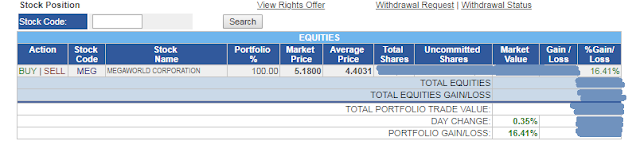

Selling Off Megaworld (MEG) and Avoiding Stocks -- For Now

|

| Hmmmmm... |

Since not that much people trade stocks here too (or trade anything at all) compared to Indonesia, Singapore and Malaysia for instance, most of our trading volume here comes from foreign investors as well.

So if they're feeling conservative in the global equities market as a whole, then they're most likely going to sell their holdings here too.

|

| Sold when the PSE index touched the MACD |

I never follow the cliche advice to sell high, buy low because nobody can predict where exactly those tops and bottoms are. I often hear that silly advice from brokers and people who never even traded in their lives. They're just parroting what those brokers, finance consultants and cringey finance gurus say.

You can however, have some "hunch" when to get in or out of the market, but whether you listen to that and act quickly, or simply ignore because you're "investing" in the stock market anyway, is up to you.

|

| Unfortunately, I don't hear this yet. Only experienced this in cryptocurrencies lol. |

Nothing wrong with "investing" in the stock market, especially that's what Warren Buffet does.

But I personally already stopped listening to him last year especially since he's not even a trader and his strategy isn't aligned with my trading style anyway. Also good luck losing THIS. MUCH. No disrespect, but the older we get, the more conservative we should be because we won't be alive that long to recover that loss. If I were him, I'll just retire, sell half, and treat my family to a better home, a mansion perhaps with a butler or maybe even start investing in AI systems, and just spend more quality time with loved ones.

Berkshire definitely has more holdings and can recoup that loss. Probably. Assuming other stocks perform well. But if they all plunge down if the worse is yet to come, then I wish him a good retirement package at least. Or some good art investment he and his family can easily sell.

I'm obsessed with Gerhard Richter's works!

Back to local stocks. If trading penny stocks here (aka basura stocks) is considered gambling, holding PH stocks too long is high risk especially here in the Philippines, short selling is still not allowed.

They said it's going to be implemented October last year, but I don't know what happened since then. Short-selling is still not allowed in the Philippines as of March 2019.

Feature image by Niv R. of Unsplash

0 comments:

Post a Comment