in this pass-the-ball game (there's probably some truth in there), while the Brits and American try their best to mind their own business, and the Russians, Chinese and Koreans have their own plans. Unlike Greece though, the ECB has more to lose if Italy leaves the EU too (especially with Italy being one of the top contributors in GDP growth in the Eurozone), with Spain possibly be the next.

However, if until now UK is still struggling in reaching a final agreement about its Brexit, can these other European countries really successfully make it, especially with this carrot?

That's true.

Bear #2

Though I don't buy Goldman not knowing what's happening next in Italy, and Eurozone for that matter especially since both the banks and media are good in brainwashing the public (I've already been burned twice: Brexit and Trump), I'm convinced that Euro will definitely continue to go south as soon as it's verified that Trump will indeed impose tariffs not only to China but also to US allies this time-- and he's reported to be eyeing the Eurozone for that 2.5% vs 10% import tax issue.

Countries charge U.S. companies taxes or tariffs while the U.S. charges them nothing or little.We should charge them SAME as they charge us!— Donald J. Trump (@realDonaldTrump) February 4, 2017

If that's not enough to break the current 1.145 support in EURUSD, then we're being fooled indeed and in reality it's gonna bounce up soon since June Fed rate hike has already been priced in:

Aside from (overpriced) oil and houses, a bearish EUR seems like another sign that either a crisis or a bearish market is imminent. I'm actually surprised that the net non-commercial traders are still EUR net long in the COT. Maybe once they realized what's amiss and it gets in the news, it's already too late. I'm also very surprised that gold recovery isn't kicking in that much, considering safe haven assets such as CHF and JPY start to rally now.

Hmm, interesting.

Bear #3

There's a Russian malware spreading lately through home and small office routers called VPNFilter being deployed by the group named Fancy Bear, so FBI advises everyone to reboot our routers. Unfortunately, some parts of the malware persists after reboot and it's very hard to detect. I'm paranoid about it because I recently experienced BSOD and lost my wifi again thanks to some crypto-mining malware that made its way on my laptop because I've been stupid enough to try out Firefox since it consumes less RAM than Chrome.

Seriously, I should uninstall Mozilla Firefox and Internet Explorer too, and only keep Google Chrome because the latter is more effective so far in blocking those bad stuff-- with the help of a bunch of extensions of course, and it's highly advisable you do the same and install the following in your Chrome browser:

- Avira

- AdBlockerPlus

- HTTPS Everywhere

- Coin-Hive Blocker

- PixelBlock

My Wifi Card is ok again (though another highly suspicious BSOD might destroy that hardware itself so I need to be more careful next time), and though Malwarebytes isn't really that thorough in detecting and cleaning (unless if you're using the paid version maybe), Avira is reporting my laptop clean now after my 2nd and 3rd runs, so I'm ok with that (again #notsponsored, I just trust Avira so much since college days. I've tried Avast, AVG, Kaspersky, Norton, Microsoft Security Essentials--- the last one being the most useless among these, and only Avira was able to detect and clean trojans and other malware trying to hide files and creating exe dupes of them-- the early stages of ransomware).

I've also (painfully) manually double-checked hidden folders and regedit just in case those nasties attached themselves in rootkits and such (I don't use CC Cleaner, highly risky). So far seems clean. But I need to look into adding File Shredder and paid VPN in my arsenal soon, and regularly run Avira for any hidden bots silently waiting in the background that I might not be aware of.

I have a suspicion that these Russian (and Korean) hackers are back in the scene again to create another wave of hype in their favorite Bitcoin, just like the WannaCry movement last year.

Bear #4

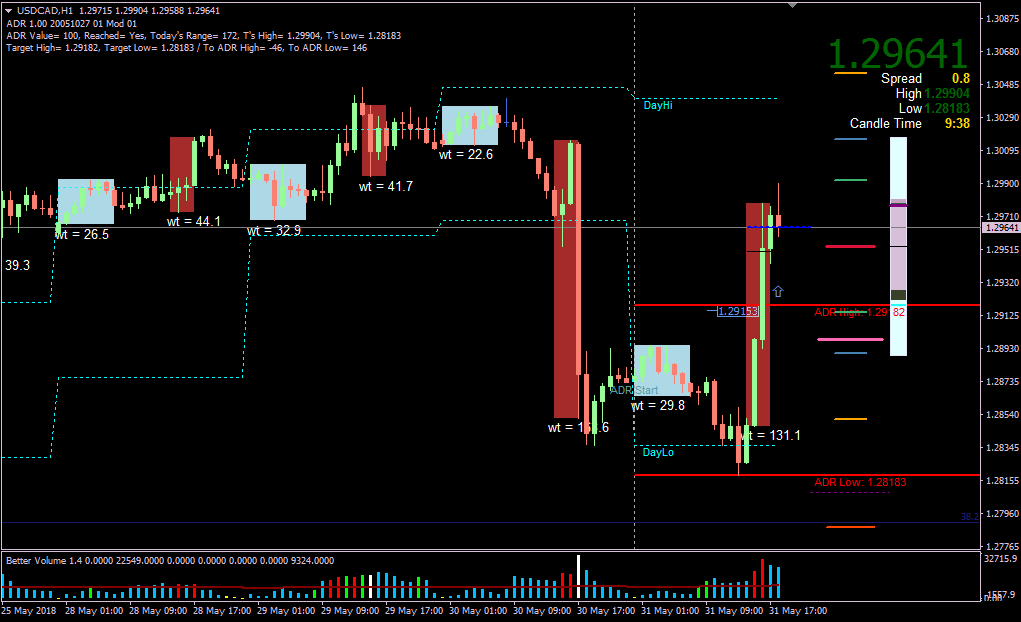

CAD pairs dropped and gapped lately after the BOC announced that it's keeping its rate unchanged. If that doesn't make sense, just keep this in mind:

It's a classic dump and pump scheme. Just look at USD CAD now though:

Bear #5

Though I don't wanna be a harbinger of gloom and doom, there's something I can't pinpoint yet regarding the stock market (that's why I haven't bought any now again after selling all my positions early last year), that makes me unconvinced about this:

8. Similar line... 'markets don't go up in a straight line', time in the market can be feast or famine. h/t @michaellebowitz $SPX $SPY pic.twitter.com/gSQW4sK3J4— Callum Thomas (@Callum_Thomas) May 26, 2018

Even I'm disagreeing with Buffet now. Wow.

Is this the effect of drinking too much Coca-cola? One thing's sure though: it's too early to say we're in the beginning of a bullish equity market ride now. There are a lot of risky variables: Central Banks investing in stocks now (when ideally and in theory, they shouldn't), cryptocurrencies entering the picture, and Central Banks issuing their own cryptocurrency.

As much as I want to be optimistic to attract abundance in life, I need to be cautious too especially when this becomes true: another one bites the dust. I'll wait for all these dust to settle first.

Feature image from Zdeneck M. of Unsplash.

0 comments:

Post a Comment