FX Outlook for November - December 2020 After the US Elections

General risk-on sentiment after the US elections and the announcement of a working vaccine by Pfizer. (Also, to all veterans out there, thank you for your service 🎖🛦)

Higher possibility of the greenback rebounding soon, along with a weaker pound, a possible bullish fakeout in the fiber, and Japanese yen and South African rand remaining strong relative to other currencies (whether that includes the US dollar or not, we'll see)

Disclaimer: For illustrative purposes only to guide the author in her own trades. This is not meant to be financial advice. Do your own research and due diligence and see the Disclaimer page.

I've updated the previous month's outlook recently to compare how the prices in reality went vs. the forecasted movement. Overall they're within the forecasted range, except for AUDUSD which moved opposite of what's forecasted and USDZAR dropping further with stronger South African Rand. Let's see how the remaining months of 2020 will go.

DXY

📌 Recover back to 94.5 or go flat and move sideways

The technicals hinting a possible double bottom, and the fundamentals with a Republican senate abating the Blue Wave fear, as well as an expected smoother trading relations under Biden, all support recovery of the USD at least during short to mid-term. Whether that recovery will continue or USD index will start to move sideways instead remains to be seen.

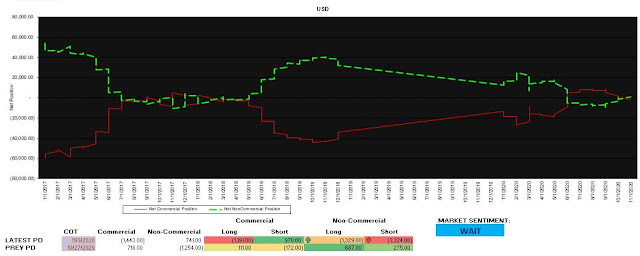

COT graph of non-commercial traders hinting an upward reversal above 0 level also supports USD recovery. However need to wait for how these speculators actually move especially they're also gauging how much stimulus package Biden will approve (generally causing depreciation of USD) as well as how he will enforce the increase in corporate taxes that is part of his agenda.

Although we generally don't need to worry about Biden's plans yet until end of this year, it's best to remain cautious and wait for bullish confirmation from the whales first (if there really is), or brace for a surprising bearish turn especially Covid cases in the US still continue to rise and beat their previous highs (rumored to double from 10 million to 20 million by Christmas).

DXY on December 2020:

AUDUSD

📌 Recover but most likely only up to 0.74 before dropping near 0.70

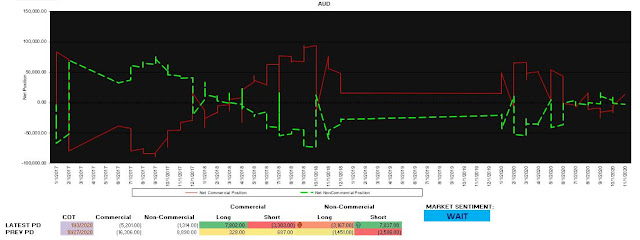

Last Nov 3, RBA cut cash rate from 0.25% down to 0.10%, cut interest rate on reserves from 0.1% down to 0%, and began doing QE for the first time to the tune of $100 billion to help its economy recover from current recession.

However it's rumored that RBA is planning another rate cut in the near future, although Gov. Lowe is generally against it and most likely prefer further quantitative easing instead. Though these cuts and QE may help Australia's economy recover, the immediate effect is a weaker AUD especially in relation to USD despite a recovery in China's economy as well.

COT showing whales going short further hints that any recovery for the Aussie now is temporary -- but we'll see. It still depends mainly on how USD will move.

AUDUSD on December 2020:

EURUSD

📌 Spike near 1.20 and create double-top before reversing

The 2nd wave of the pandemic is still weighing on the Euro zone, and how EURUSD moves depends on the general sentiment in the Euro zone in relation to the strength of USD. Assuming that USD will indeed appreciate soon especially with bullish factors mentioned above, expecting this pair to create a double-top near 1.20 (2017 high) before dropping to 1.155.

But if USD will surprise us with further weakness instead, and if there's no UK-EU deal happening before the December 31 final deadline, expecting this pair to go volatile and move sideways between 1.16-1.20, while other EUR pairs rise.

Although COT graph for Non-commercial traders above 0 level still shows a general bullish sentiment for Euro, the recent bearish net changes hint of possible reversal to come soon in EURUSD.

EURUSD on December 2020:

GBPUSD

📌 Spike near 1.35 (barely hit it) before suddenly dropping down near 1.265

Although I expect better trading relations soon between UK and US, Biden also goes for holding the Good Friday agreement with Northern Ireland. There's also more likelihood that there still won't be a proper deal between UK and EU this month (and even before December 31 comes), so the likelihood of UK finally exiting EU without a deal is high which is bearish for the UK more than the EU especially the Euro zone as whole is its largest trading partner.

COT also shows a bias on the downside, even more so with Non-Commercial traders repositioning their previous longs and seemingly increasing their shorts now.

NZDUSD

📌 Continue to go up to 0.69-0.70 before bouncing back to 0.68

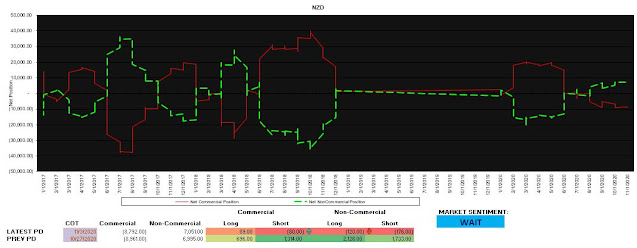

Expecting Kiwi's current bullish momentum to continue especially unlike other central banks, RBNZ retained its current rates. It's rumored to consider going to negative territory by next year. However, if New Zealand continues to manage its covid cases well, RBNZ is most likely to retain its current rates still by next year which is definitely bullish for NZD.

COT report suggest a wait and see approach. The graph of non-commercial traders suggests a bias on the upside for NZD. However since USD is also bound to recover soon as well, it's best to pair up NZD with bearish currencies such as CAD instead.

NZDUSD on December 2020:

USDCAD

📌 Either sudden bounce up from 1.30 towards 1.345 or quiet sideways movement near 1.293

Despite Canada's better than expected employment figures last week, its PMI figures remain on the conservative side. CAD is most likely gonna be affected by sentiment in oil which is rallying lately. However, this is only mainly driven by the Pfizer vaccine news, with its efficacy still yet to be tested by the public. Feeling sus about Pfizer's own CEO selling 60% of his own shares in Pfizer lately (like, why you have no trust in your own products and value of Pfizer shares to rise way more in the future and just hold instead?).

COT report and recent net change of non-commercial traders' position lately are both heavily biased on CAD being bearish and supports a bullish USDCAD (again assuming that USD recovers indeed soon).

USDCAD on December 2020:

USDCHF

📌 Continue being volatile while moving sideways near 0.90, with possibility of dropping to 0.886

Most likely USDCHF will continue to ride both the impact of US Election aftermath and whether or not UK and EU will reach a deal before the ultimate Brexit by end of this year. Although CHF is considered a safe haven asset too like JPY, any signs of it appreciating can be easily reversed by the SNB intervening (more so once Biden officially sits in the office and rumored to have a softer stance against currency manipulation compared to Trump).

USDCHF on December 2020:

USDJPY

📌 Reach 106-106.8 before either going volatile sideways or tumbling down near 102.5

Despite a hawkish BOJ in general, and its new scheme to strengthen its regional banks' capacity by encouraging them to merge and avail of the 0.1% interest per annum as reward to prevent possible bankruptcy especially by smaller banks, USDJPY is likely to follow sentiment about the USD more. Therefore despite a strong JPY as well, there's possibility for USDJPY to climb further up to 106.8 before going volatile sideways afterwards.

COT report shows a bullish bias on JPY, and the net changes in Non-commercial positions hint about further volatility in USDJPY, if not a sudden drop back near 102.5.

USDJPY on December 2020:

USDMXN

📌 Drop up to 20 before bouncing back up to 20.8

USDMXN is most likely to somehow follow the movement of USDCHF, but expecting the former to drop only up to 20 before recovering once more and going volatile sideways. There's a rumored 25bp rate cut soon by Banxico, however with the risk of either a spike or worsening inflation especially on Mexico's food prices under lower rates, let's see if the rate cut will indeed happen (and if ever, expecting USDMXN to recover up soon).

Despite a bullish bias overall in the COT reports, recent net changes in non-commercial traders' positions suggest a wait-and-see approach especially in relation to USD.

USDMXN on December 2020:

USDZAR

📌 Recover and bounce up from 15.27

Although South African Rand had been recovering and getting stronger lately, expecting a possible USD recovery too to finally drive this pair up especially after seemingly forming a bullish hammer in its weekly chart early this week. However if that expected USD recovery won't happen especially Covid cases in the US continue to rise and surpass its previous highs, while South Africa on the other hand is now currently at its lowest alert level (level 1), this pair is most likely to break its 2018 high and drop further down to 14.50 instead.

COT report suggests waiting on the sidelines first, despite an overall bullish trend of the the non-commercial traders graph (green).

USDZAR on December 2020:

0 comments:

Post a Comment